Globally, stock market performance has been reasonably good so far this year. Even though the year started on a subdued note on concerns of monetary tightening by the leading central banks, the situation changed dramatically with the Fed announcement at end January that ‘tightening is on hold’. Later, as the global economy began decelerating sharply, all the leading central banks switched to an accommodative monetary stance. Now, for the first time in the last 10 years, world’s 20 leading central banks have cut interest rates to address the pronounced economic slowdown. According to the IMF global GDP growth rate is likely to decelerate to 3 percent in 2019 and there is a threat of the global economy slipping into recession in 2020 if the trade skirmishes continue to linger.

Globally, stock market performance has been reasonably good so far this year. Even though the year started on a subdued note on concerns of monetary tightening by the leading central banks, the situation changed dramatically with the Fed announcement at end January that ‘tightening is on hold’. Later, as the global economy began decelerating sharply, all the leading central banks switched to an accommodative monetary stance. Now, for the first time in the last 10 years, world’s 20 leading central banks have cut interest rates to address the pronounced economic slowdown. According to the IMF global GDP growth rate is likely to decelerate to 3 percent in 2019 and there is a threat of the global economy slipping into recession in 2020 if the trade skirmishes continue to linger.

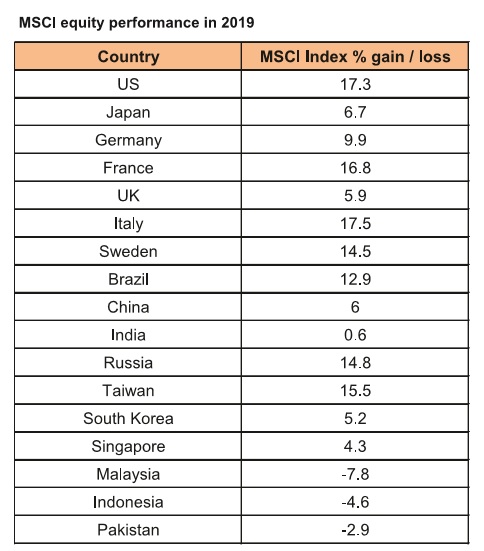

The accommodative monetary stance and synchronized rate cuts by the central banks have kept global equity markets buoyant. See the MSCI equity performance in 2019 as on 10th October 2019.

It can be seen that from the table that US, Japan, leading European nations and BRICs excluding India have done well. Malaysia, Indonesia and Pakistan are poor performers.

Why is India under performing?

A combination of factors has led to India’s under-performance. After reaching record highs following the massive electoral win for the NDA the indices started declining steadily on the back of negative economic news. The budget, which imposed surcharge on FPIs, proved to be a major trigger for the steady decline in markets post-budget. Sustained selling by FPIs impacted the sentiments and the market moved into a sell on rally mode. The sharp growth slowdown and negative economic news hugely impacted the market.

The sharp cut in corporate tax rates and the slew of reforms announced by the government has certainly boosted the sentiments. But the biggest drag on the market is the poor corporate earnings. Corporate earnings have been growing only at around 5 percent during the last 5 years against the average of 15 percent since liberalization. A sustained bull rally will emerge only when growth and corporate earnings indicate strong revival. This might take a few quarters more but is sure to happen, sooner than later.

Investors should understand the cyclicality of the market and returns. Returns from investment will not come in a steady and consistent trend. Returns come in ebbs and flows. During the 5-year period 1994-99, the market almost stagnated and didn’t give any returns at all. Therefore, during challenging times like now, investors should be more patient.

There is value emerging in small and mid-caps. In 2017, due to sustained and irrational fund flows into small and mid-caps, their valuations were pushed into bubble territory. Small and mid-caps, which were quoting at premium to Nifty, are now quoting at discount to Nifty and valuations are becoming attractive. Mid-caps and small-caps are down 30 percent and 40 percent respectively from their January 2018 peaks. Time is appropriate for allocating funds to the mid and small-cap segment. Investors should not commit the mistake of stopping SIPs. Continue with SIPs, and if possible, increase allocation to equities.