In equity market parlance, players and traders are described by two famous references: ‘The Bull’ and ‘The Bear’. Bulls are those packed with action anticipating a price rise and Bears are those loaded with stuff anticipating a price drop. Bulls and Bears are opposite to each other. They don’t cheer together. The market is always a combination of both.

In equity market parlance, players and traders are described by two famous references: ‘The Bull’ and ‘The Bear’. Bulls are those packed with action anticipating a price rise and Bears are those loaded with stuff anticipating a price drop. Bulls and Bears are opposite to each other. They don’t cheer together. The market is always a combination of both.

There is another type of investing community that may be called ‘The Tortoise’, and they are fast growing in the recent times. Tortoises are a type of investors, who keep it simple, invest gradually but regularly, make use of the opportunity during the price drop, patiently hold on to their investments and benefit from gains during the price rise in the long-term: yes, they are the ones who invest systematically through SIPs.

What’s best? Tortoises are friends with both Bears and Bulls. Bears help them in buying more units during market corrections thus enabling rupee cost averaging and Bulls help in compounding of wealth over the long-term through price rises.

As an asset class, equity outperforms other assets in the long term; but in the shorter periods, it is subject to constant volatility. It is difficult, almost impossible, to time the market. That makes us ponder over a question: Is there a way to invest in equities which would not only help us to participate on the upside in the long-term but would at the same time manage the in between volatility sensibly? Yes, the answer is Systematic Investment Plans (SIPs).

All of us invest expecting growth in our investments. But market doesn’t move in a straight line. The key question is, when markets drops in between, what are we doing about it or are we doing anything at all? SIP essentially handles this vital element in a better way. SIP helps to invest steadily, without having to worry about timing the market. This regular investing habit helps in cost averaging by buying more units when the NAV or market comes down and acquiring lesser units when the market or NAV moves up. In the long run this helps in discovering an average price and resultant yield, which is likely to be better than what one would have got otherwise with multiple investments (except for some cycles). When the prices appreciate over a period of time, enhancing the underlying portfolio’s performance, the returns are compounded.

Patience is a Virtue

With the ongoing market corrections, many SIPs started recently have been giving negative returns and many investors might feel bad about starting one and some may even be thinking of stopping their SIPs. A look at investment history would help balance the thought. There were many instances in the past, when SIP returns were negative in the short-term, but grew remarkably positive over the next many months / years.

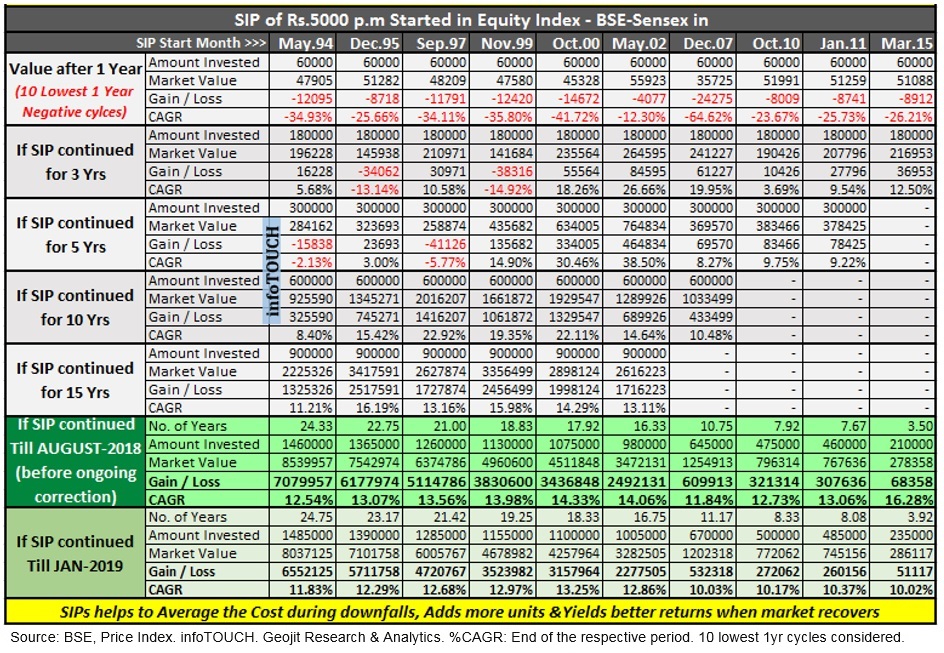

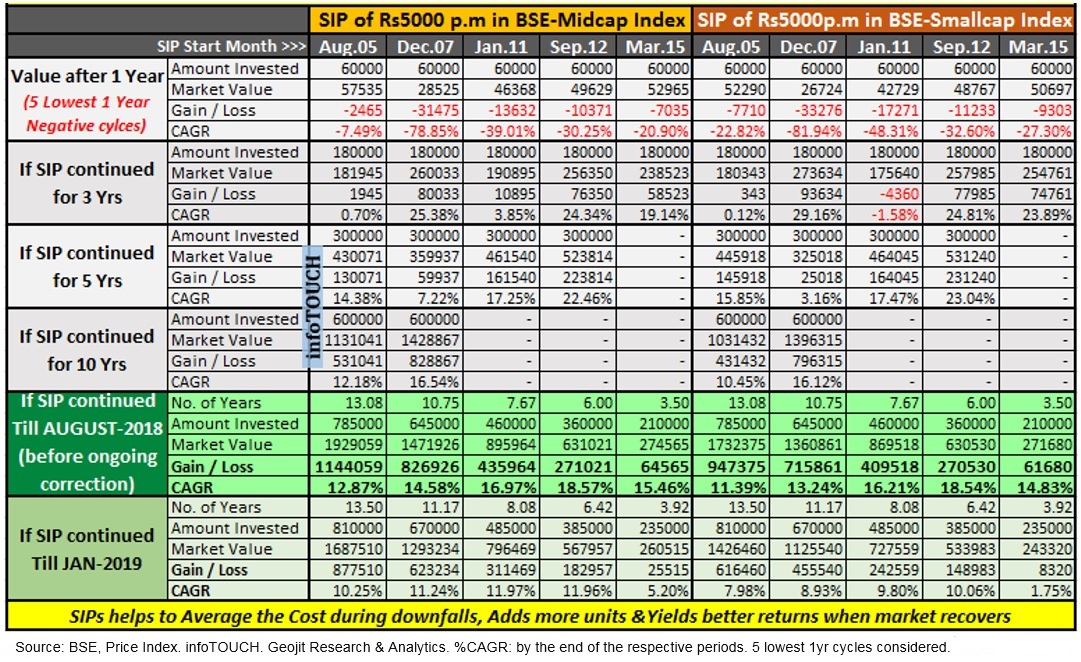

We did some number crunching to understand this. To get a better idea, the illustration was done across market cap portfolios, viz., large-cap: Sensex – comprising the top 30 companies, mid-cap: BSE-Mid-cap Index – comprising mid cap companies and small cap: BSE-Small cap Index – comprising companies with smaller market cap.Then we carefully selected the 10 lowest short-term SIP performance (over one year) in Sensex and 5 lowest cycles in the case of mid and small caps, to assess the performance if someone CONTINUED with the SIPs over longer tenure.

As can be observed from the outcome in the table given below, there were many instances in the past, when the SIP returns were negative over one year (short-term), some lesser than -70%. But interestingly if the SIPs were continued, which is what is ideally expected, the returns were surprisingly positive in the next three to five years or in the long run. The overall pattern or observation is similar across Large, Mid or Small companies portfolio, except for varying figures. This shows, how at times short-term negatives can be misleading and stopping SIPs can deprive us of the longer term compounding benefit. There is a possibility for a period bias here. Intermittent period like 2 and 4 years could be different. But overall what we observed in an SIP investing is that, beyond 4 to 5+ years, the probability of loss becomes negligible and also even in those instances when returns were negative due to an end-of-the-term bear cycle, the return becomes positive in the next 7 to 10 months. Also if you observe closely, the value of investments and the gains expand over the long term because of the compounding effect. For example, a Rs.5000 SIP in Sensex started in Sep-1997 was valued Rs.2.59 lakhs after 5 years, with a loss of -41,126. If one had continued the SIPs, going through the corrections by accumulating more units at lower cost, the value at the end of 10 years was Rs.20.16 lakhs with gains of Rs.14.16 lakhs. That’s the power of Compounding, the 8th wonder of the world.

One of the main reasons we compare an SIP investor to Tortoise is because of the needed quality called ‘Patience’. It is a strong ingredient when it comes to the recipe of success in equity investing. Investors should not be distracted by the near term corrections that sway the returns, but keep investing regularly focusing on the long-term goals.

A few reasons SIP investors should behave like a Tortoise:

- Longevity – Equity delivers in the long-term. SIP is an effective tool to plan for the long-term goals.

- Measured Start – It is good to allocate some time for goal planning. SIP is an effective tool to plan for the Goals. Planning takes time. But start adequately and early. Invest Right.

- Keep moving on – Ignore what others are doing and just focus on advancing your investments step by step, steadily towards the goal.

- Consistency – Since we have calculated and started investing the needed amount that is well within our means, it doesn’t strain the fund availability and hence one can keep investing continuously.

- No Fatigue – In SIPs we invest regularly, irrespective of the price levels. Essentially we don’t take the stress, pressure and anxiety of ‘Timing the Market’, and hence there is no fatigue for such investors.

- Shell cover – Asset allocation and systematic investments are a great combination. They protect and help during times of adversaries and sensibly approach the sporadic volatility.

In reality, a long-term investment journey consists of many Bull runs and Bear descends. Though we cannot stop the volatility, we can manage the investment approach in such a way that it handles volatility better.

Tortoises do SIP – a unique technique where both Bears and Bulls help them in wealth creation. Like in Aesop’s fable, the Tortoise eventually wins!!