“Hundreds of theories have been advanced concerning the ups and downs of business, the so-called business cycle: variation in the money supply, inventory over-balance and under-balance, changes in world trade due to political edict, consumer attitude, capital expenditure, even sunspots and juxtapositions of the planets. Pigou, the English economist, reduced it to the human equation. The upward and downward swings of business, are caused by excesses of human optimism followed by excesses of pessimism. The pendulum swings too far one way and there is glut; it swings too far the other way and there is scarcity. An excess in one direction breeds an excess in the other, and so on and so on, a diastole and systole in never-ending succession.” Charles J Collins wrote this in 1978 in his foreword to the famous book from Frost & Prechter’s on Elliot wave principle. Forty years since this was published, the theory is still very much in demand.

“Hundreds of theories have been advanced concerning the ups and downs of business, the so-called business cycle: variation in the money supply, inventory over-balance and under-balance, changes in world trade due to political edict, consumer attitude, capital expenditure, even sunspots and juxtapositions of the planets. Pigou, the English economist, reduced it to the human equation. The upward and downward swings of business, are caused by excesses of human optimism followed by excesses of pessimism. The pendulum swings too far one way and there is glut; it swings too far the other way and there is scarcity. An excess in one direction breeds an excess in the other, and so on and so on, a diastole and systole in never-ending succession.” Charles J Collins wrote this in 1978 in his foreword to the famous book from Frost & Prechter’s on Elliot wave principle. Forty years since this was published, the theory is still very much in demand.

However, Elliott Wave (EW) theory is different from other approaches of stock market analyses which rely on empirical, pictorial or statistical studies. The EW analysis is mathematical in application, but mastering it requires the proponent to be willing to see those numbers or market moves with a human behaviour filter.

The extensive period of time that is required to master the theory and the time intensive nature of the analysis, all but ensures that few would be committed long enough to arrive at credible results. Glenn Neely who went on to propose Neely extensions to EW in an effort to simplify the application of EW theory was of the view that frequent indeterminacy was a major problem. He wrote: “The price or time termination area of a trend is not predictable, with a high degree of confidence, until an Elliott Wave pattern is on the verge of completion. Sometimes, confidence is not obtainable until after a pattern has completed. This fact keeps most of the public suspicious about the Theory. As the market approaches the end of a move, the pattern in progress begins to become clear. As it moves away from the identified turning point of a previous pattern and moves toward the middle of a new pattern, the number of possible patterns in progress again increases. This is the reason experienced Elliott analysts can disagree on the position of a market during certain time periods: each is choosing what he or she considers to be the best scenario of the interpretations possible.”

What is behind Elliott wave theory?

It is easier to understand this by looking at what is measured and how it is measured, in EW theory.

The what:

Though commonly touted as a forecasting tool, EW theory is essentially a detailed description of how markets behave. To understand this, we need to look at how our mind is conditioned. Normally, we believe in the linear causality of the events. We attempt to understand events by attaching a cause and effect to them. Each event of today, is therefore a product of yesterday’s event. There is nothing wrong with this approach, and it certainly helps us in our daily transactions, be it between people or businesses. But it is elementary at best, and, complex events deserve a better way of explaining. In the case of stock market, investors are at times confused as to why certain events do not result in resultant price move, or that some price moves do not happen at a time they thought they would. This is where the wave principle steps in.

Waves have been important to man in his scientific pursuit; in understanding the physics of nature. It is an integral part in our efforts to understand acoustics, optics, quantum mechanics, electromagnetic fields, curvature of space time, etc. Hence it is not surprising that the versatile wave concept has been used to explain stock market moves. EW theory sees the patterns of directional movement in markets, as waves; three impulse moves that are in the direction of the major move, and two in between, which are counter trend, and moves in the opposite direction of the major move. This 5 wave pattern is to be followed by a 3 wave corrective move. So, that explains the what.

The how:

One of the questions posed in the famous Book of Calculus – Liber Abacci, by Leonardo Fibonacci goes thus:

“How many pairs of rabbits placed in an enclosed area can be produced in a single year from one pair of rabbits if each pair gives birth to a new pair each month starting with the second month.”

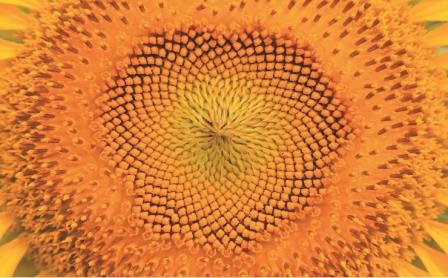

The answer to this question has given us the Fibonacci sequence. In one year, the Rabbit family had 144 pairs, progressing every month as 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144. The number of pairs is 1 at the start of first and second month, but by the third month the first pair produces, giving; so we have 1, 1 and 2. Younger pair does not reproduce in the next month, because it isn’t two months for them, but the older pair reproduces, taking the total to 3. So the sequence goes on as 1, 1, 2, 3 and so on. This sequence can also be progressed by adding the last two numbers to the get the next number in the sequence. Further, the ratio of these numbers give a whole lot of fractions, one of which approaches the irrational number phi or 0.618034, the golden ratio[1], and many more which are significant in the real world applications, but any further discussion on them is beyond the ambit of this article. Elliott was the first to relate this sequence to the market moves, having found that the number of Dow Jones Industrial Average index points between 1921 and 1026 stretching from the first through the third waves was 61.8 % retracement of the number of points in the fifth wave from 1926 to 1928. More evidences of the golden ratio and its derivatives embellished the usefulness of the EW theory with time, leading to widespread use and advancement in the theory.

Under the wave principle, every market decision is both produced by meaningful information and produces meaningful information. This feedback loop is governed by man’s social nature, and since he has such a nature, the process generates forms. As the forms are repetitive, they have predictive value. This feedback concept sits perfectly well with Fibonacci sequence, which displays a sustained relationship with the constituent elements.

Will the EW theory stand the test of time?

Asymmetry of information flow is one of the major drivers of price move or a period of time. Two factors that have changed over the years and have come to influence such flow are media and the information technology. The former gets to influence the type of information and the timing of the flow, while the latter plays a role in the actual dissemination and influence the impact. In mass communication, agenda setting refers to media’s ability to influence or to tell us what issues are important. We have seen governments brought down, and elections won on the basis of managing what news reaches whom. But then, propaganda has always been a powerful tool since time immemorial. Today, only the medium looks to have changed. But there is a very evident change in the pace with which information reaches us, thanks to technology, though that is not coincided by sufficient increase in memory or brain’s processing power in order to effectively utilize the information deluge. The extensive use of algorithmic trade also needs to be factored in. To an extent, they do challenge the efficient market hypothesis, in that both these factors can influence how markets absorb price sensitive information. Given the pace of automation and improvement in technology, it is a given that the decision making process in the market will see changes, some of which we have already begun to see. But, will it render EW obsolete? Not quite; at least not yet. Its USP lies in the fact it explains progress. On current evidence alone, EW is thriving well, as the market moves continue to be replete with golden ratios, which is so omnipresent in the nature’s building blocks. As long as that remains, and humans continue to be behind decision making, Elliot wave theory shall remain a capable way of explaining stock markets.

Notes:

[1] In mathematics, two quantities are in the golden ratio if their ratio is the same as the ratio of their sum to the larger of the two quantities.

Citations:

Neely, Glenn (1990). Mastering Elliott Wave.

Frost and Prechter (1978). Elliott Wave Principle