By Dr.V. K. Vijayakumar

In the Irish playwright Oscar Wilde’s play ‘A Lady Windemere’s Fan’ a character remarks: “a cynic is a man who knows the price of everything but the value of nothing.” Oscar Wilde was criticizing the tendency of some people to assess everything in terms of money. In romantic literature real value is priceless. Of course, there are many things in life that can’t be valued in monetary terms. But, in investment, price is hugely important. Value creation and wealth generation depend largely on the price an investor pays for an asset. That’s why Warren Buffet famously said, “it’s far better to buy a wonderful company at a fair price rather than a fair company at a wonderful price.”

What is value investing?

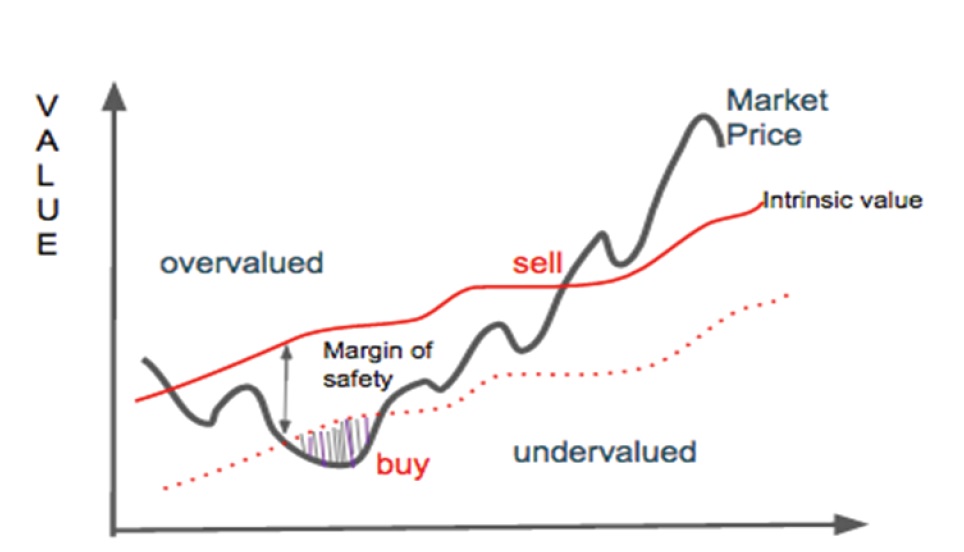

Value investing is an investment strategy that involves buying securities that are underpriced. A security is underpriced when its market price is less than its intrinsic value. In simple words, value investing is buying a security cheap and waiting for its price to go up.

Benjamin Graham is the father of value investing. Benjamin Graham and David Dodd, who taught at Columbia Business School, developed the ideas of value investing. The ideas were developed in their great work ‘Security Analysis’ published in 1934. Basically, they advised buying stocks that are cheap; that is, buying stocks that are cheap in terms of parameters such as PE Ratio, Price to Book, Dividend yield etc. The difference between the intrinsic value and market price is the ‘margin of safety’. If the market price is lower than the intrinsic value, the stock is safe to invest. If the price paid for the stock is much lower than its intrinsic value, sooner or later, it results in phenomenal wealth creation. As Benjamin Graham said, “price is what you pay; value is what you get.”

Different styles of value investing

Benjamin Graham has many followers. Consequently there are different styles of the strategy. The most famous follower of Graham is his student, the legendry Warren Buffet. Buffet gave lot of importance to the quality of business and management. Buffet himself was influenced by his friend and partner, Charlie Munger.

Mr Market

Graham developed an allegory called ‘Mr Market’ in his magnum opus “The Intelligent Investor”. Mr Market is a highly emotional and volatile character. He is very happy at times; sometimes he is very sad. He oscillates between euphoria and despair. When Mr Market is happy, stock prices go up. When Mr Market is sad, stock prices go down. When he is gripped with despair, market crashes. When he is euphoric, prices shoot up to irrational levels. This manic-depressive character of Mr Market offers opportunities to investors to buy low and sell high.

Absolute and relative value

In bull markets it would be difficult to find absolute value. As a bull market matures most stocks would be fully priced and it would be difficult to find absolute value. During such times, relative value becomes important. For instance, at the peak of the 2003-08 bull market in India, most stocks were overpriced. In other words, there was no absolute value. But pharma and IT provided relative value. Investors who invested in these relatively underpriced stocks gained substantially in the years that followed the recovery in stock prices after the crash of 2008.

Or, take the ongoing bull market in India. Valuations are higher than historical averages. In mid and small-caps valuations are excessive. In brief, spotting value is extremely difficult. Of course, there will be hidden gems at all points of time; but spotting them would be a herculean task. It is important to understand that the returns from investment will be huge if a stock is bought at low absolute value than at low relative value.

Market crises creates absolute value

Really attractive absolute values emerge during crisis. That’s why experts say, “buy when there is blood on the streets.” In this age of globalization, crises in Developed Markets will easily spread to all markets since economies and markets are interconnected. Investors can learn from two examples in recent history.

The terrorist attack on 9/11 was a ‘black swan event’, which led to panic and crash in markets across the globe. Stocks were available at attractive absolute values. Similarly, the global financial meltdown of 2008 and the Great Recession that followed led to sharp and massive fall in stock prices. Investors who bought stocks at attractive absolute values during these crises made huge profits when the markets rebounded. Since markets are manic-depressive, such opportunities emerge once in a while. Warren Buffet put it succinctly when he said: “ Charlie and I have no magic plans to add earnings except to dream big and be prepared mentally and financially to act fast when opportunities present themselves. Every decade or so, dark clouds will fill the economic skies and they will briefly rain gold. When downpours of that sort occur, it is imperative that we rush outdoors, carrying washtubs not buckets. That we will certainly do.”

SIPs as value investing

In mutual funds, fund managers do asset allocation, which is actually buying low and selling high. Fund managers continuously churn portfolios by exiting from over-valued stocks and entering stocks, which are relatively under-valued. Systematic Investment Plan is a form of value investing. In SIPs the investor invests through ups and downs of the market. Big value is created when investors invest through a bear market. Many first-time retail investors enter the market at its peak and then panic and exit when the market crashes. Even an investor who enters the market at its peak can make money if she continues to invest systematically. Imagine an investor who entered the market at the peak of the previous bull run in 2008. If she had continued investing through the bear phase that followed, she would be sitting on huge profits now. Big losses are incurred when investors panic, stop investment and exit from the market.

In the ongoing bull run, finding absolute value is not easy. Hidden gems always exist, but spotting them requires extensive research and expertise, which are normally beyond the reach of retail investors. Therefore, it would be better to leave the pursuit of value to professional fund managers by investing systematically because SIP is an efficient form of value investing.