It is rare for Indian markets to have “elections” remaining as a key topic in the aftermath of general elections, because euphoria usually settles down soon after elections results, and attention gets naturally diverted to the full year budget, macros, rate decisions, and global events, as the case may be. But, that wasn’t to be this year, with markets bracing for a political storm following the proposal for a “One nation One election”. The furore around the proposal is representative of the importance that the elections hold for India, and by extension, India’s stock markets. India’s general elections is considered to be one of the costliest in the world. According to forbes.com, India’s 2019 election was estimated to have cost over $7 bilion, a 40 percent increase from the $5 billion for 2014 elections, making it more expensive than the US presidential elections which cost $6.5 billion in 2016. Elections herald a new beginning. It is often greeted with optimism, not only for the hopes of a change, but also for the booster dose it receives by way a huge influx of money, which propels consumption, travel etc.

It is rare for Indian markets to have “elections” remaining as a key topic in the aftermath of general elections, because euphoria usually settles down soon after elections results, and attention gets naturally diverted to the full year budget, macros, rate decisions, and global events, as the case may be. But, that wasn’t to be this year, with markets bracing for a political storm following the proposal for a “One nation One election”. The furore around the proposal is representative of the importance that the elections hold for India, and by extension, India’s stock markets. India’s general elections is considered to be one of the costliest in the world. According to forbes.com, India’s 2019 election was estimated to have cost over $7 bilion, a 40 percent increase from the $5 billion for 2014 elections, making it more expensive than the US presidential elections which cost $6.5 billion in 2016. Elections herald a new beginning. It is often greeted with optimism, not only for the hopes of a change, but also for the booster dose it receives by way a huge influx of money, which propels consumption, travel etc.

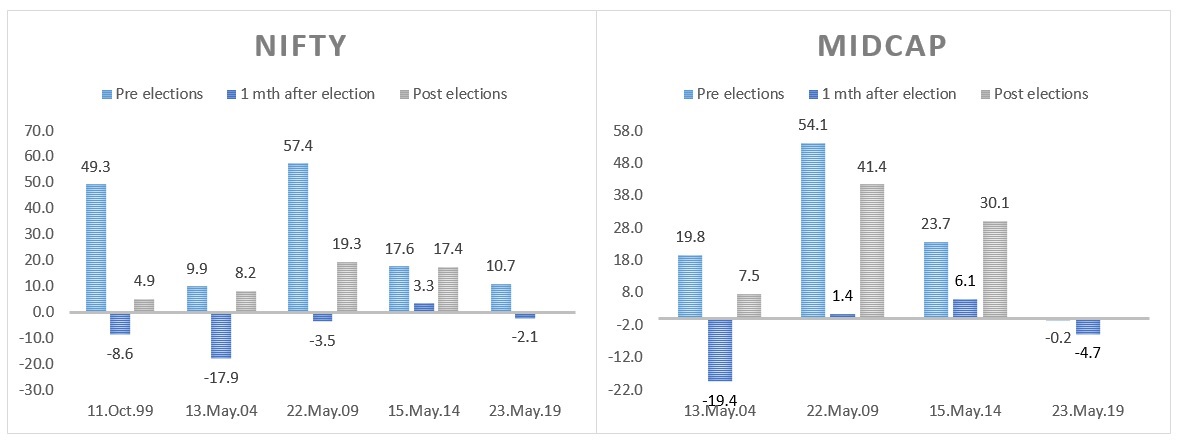

We have looked at Nifty and other sectoral indices 6 months before and after elections during the last two decades to see if there is a pattern in stock market moves centering elections.

We found that Nifty gained handsomely during the 6 months prior to elections, but was not able to replicate such gains in the period after elections. Further, the extent of rise has also become smaller and smaller over the years, pointing to either a decline in the influence of elections, or to the plain fact that the Nifty stocks are not prone to euphoric moves but are rather more steady. The second argument is reflected in the case of midcap index which has shown a far bigger up moves before and after elections, though, like in Nifty, the pre poll performance was improved upon, only in one election year – 2014. Small cap index performance is not included in this analysis as it has similar performance as midcap index.

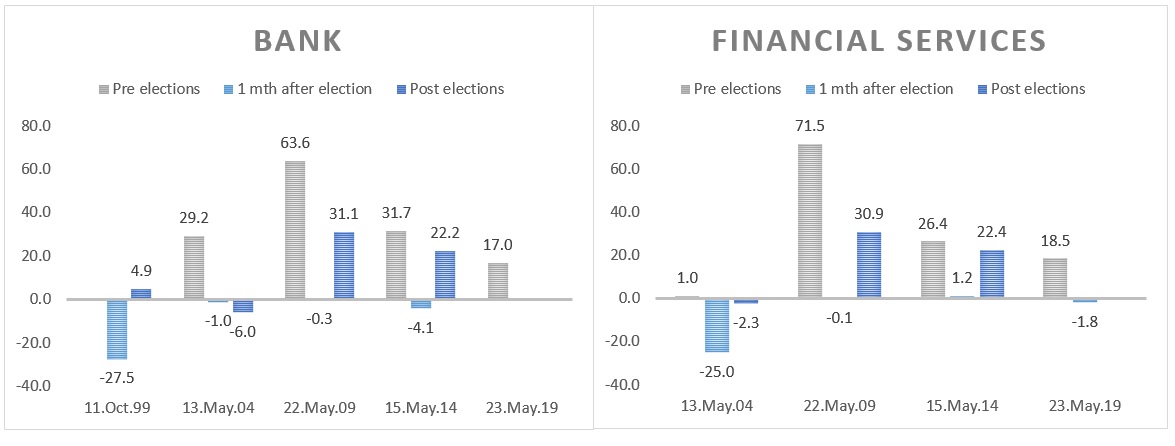

Stocks in Bank and Financial services sector also show similar trend, but it can be seen that the pre election moves are usually relatively much bigger. This is largely because, these are the companies that fund growth, and naturally, any sign of growth gets amplified in their stock price, mostly ahead of elections. Banks have only once given negative return in the post poll period, but, as is the case with nifty, these sectors’ performance prior to elections have rarely bettered, in the 6 months soon after.

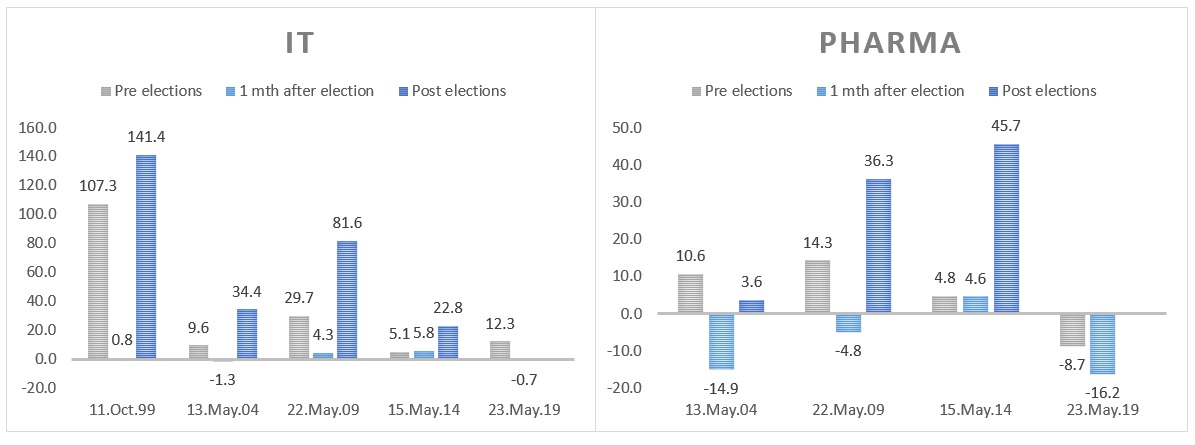

IT and Pharma sectors have been exceptions as post poll performances have outshone that of the pre poll moves, and by a whopping margin. Pharma gained over 36 and 45 percentage in the six month period after 2009 and 2004 elections, respectively. It needs to be remembered, these are sectors where forex and other international cues hold sway.

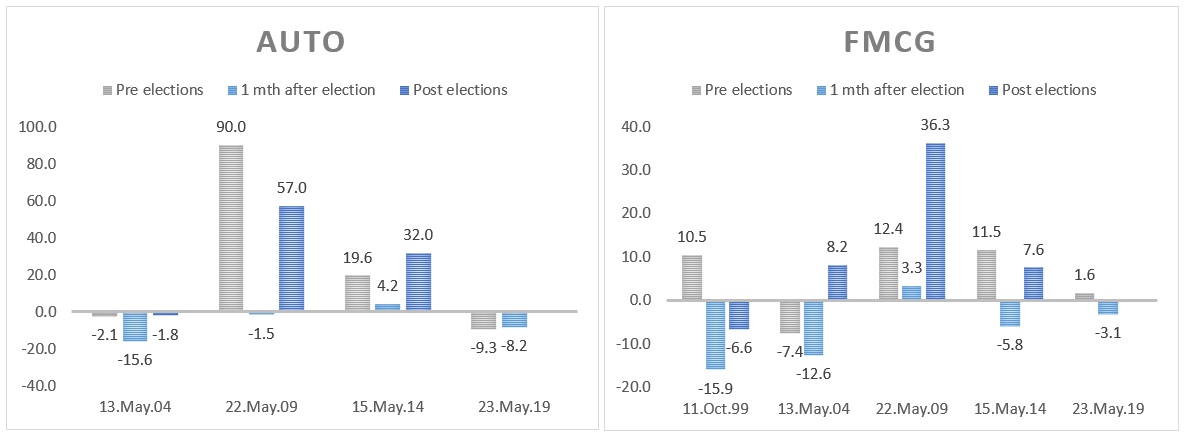

Defensive or Cyclicals, patterns were not much different, but FMCGs generally fared better in the post poll period.

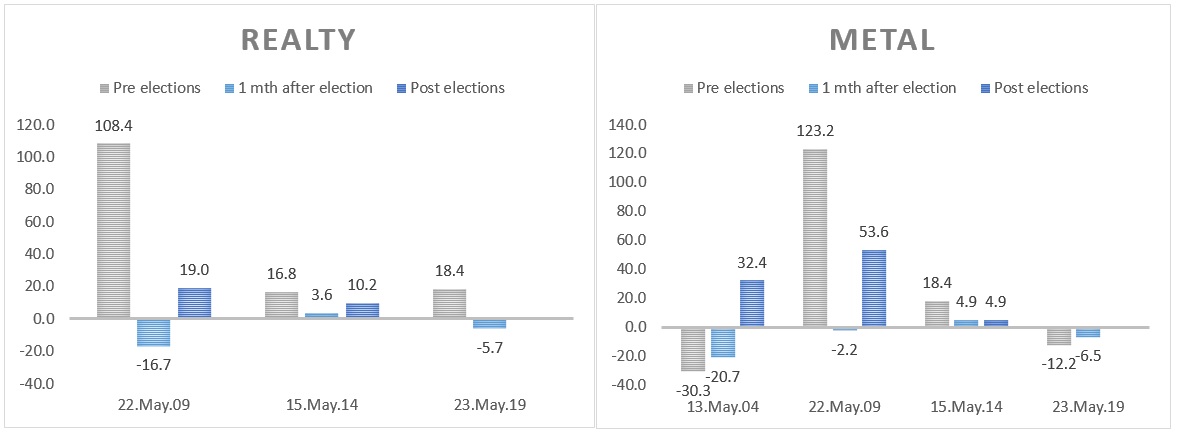

Realty and Metals have not really given into any patterns that suggest that elections hold sway.

So if one were to follow previous patterns for picking sectors in the six months, IT and Pharma are contenders. While we were at the pre-post election comparisons, we also looked at how markets behaved in the first month after elections. In almost all the cases, we found that performance in that period rarely bettered pre poll excitement. This is understandable, as the months long build up that catapults market to peaks in May during the election year, needs to have a breathing space before the next wave begins. But it is important to note that, unlike in other election years post 2004, almost all major indices have registered either meagre or negative returns in the month after elections, ie June. It is an ominous sign. Can FM’s maiden budget on 5th July revive the animal spirits of economy?