By Anil R

By Anil R

OPEC production cuts and geo-political tensions boil oil prices

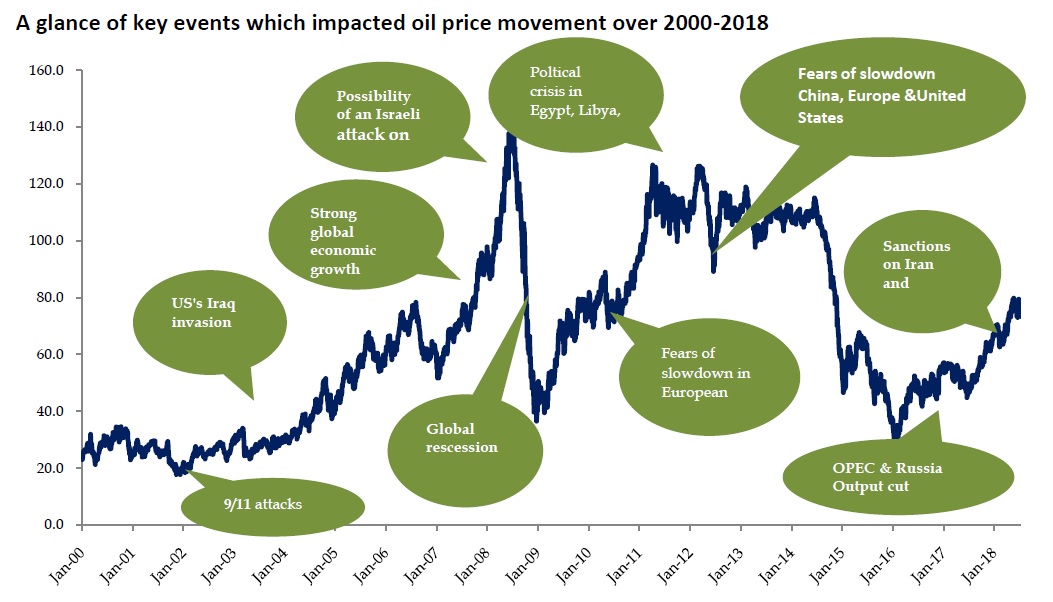

After almost two and a half years of benign prices, oil prices have witnessed significant jump and is currently trading at $72/bbl, up by 56% versus the year gone by. Key reason for this sharp up-move has been the supply cuts by OPEC and Russia. Brent is up by nearly US$10/bbl post the November 2017 agreement to extend production cuts until the end of 2018 in an attempt to re‐balance the markets and inventory levels. OPEC and Russia have been quite successful in curbing production along with an increasing rate of compliance pushing oil prices up.

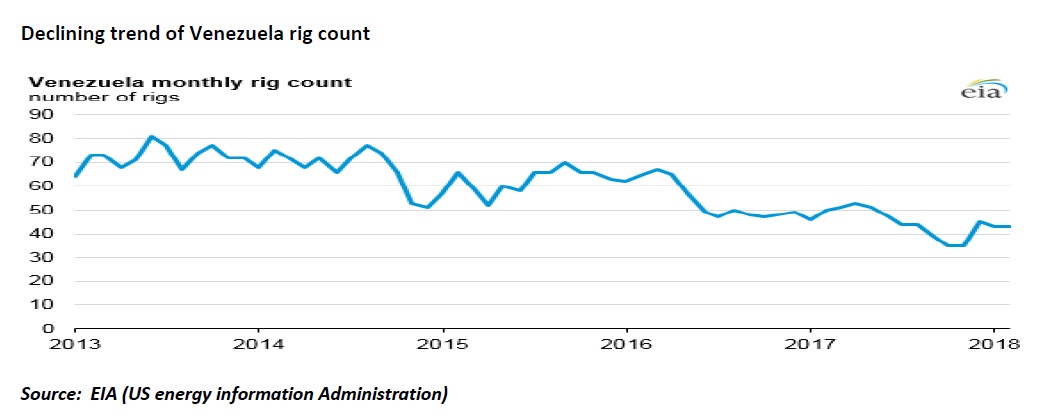

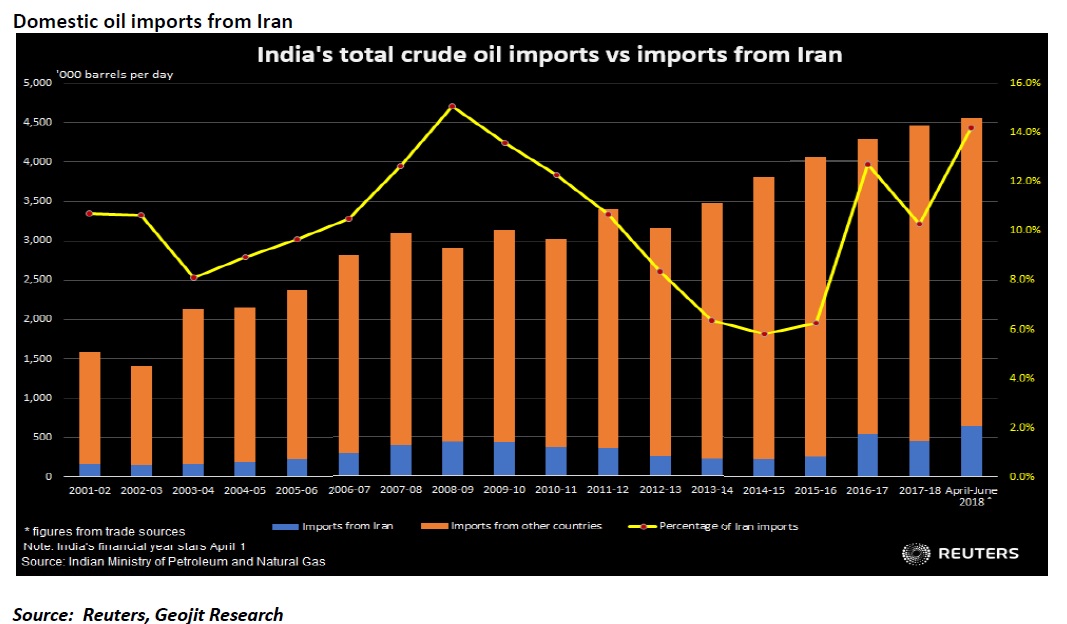

Additionally, the other factors which contributed to this up-move were the geopolitical tensions in the Middle East, supply disruptions in Venezuela and new US sanctions on Iran. In the case of Venezuela, ongoing economic crisis has impacted oil production in the country. Venezuelan output has plummeted by nearly 40% since 2015. Despite production ramp‐up from the US, the threat of US withdrawal from Iran nuclear deal and announcement of fresh sanctions helped oil prices to touch $80/bbl. However, after making a high of $80/bbl, oil price has consolidated and is currently trading at $72/bbl. This fall in price was largely due to Saudi Arabia and Russia agreeing to compensate for any disruption due to the sanctions on Iran.

Additionally, the other factors which contributed to this up-move were the geopolitical tensions in the Middle East, supply disruptions in Venezuela and new US sanctions on Iran. In the case of Venezuela, ongoing economic crisis has impacted oil production in the country. Venezuelan output has plummeted by nearly 40% since 2015. Despite production ramp‐up from the US, the threat of US withdrawal from Iran nuclear deal and announcement of fresh sanctions helped oil prices to touch $80/bbl. However, after making a high of $80/bbl, oil price has consolidated and is currently trading at $72/bbl. This fall in price was largely due to Saudi Arabia and Russia agreeing to compensate for any disruption due to the sanctions on Iran.

Global economic growth picking-up

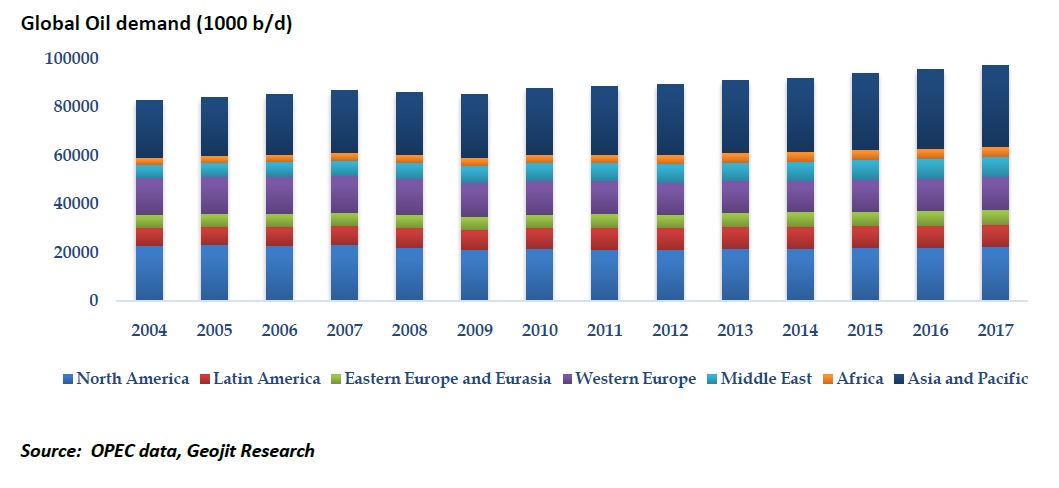

Another factor supporting high oil prices is the pick-up in global economic growth. IMF maintained a status quo on global growth outlook at 3.9% for CY18 and CY19. Stability in global market followed by ease in trade tensions will increase demand for oil. As per IEA estimates, global oil demand is estimated to be at 99.3 mb/d in 2018 vs. 97.8 mb/d in 2017. On the domestic front, with expected buoyant GDP growth, India’s oil demand is anticipated to grow by 3% in FY19 to 227 MMT from 220.43 MMT in FY18 (as per PPAC estimates).

Source: Bloomberg, Geojit Research

Source: Bloomberg, Geojit Research

Sharp rise in price after 2004

Till end of 2004 prices were relatively stable and remained in $20-30 range. However from early 2004 onwards price moved up due to production cuts by OPEC and non-OPEC producers, general strike in Venezuela and conflict in Iraq. After breaching the psychological barrier of $60/bbl, the overall trend has been up. Key reasons were delay in supply catching up with demand and rise in geopolitical tensions. Hurricane Katrina in US in mid 2005 and decline in oil production in Iraq due to conflicts caused decrease in production by 1 million barrels per day. Oil prices touched an all time high of $78/bbl in August 2006. Additionally flare-up in tensions due to North Korean missile launch and Israel-Lebanon conflict also added to the woes. However, for a brief period, prices fell to $52/bbl in January 2007 as global demand slumped.

2008 oil shock and Subsequent collapse to $32/bbl

The key events were:

- Strong global economic growth during 2007 and decrease in non-OPEC supply.

- Venezuela cuts off oil sales to ExxonMobil during a legal battle over nationalization.

- Iraq war and supply disruptions in Nigeria.

- Fears of an Israeli attack on Iran.

However, oil prices fell sharply in the second half of 2008 as the financial crisis hit global economy.

The sharp spike between 2009-July 2014

From relatively stable levels of $40-$50/bbl range till early May 2009, prices witnessed a steady upward momentum due to political turmoil in Egypt, Libya, Yemen, and Bahrain. Further, fears of more instability in other countries pushed the price of oil over $100. Further increasing tension between Iran and the West pushed prices above $125 per barrel in February 2012. Pick-up in global economic growth further drove the prices up.

A sharp fall…retesting of $30/bbl mark

The slide in crude oil prices began in mid-2014 as the slowdown in demand from developing countries and expansion of crude supply in North America, largely from shale oil, led to rapid build-up of inventories. The decline in prices accelerated as OPEC declined to cut its output to rebalance the market in an effort to regain market share and output from Iran flooded the markets as UN sanctions on Iran were lifted in July 2015.

Impact on Indian macros

India is the third largest importer of crude oil and the country’s import dependency is ~80%. Considering the US decision to re-impose sanctions on Iran and other supply disruptions there are upside risks to prices. Rising oil prices will have impact on domestic macros like inflation, current account and fiscal deficits, which will have a spillover impact on monetary policy, consumption and investment behavior in the economy ultimately impacting GDP growth. As per the Economic Survey 2018 estimates, every $10/bbl increase in oil prices will reduce growth by 0.2-0.3 percentage points, increase WPI inflation by about 1.7 percentage points can worsen the CAD by about $9-10 billion dollars.

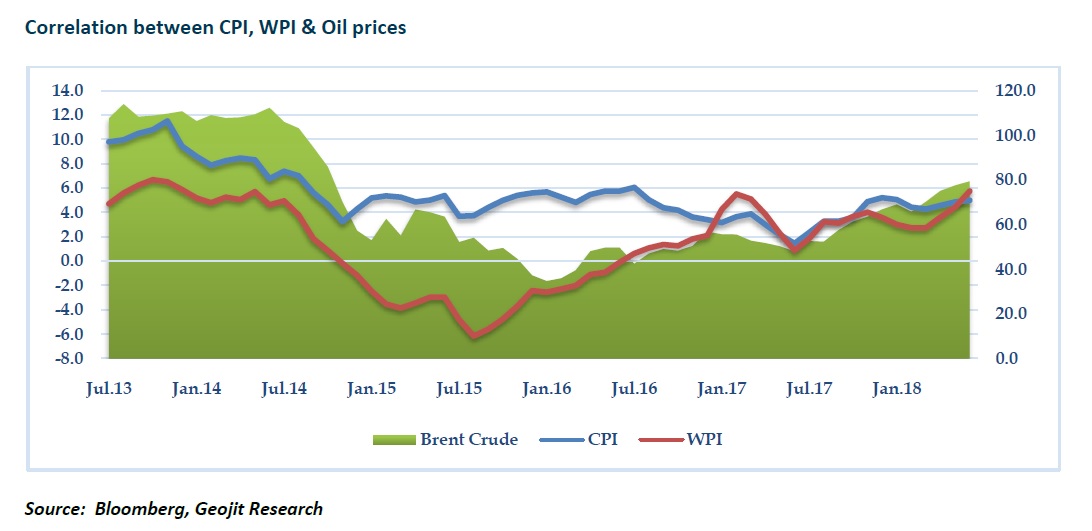

Impact on inflation

A 10% rise in crude oil prices would result in 20-30 basis points impact on GDP growth if the full costs were passed on to consumers. At time of higher oil prices, tighter monetary policy is followed to meet the inflation target, which will impact discretionary spending. June CPI rose to 5% (5 month high) largely due to higher fuel prices. Considering this, we may expect RBI to turn more hawkish in the next policy meet.

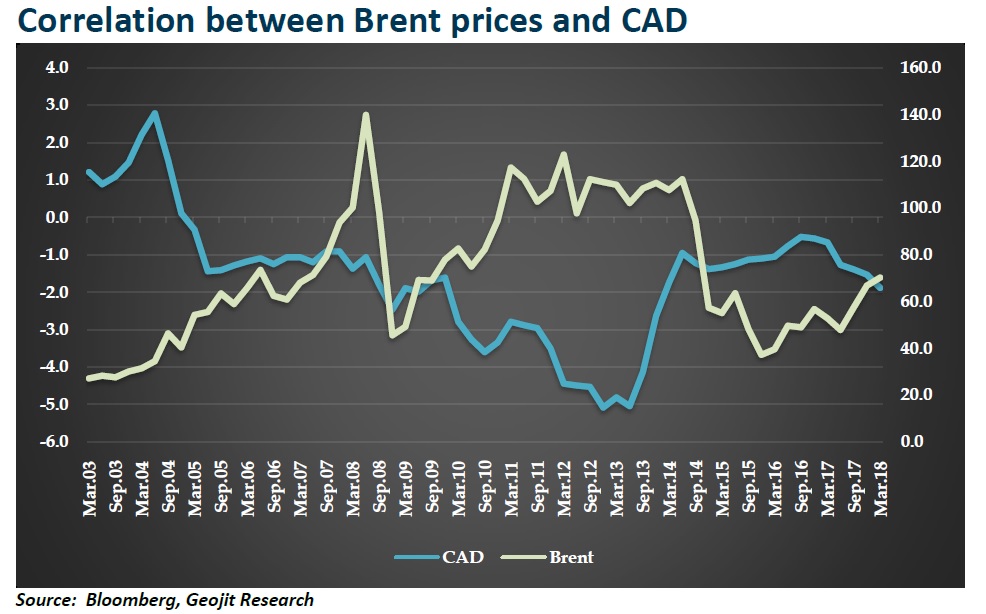

Correlation between Brent prices and Current Account Deficit (CAD)

Correlation between Brent prices and Current Account Deficit (CAD)

According to PPAC (Petroleum Planning and Analysis Cell), a US$10/bbl rise in oil prices increases India’s import bill and, hence, CAD by 0.3% of GDP. Oil imports during April- June 2018-19 was at $34.64bn which was up by 49% versus $23.18 bn to same period last year.

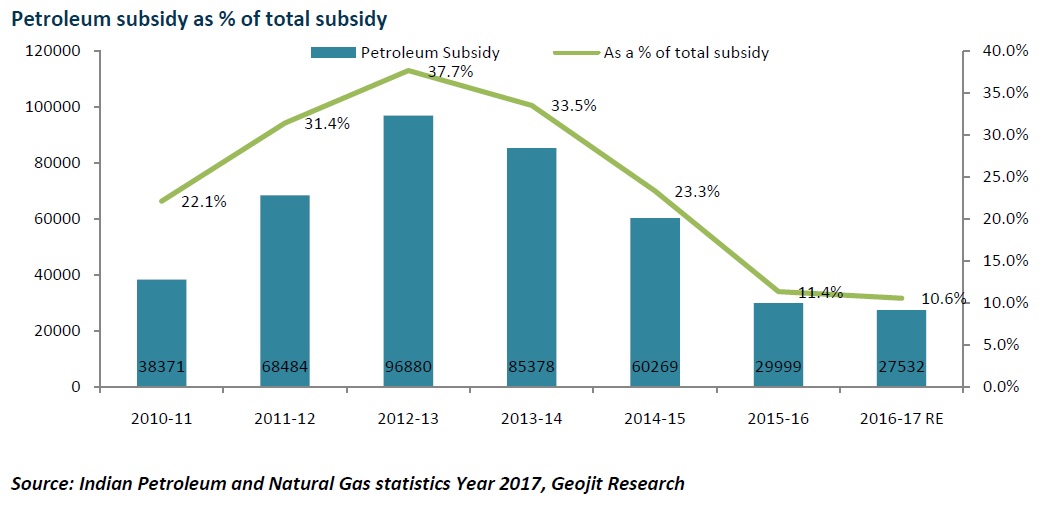

Subsidies and impact on deficit

India’s oil related subsides narrowed to 10.6% of overall subsides in FY17 from the peak of 38% in FY13, due to a sharp fall in global crude oil prices and energy sector reforms. Measures undertaken by the government include the deregulation of diesel prices, monthly increases in kerosene and LPG prices and direct benefit transfer. Government has budgeted Rs 25,000cr for fuel subsidies for the current fiscal. Rising oil prices and government’s widening fiscal deficit will leave little scope for excise duty cuts in petroleum products during the run up to the election.

Our view on oil prices

Our view on oil prices

Modest surpluses and shortages can trigger wide fluctuations in prices, because demand in the short run is rigid. However, in the long run higher price will provide incentive for producers to increase output. Currently price has dropped ~$10/bbl on expectation of higher output from OPEC and Russia. Issues related to sanctions on Iran and other supply disruptions are evolving, while final outcome is difficult to predict. Having said that, rising output from US and higher production from OPEC and Russia will compensate the current supply disruptions, capping the prices at $80/bbl.