Every time, equity markets make a steep directional move, irrespective of the direction, investors’ portfolio returns usually lag behind index returns. When Nifty rallies, most investors portfolio lags, and when Nifty falls, investors’ portfolio falls faster. And the usual lament is about Nifty not being a perfect benchmark. Why is this so? Or is it because, the investor, in his desire to beat the benchmark stock his portfolio with stocks with higher risk?

Well, let us not beat the investor anymore, and turn our attention on to Nifty’s position as a benchmark. The true hallmark of a benchmark lies in its ability to reflect the investment conditions or returns, as accurately as possible. The index managers usually bring this by ensuring that the index has a fair representation of major sectors important to the economy. What is often missed is that even while ensuring such a representation, the index managers do a semi-annual policy weeding out weak ones, within such sectors, ensuring that through such a simple, yet systematic approach, the index remains head and shoulders above the common man’s portfolio calculated over a long time frame.

There have been plenty of articles and observations on the topic, but let us put those to rest for the time being and instead sidestep the benchmark argument by observing what has been happening in the US markets with respect to Dow Jones Industrial average’s role as a benchmark. For a while, and especially so during the last four months, it has been observed that on many days, there has been a big divergence between the Dow Jones index and the tech-heavy Nasdaq 100 index. Well, it is not uncommon for sectoral indices to diverge from benchmark indices, but rarely do such divergences sustain for longer periods.

Chart 1: Dow Vs Nasdaq 100

Professor Jeremy J. Siegel at the Wharton School explains in this article here, why he called the Dow “deeply flawed”. For one, it is only a basket of 30 stocks. It also does not have representation from some sectors like “utilities”, and is weighed heavily in favour a few stocks.

With Covid-19 changing the global landscape possibly forever, the argument of why Dow may not remain the flag bearer any more is built on the visible inability of the Dow’s constituent stocks to respond to Covid-19 challenges. Recent developments adequately explain why; the pharma stocks, Merck and Pfizer could not respond to the Covid-19 challenges, social distancing wearing down retail giants like Walmart, or energy behemoths like Exxon’s prices plummeting amidst oil market slump.

But where such arguments digress in an Indian comparison is how Dow uses share prices for index construction, while Nifty uses market capitalization, which is a much fairer representation. But that does not absolve Nifty of the accusations of “not being a fair benchmark”, because it does have a challenger.

Nifty Next 50, the challenger

Nifty Next 50 index consists of the 50 stocks that come after the top 50 stocks by market capitalization which constitutes the Nifty 50 index, and hence the suffix “Next 50”. The time spent being inside this index is usually seen as a dress rehearsal before getting promoted to the big league, which is the Nifty 50.

Chart 2: Nifty 50 Vs Nifty Next 50

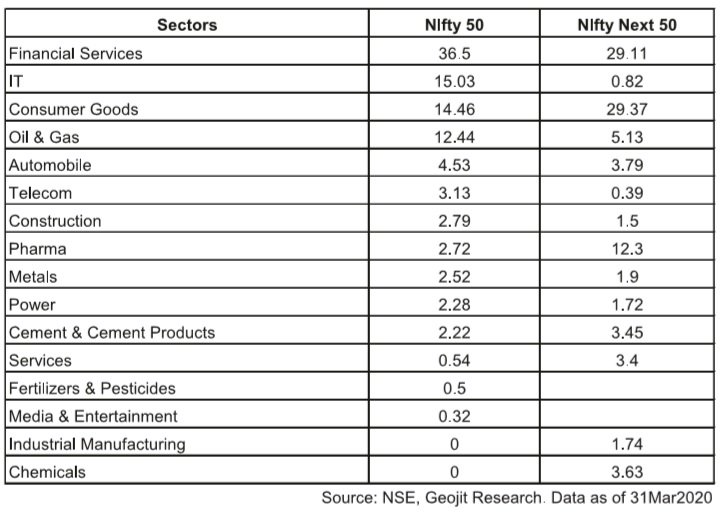

From chart 2, it is evident that the Next 50 stocks are not just relaxing with their feet up, waiting to be called up to join the ranks of N50, but were doing hard work. Their performances were clearly seen diverging on the positive side when markets started reversing from the March lows. And this begs a closer look. One of the reasons is the difference in the sectoral allocation of the two indices. Take the case of Pharma, which has been a stellar outperformer during the fall as well as the recovery stage. Pharma composition is 2.72%, whereas in the Next50 index, the contribution balloons to 12.3%. The Next50 also has a lower representation of the confidence-stricken financial services,

Table 1: Nifty Next 50 Constituents

Post Covid-19

When we step out from the shadows of Covid-19, we are most likely to see a consumption spree, for which Next50 is better poised to benefit from, with its higher representation of consumer goods, when compared to Nifty 50. As the economy limps back to normalcy, NPA worries will surface, but Next50 having lesser representation may be expected to fare better. And before all these play out, a higher composition of Pharma could ensure that Next50 heads into the post Covid-19 scenario with a firmer number.

The catch?

Next 50 has a higher standard deviation, as well as a higher PB (price to book value) and PE (Price to Earnings), all of which are indicative towards volatility and a higher element of risk than Nifty 50. Nevertheless, I prefer to call this as an aspirational index, because it blends both the qualities of mid cap as well as that of Nifty 50 indices. It does not look like a compromise, but rather a matter of choice.