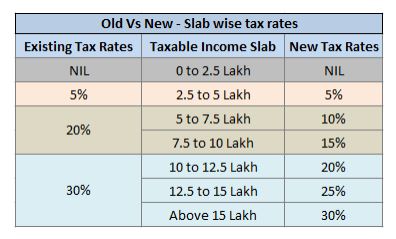

Union budget 2020-21 announced new tax slabs that would co-exist alongside the then existing tax regime. New tax regime has a simple to adopt structure with lesser rates, but one has to forego most of the exemptions that they avail at present. Existing regime continues to have the same modus operandi with most of the widely availed sections.

To help you choose which tax regimen is best for you, we offer you an easy to understand guide.

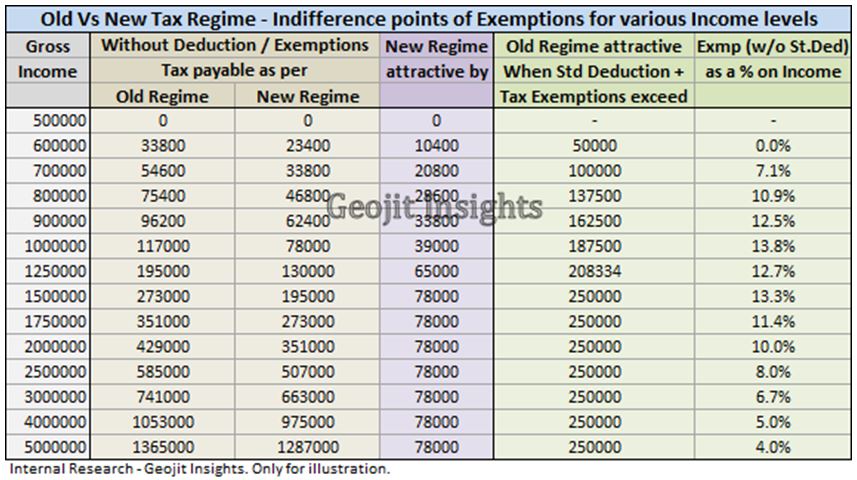

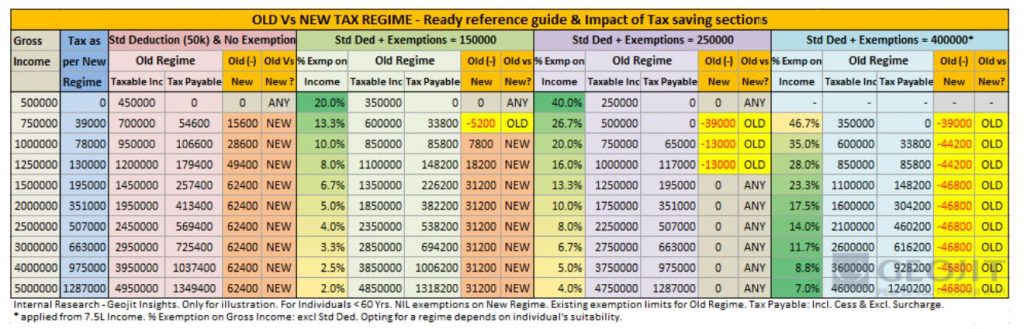

This brings us to a point of deciding between the one that is ‘Mathematically Simple’ Vs ‘Economically Beneficial’. We have done a quick scenario analysis to figure out the expected tax liability as per the Old and the New tax regime. We have graded up the scenarios with different exemption limits to get a sense of the overall picture. Of course, these calculations are only for illustration purposes with certain common assumptions. Individuals should consult with their tax advisors before making any decision.

Ballpark figures of Deductions + Exemptions limit, beyond which Old Regime is attractive:

Observations are enlisted here:

- New regime is good if No exemptions are availed.

- As the amount of exemptions increase, the Old regime becomes attractive.

- An observation: When Individuals continue to Save and Invest for their future (opt for ELSS, PPF, NPS, etc), incur tuition fee expenses, take insurance (life or health) for protecting from financial uncertainties, pay interest on home loan, does donations, etc. and if these are eligible to be claimed under the existing respective tax saving sections which reduce the tax liability, it’s wise to opt for it, so long as these sections prevail.

- The higher one saves/allocates (in tax-saving instruments), the more Old tax regime is beneficial.

- Opting for a particular tax regime depends on an individual’s suitability, after considering relevant factors.

- Budget has retained rebate U/s 87A that gives full tax exemption to those earning up to Rs.5 Lakh.

- As the income level goes up, the potential to invest or save for the future goes up as well and individuals should be aware of it and invest sufficiently as per the risk appetite and asset allocation for their goals.

- The difference by which a particular regime is attractive, remains the same after Rs.15,00,000, across exemptions. Eg: At an exemption amount of Rs.400000, Old regime would be beneficial by Rs.46800 across all income ranges, upwards of Rs.15 lakh.

Some prominent Tax saving sections and the limits p.a:

- Section. 80C: Covers investments made in instruments such as ELSS, PPF, Expenses like Tuition fees paid, Repayment of home loan principal, payment of Life insurance premium, etc. Has a limit of Rs.1,50,000.

- Section. 80D: Health Insurance Premium. Limits: Rs. 25000 + Rs.25000 (Self & Parents are <60 Yrs age) ; Rs.50000 + Rs.50000 (Self & Parents are >60 Yrs age).

- Section. 80CCD (1B): New Pension Scheme. Limit: Rs.50000.

- Section 24: Interest payment on a home loan, up to Rs.200000 (also there are affordable housing loans with separate limits subject to conditions).

In addition to the above, there are a few other exemptions/allowances which are available for claiming as a deduction. Overall it’s highly possible that someone could be already availing exemptions in 80C, 80D, 80CCD(1B), Sec.24, which in the current context would make the old regime beneficial.

It’s highly advisable to plan the yearly tax-saving allocations well at the start of the year, especially the equity-oriented ones like ELSS as they are subject to market volatility (investor suitability requested).

As explained in the budget document, an individual assesse (without income from business or profession) can switch between new or old tax regime, every year (particularly at the time of filing of returns). It is also mentioned, those with income from the business profession, if they opt for the new regime, can switch to the old, once in their lifetime. They again cannot opt for the new regime, till that year in which their business income ceases to exist or becomes nil (refer to Budget documents for the latest and more info).

Old Vs New tax regime calculator: Click here, to find the difference in tax liability between the old and new regime. Please note that this is only for illustrative use and not for any official tax-related decisions.

BERY GOOD DETAILS .