Export mix to be the next leg of growth

Triveni Turbine Ltd (TTL) is the domestic market leader in steam turbines up to 30 MW. The company designs and manufactures steam turbines up to 100 MW, and delivers robust, reliable, and efficient end-to-end solutions.

Key Highlights

TTL reported the highest ever revenue achieved in a quarter at Rs 503cr, a growth of ~17% YoY in Q3FY25, led by robust execution in export orders (31% YoY).

EBITDA margin improved by 232bps YoY to 21.7%, due to better revenue recognition in Product segment and a drop in other expenses.

The order book grew by 15% YoY, supported by 20% YoY growth in order inflows in 9MFY25. Strong growth in export orders by 41% YoY, combined with an improvement in export contribution (65% mix), provides visibility for both revenue and profitability for coming quarters.

The company has received a 160 MWh long duration energy storage (LDES) system at NTPC’s Kudgi supercritical thermal power plant for a consideration of Rs290cr, with this TTL is foraying into a new product segment.

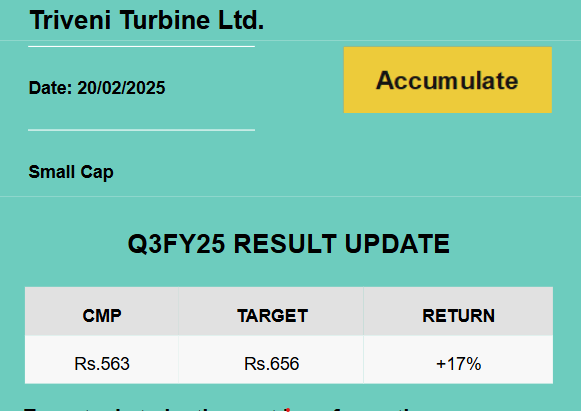

OUTLOOK & VALUATION

A strong mix of international orders (65% of the order book vs 52% earlier) is expected to increase the earnings visibility in the coming quarters. On the domestic front, there is a slowdown in order inflow, in 9MFY25 domestic order book declined by 22% YoY. Due to slow pace in domestic execution, we reduce our revenue estimate for FY25E/26E by 7.5/7.3% respectively. We therefore revise our rating to Accumulate and value the stock at a P/E of 40x on FY27E EPS with a revised target price of Rs 656.