By Vinod Nair

By Vinod Nair

Although narrow and volatile market continued to surge during the year till date, the confidence of the market was tested constantly by headwinds from the domestic and global markets. A few sectors did well while some tumbled. The broad market was not rewarded but stocks and sector picks held the key to the market. Once again our domestic market is going through a critical phase, which may continue over the next one to two quarters. The impact on the equity market will be more, given the likely changes happening between liquidity and risk. This will reverse as the global financial market stabilizes.

Market was taking a breather after a narrow upsurge…

The market reached an all-time high of 11,760 (Nifty50) on 28th August, a 13% YTD return, led by attractiveness of the Indian market compared to the other emerging markets, revival in earnings growth and improvement in the domestic economy. Relaxation in crude prices and sustained domestic inflows also helped the market. Post this run, market took a breather assessing the situation and started consolidating in September.

Though our market was positive throughout the year, the rally was narrow and lacked buoyancy. Much of the benefit was skewed to a set of stocks and sectors while the broad market continued to be timid. Blue-chips took India’s market capitalization to a new level @ Rs159.5trn, which is a 10year CAGR of 17.5%; 120% of India’s FY19 GDP forecast. India’s one-year forward price to earnings ratio is high at 18x and 24x on a trailing basis and 65% premium to the Morgan Stanley Capital International – Emerging Market (MSCI-EM). Valuation of some of the stocks especially in sectors like consumption, IT, pharma, chemical and exports are very expensive. For example, P/E of FMCG industry is at 37x, which is 20% higher from the 3 year averages, IT at 19x, 20% higher and Pharma at 26x, 20% higher.

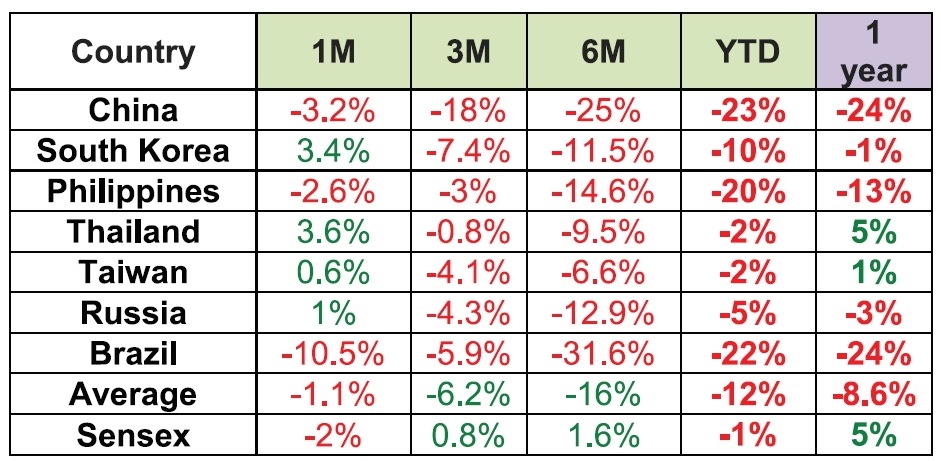

Please note, in the global equity market, though India is disproportionately and highly valued, we are amongst the best emerging market performers.

Market Return (USD Terms)

Currently, heavy depreciation in INR, topsy-turvy crude prices, risk of higher inflation in the future, fiscal deficit and consolidation in emerging markets is impacting the market. Oil is back to the troubled region of $80 and Current Account Deficit widened to 2.4% of GDP in Q1FY19 compared to 1.9% in Q4FY18: a soup of worry for the Indian market. India’s Forex reserve has reduced from a high of $426.1bn in April to $399.28bn on 7th September. This is due to selling by FIIs in the Indian bond market, supply from RBI and higher cost of imports. RBI has been supportive but INR has depreciated by 14% YTD. Given this situation, RBI is likely to hike the interest rate in the near future, which in-turn will provide some cushion to the currency market.

It’s turning into a long break…

Given the high volatility in the Emerging Market led by trade and currency war along with increase in interest rates, this break of the domestic market is getting extended. Many segments of the money market have been impacted leading to a rise in domestic yield, which has come back close to the last high of 8.2%.

Externally, US market is getting flattish while European Markets are turning negative and Emerging Markets are hugely underperforming, MSCI-EM is down by -2.5% on a weekly basis and -11% on YTD basis. Performance of the world equity market has been impacted given the imbalance in the financial market, in which India is also being impacted. Regarding the YTD performance of key emerging markets, all major markets are down: China by 23%, South Korea by 10%, Philippine by 20%, Taiwan by 2%, Russia by 5%, Brazil by 22% and South Africa by 22.5%. India in dollar terms is down by 1% while in INR terms is up by 11%.

A strong economy will handle the pain…

Market was hoping that given the revival in the earnings growth in Q1FY19 and better economic growth, this narrow trend will spread to the broad market. India’s GDP grew by 8.2% in real terms during Q1FY19 compared to Q1FY18, which was the fastest growth in 9 quarters. Private consumption expenditure grew by 8.6%, gross fixed capital formation grew by 10% and exports grew by 12.7%. Government consumption expenditure grew at a lower rate of 7.6% indicating that the growth in the first quarter was not driven by the government pumping up spending. Gross fixed capital formation grew by 10%, in real terms. This was impressive because this was the third consecutive quarter which witnessed robust growth in Gross fixed capital formation (GFCF). RBI’s OBICUS (Order Books, Inventories and Capacity Utilisation Survey) indicated a capacity utilisation of 75.2% in the quarter ended in March 2018 which is the best utilisation ratio in four years. This coincident uptick of multiple indicators suggests a very early phase of turnaround in the investment cycle.

Currently the momentum of equity market is getting delayed due to global headwinds. Market is focusing on the bond and currency market which are very unpredictable. US bond yield is increasing and reached the last crossing level of 3%. USD is appreciating against all currencies, Dollar Index has touched 95.2, up by 3.3% YTD. Funds are going back to the US market led by cut in corporate tax, higher yield in less risky US bonds and hike in Fed rate.

In a nutshell, frothy valuation, selling in EMs and increase in risk as mentioned by a hike in bond yield to the last high of 8.2% is impacting the market. This situation will ease only as the global bond and currency markets stabilize, which is under pressure given a possible Fed rate hike in September to December 2018. As the global market stabilizes, it will be flittered into the equity market, during which the broad market led by midcaps stocks will do well. Gap in valuation between large and midcaps has reduced and performance of midcaps will return as the system risk reduces. Currently, the adverse trend may continue as global market and high valuations are ruling the sentiment.

To address the ongoing chaos in the market, we would like to mention that all the ingredients that are required for a consolidation were already baked in the market. Factors like heightened volatility in the money market, INR depreciation, rising bond yield, selling by FIIs in the emerging markets and complete narrowness of the market YTD, showed the cautiousness of the market. This fall was triggered by the default of IL&FS, a prominent Infrastructure Financing Company. Its credit rating was downgraded from ‘AAA’ to ‘D’. ILFS had a total borrowing of Rs91,000cr as on March 2018. Out of this, Rs12,200cr was long-term loans that are likely to mature within the next one year and Rs13,500cr was short-term loans. We already have a huge NPA issue in the banking sector led by sectors like infrastructure, power, steel and other core segments. The quality of debt held by MFs declined and redemption pressure was initiated by corporate investors. With a burden to generate funds, one MF sold ‘AAA’ rated paper of DHFL (Housing Finance) at a deep discount. At the same time, higher Open Market Operations by RBI, advance taxes and volatility in money market alerted the domestic financial market to turn cautious and illiquid in the near-term. This uncertainty spread to the equity market, firstly to the Housing and NBFCs segment. Both these segments were already under pressure due to slowdown in business growth, premium valuations and hike in cost of funds. The new uncertainty extended the fall. Over the next few days, this ambiguity spread to other finance and broad market too. Now, India’s performance is coming in line with the other emerging markets to which we were outperforming year till date. This pressure is likely to continue till the time the financial market stabilizes and confidence reverts with accommodative valuations.

Posted: October 2018

One question, How today’s overall market sentiments are different from the 2008 market sentiments. Can we expect any big fall in equity market like 2008 in the upcoming months or before general elections?

In 2008, it was the financial crises of the US market which had spread across the global banking system given the high correlation of the world economies. Whereas today, we are under the tightness of the domestic financial market led by delayed effect of NPA’s problem and loss of liquidity. A resolve to this issue will depend on the measures to be taken by Govt., RBI and Credit Agencies. The degree of the domestic problem is insignificant compared to the global chaos of 2008. But at the same time, we have the on-board issues of tightness in global liquidity, increased risk reducing the attractiveness of equity as an investment class, premium valuation and domestic headwinds like elections. A combination effect of these are likely to impact the domestic market over the next one to two quarters.