By Krishna Prasad N. B.

This year, crude oil seems to be one of the best-performing commodities as yet on improving fundamentals which reclaimed above pre-pandemic levels after having hit an all-time low last year. Recovery in demand in major consuming nations and timely engagement of various producers by constraining their outputs as an effort to rebalance the world’s oil supply contributed the gains. While declining US production in the second half of 2020 along with the reversal of lockdown measures across the globe acted as a catalyst for price recovery.

After testing the record lows in April 2020 prices regained most of its losses on the back of easing lockdown measures and supply constraints and this price gain extended in 2021 as well. By early March, WTI crude on international futures platform recovered by more than 40 percent by surging to $67.98 per barrel on the second week of March. Whereas ICE Brent crude futures reclaimed above $70 per barrel at the same time. Back home, on the Indian futures platform, crude oil gained more than Rs 1400 / barrel.

Development in OPEC+

Demand for petroleum products slumped in 2020 primarily from the transportation and aviation sector, which totally contribute more than 50 percent of total oil demand. In 2020, global oil demand marked a drop of 9.7 million barrels per day. But later we could see a strong recovery in demand mainly on reopening economies and on reviving government policies. On the other hand on the supply-side was the involvement of producers group OPEC+ through extensive production cuts. As a matter of fact, the OPEC+ producers have been curbing outputs since January 2017 to cut down supply glut. In addition to this, the energy alliance had come out with a production cut of 9.7 million bpd started in May 2020 as a major step, however, improved market sentiments let the producers’ group to scale back to 7.7 million bpd in August and to 7.2 million bpd from January 2021. But later on, Saudi Arabia, the de facto OPEC leader, pledged voluntary cuts of 1 million bpd for February and March and its extension of additional one month along with greater compliance adherence in the group further boosted the sentiments. Although, increasing pressure among group to tap the recent price hikes as some of the members have acknowledged that market has already balanced which continue to raise doubts about how long the producer group will preserve the present status quo. OPEC members maintain the world’s entire spare crude oil production capacities, so it may be real disruption in world oil supplies if they start to further ease the production constraints.

US Supply and demand

Production levels from the top producer US also dropped in 2020 and it was the largest annual decline according to US Energy Information Administration’s records mainly on declining drilling activity. US crude oil production averaged at 11.3 million bpd in 2020, which was way down by 8 percent from the record annual average high of 12.2 million barrel per day in 2019. A downturn in crude oil prices as a response to Covid-19 pandemic forced crude oil operators to seal oil wells and limited the number of active oil facilities. Meanwhile, some key moves from new US President Joe Biden like revoking the controversial Keystone XL oil pipe line from Canada and moratorium on new oil and gas leases on federal land are likely to influence the dynamics of US oil industry.

Global demand and supply scenario

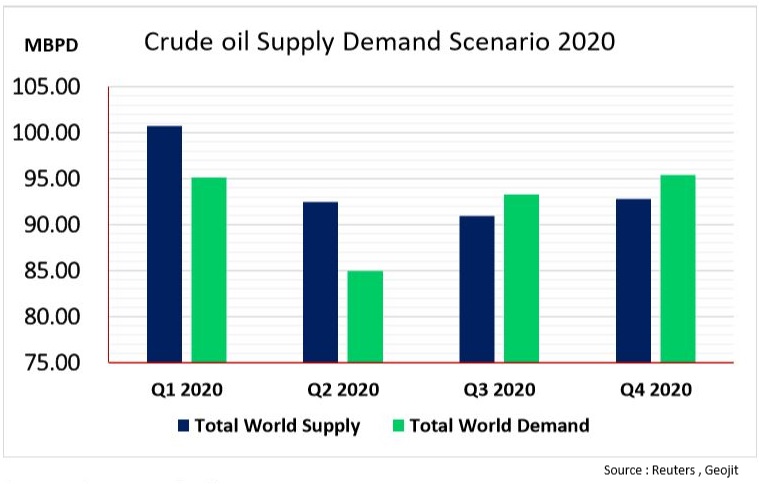

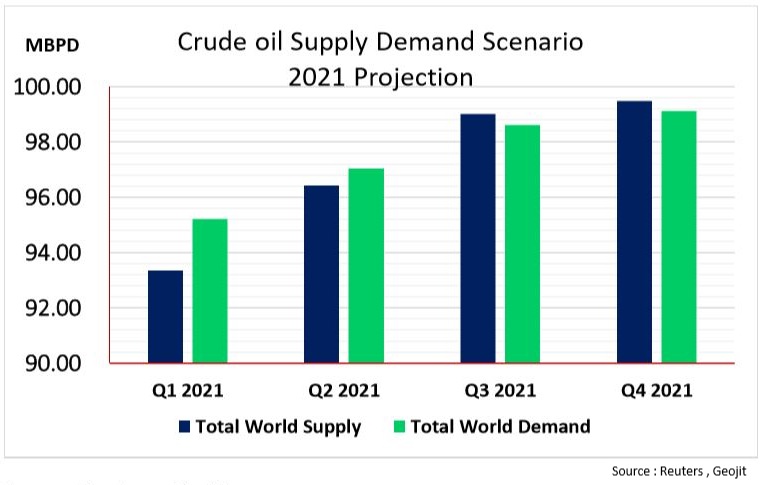

Global oil market has been stabilizing after the unprecedented crash in demand last year. The world demand for crude oil recovered in the last two quarters of 2020, and the demand exceeded supply during the same period. The global demand and supply in crude oil is expected to continue its recovery in the year 2021.

According to International Energy Agency, world oil demand is expected to rebound by 5.5 million bpd in 2021 after a major contraction in last year, consumption is expected to be higher in Q1 2021, backed by cold weather in Northern Asia, Europe and the US. Signs of improving economic condition and effectiveness of the virus vaccine deployment will largely boost demand prospects.

By tailing global trends, the Indian economy picked up from worst contraction, so the oil industry picked up as well. India’s fuel consumption is expected to rise by 10 percent in the fiscal year starting 1st April 2021. As per the Indian Government’s Petroleum Planning and Analysis Cell (PPAC), petroleum product consumption in 2021-22 is likely to reach 215.24 million tonnes with respect to revised estimate of 195.94 million tonnes consumption of the fiscal year ended last March and this significant gain is possibly the fastest pace of fuel product consumption in six years. Petrol and diesel sales are expected to go up by 31.3 million tonnes and 83.67 million tonnes.

The recent recovery in oil prices was promising, reflecting hopes of a firmer global economic recovery due to the positive impact of vaccination rollouts. But the actual demand story still depends on efficacy of Covid-19 vaccination rates along with how sustainable are the employment conditions and industrial activities in major consuming nations. Subsequent to the recent price gains, US shale producers have been adding rigs and oil wells in the recent months after a steep decline last year due to the pandemic. On the supply side, uncertainty prevails as OPEC+ may consider production adjustments after the month of April as increasing crude oil prices may encourage the OPEC members to rise from current production levels or loosen up compliance with the existing agreement. Ideally, if the benchmark Brent crude oil prices hover favorably above $65 per barrel through this quarter, the OPEC+ allies may gradually relax their supply restrictions. Therefore, the crude oil prices may find a gravitational force either way in at least to cap a firmer uptrend.