All of us are familiar with the term SIPs (Systematic Investment Plans) which have gained prominence in the last couple of years, as a disciplined and affordable investment avenue to create or build wealth over the long term. This article will now talk about SWPs or Systematic Withdrawal Plans, which most of you may have heard of, but has gained more priority post the Budget presentation this year.

Difference between Dividend option and SWPs

In case the investor chooses the dividend option of a Mutual Fund, an amount is paid back to the investors at intervals. Dividends are declared from the realized gains of the respective MF schemes. Realized gains are the profits made by the fund manager by selling shares. Schemes decide the frequency of the dividend payments (daily, monthly, quarterly, annually) and the investor can choose from the frequencies available to him.

SWPs are an alternative to investing in dividend fund. Choosing the SWP facility in the growth option of a Mutual Fund, a fixed amount can be withdrawn at fixed intervals from a chosen MF. Moreover, the frequency and amount of withdrawal can also be selected by the investor. The SWP is not a product but is merely a facility available with all MF schemes, which allows disciplined withdrawals from any type of fund, be it Equity, Debt or Hybrid.

History

Before Budget 2020, dividend options of MFs were preferred by those investors who required a regular income and also by those who believed that opting for dividends would be construed as profit booking also (not entirely true, because dividend is not always paid from gains). Dividend taxation norms have undergone many changes, having been taxed directly and indirectly in the hands of the investor, since DDT was first introduced in Finance Act, 1997. In Budget 2018, 10% DDT on equity funds was introduced while for debt funds it remained at 25%. DDT was paid by AMCs at source and remained tax free in the hands of the investors. This meant that tax was levied at a flat rate on the distributed profits, across the board, irrespective of the marginal rate at which the investor is otherwise taxed. So although the investor was not taxed directly, there would be an indirect tax at the same rate for big and small investors alike. The provisions were therefore considered regressive.

However, the Finance Bill, 2020, replaced DDT with a classical system of taxation, that existed before the DDT and which is prevalent in most of the developed markets of the world. Instead of levying DDT, the tax will be levied in the hands of shareholders, at their applicable tax rates. The removal of DDT is in line with the recommendations of the Direct Tax Code Panel and brings in fairness amongst taxpayers. This means that if you are in the higher tax slab (30%), you will have to pay 30% tax on the dividend income compared to the earlier indirect 10% DDT. However, if you are in the lowest tax slab (5%), you will benefit and end up paying lower tax on the dividend income. TDS will be deducted at 10% on dividends received above INR 5,000 in a year. Moreover, the additional tax of 10% on dividend income in excess of Rs. 10 lakh per year also stands abolished.

Benefits

· Opting for SWP facility is very tax efficient and is easily the biggest advantage that it has over the dividend payout option. SWP is considered as redemption from Mutual Funds and therefore, attracts tax in the form of capital gains.

· In case of investment in Debt fund, if the withdrawal process starts within 36 months then it falls under Short Term Capital Gain (STCG), which is charged as per the individual’s income slab rates. However, if SWP starts after 36 months then it attracts Long Term Capital Gain (LTCG), which attracts only 20% tax along with indexation benefits.

· For investments in an equity fund, if the redemption is within 12 months, it attracts STCG, which is charged at 15%. If SWP is after 12 months then gains over and above Rs.1 Lakh attracts a tax of just 10% (plus cess) without indexation benefits. Tax is payable only on the capital gains, and not on the principal amount, and additionally one can take advantage of LTCG taxation relaxation of upto Rs.1 lakh in a particular year. For investors receiving Rs.5 lakhs dividend income and falling in the highest tax bracket, they will have to pay upto 30% tax, while for SWP you will have to pay 10% tax on just the gains above Rs.1 Lakh, after 12 months.

· At least in the initial years when the profit component of the payout is lower, you may end up paying NIL tax, as long as the profits are below Rs.1 lakh. An investor of a small sum may be able to avoid tax on his SWP, if the total LTCG in Equity remains below the Rs.1 lakh threshold.

· Even opting for SWP in debt funds, giving equivalent FD returns, is a more tax efficient method than income from FD investments.

· SWPs help investors withdraw with the benefit of Rupee cost averaging. It gives the benefit of an average NAV while exiting, rather than a particular NAV while exiting at a particular point of time. Just as SIPs avoid market risk at the time of investment, SWPs lower market risk at the time of redemption.

· SWPs give assured and fixed income to meet regular and important requirements for the long term (retirement expenses) or short term (college fees, short term EMIs etc.).

· Also, in life, there might be instances when your family members require your financial assistance to address their contingencies and giving money in lump-sum may not be the most ideal approach. Under such circumstances, an SWP would lead them to be financially independent and responsible while also letting the investor have control over the payment period and amount of the payout.

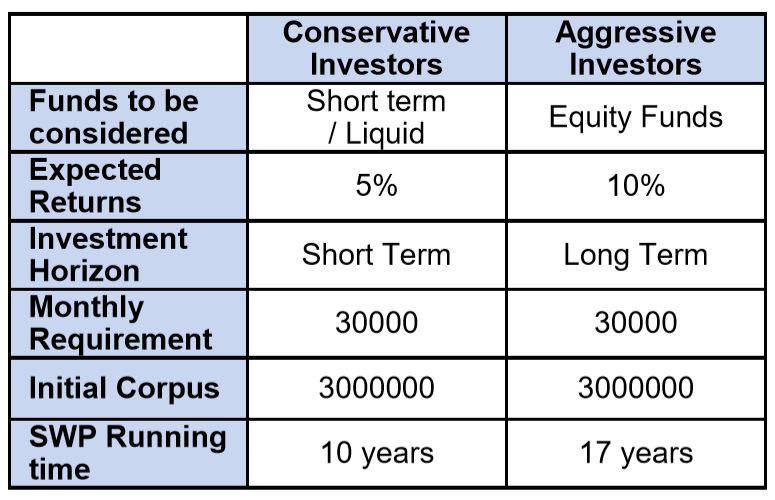

Consider an investor with an Investment corpus of Rs.30 Lakhs, with a monthly requirement of Rs.30000 (1% of corpus) and expected return rate 10%. This corpus will last for around 17 years of his retirement. If the SWP is started in the growth option of a conservative fund, then SWP will run for 10 years. This is what we need to understand about SWPs and the importance of planning, in our withdrawals. Everything else remaining the same, but if the corpus is Rs.40 lakhs, the SWP will remain functional well into our retirement life. Also, if the requirement as a percentage of the total corpus is below the expected rate of return then the SWP will remain active for the entire retired life. So the tradeoff, which is inherent for any investment, will have to be risk vs. return or saving more (the initial investment) for retirement.

For conservative investors or for investors who have a short-term time horizon, the SWPs can be started in short term debt funds or money market funds like liquid funds. This would ensure liquidity, relative safety and these funds have historically given better than FD returns. The trade off would be smaller monthly withdrawals as a percentage of the total corpus since the returns are also lesser. For aggressive investors or for investors with a longer time horizon, SWPs can even be started in equity funds. Although chance for losses is higher in the short term and in the beginning the SWPs may eat into principal amount, these will be offset in the long term as equities start performing. The advantage is that with the expected return being higher, the monthly withdrawals as a percentage of the total corpus can be higher and this can be used for long-term retirement planning with a comparatively smaller corpus.

Another alternative is to invest in an equity fund while keeping a year’s worth of redemption amount in a money market fund and take the monthly withdrawals from this source instead. This could be a good option to overcome the volatility inherent in the equity markets in the short term.

Things to keep in mind

It is better not to choose SWP option if you have a regular cash flow. Here SIPs would be ideal since it will help to create wealth. This can then be used for SWPs when we do not have a regular cash flow or when we are retired.

· SWPs are a good profit booking option in a rising market but can have a reverse effect in a bear market when more units will have to be liquidated to meet the withdrawal commitments.

· A higher initial investment is always better to avoid any surprises

· The withdrawal rate should be fixed in sync with the expected returns of the fund and the time horizon for which the cashflow is required. If any one of the factors is out of sync you will be impacted either due to faster depletion of the corpus or with cashflows unable to meet your commitments.

· Understanding how much income is required for retirement is an important step in establishing a SWP.

If SIP is about investing bucket by bucket, SWP is all about drawing water from a well, by the bucket. Bucket by bucket, the well will have enough time to replenish itself, which means you can use it forever, but pump it out; the well may not have enough time to replenish itself and may go dry. Here the water in the well is the investment corpus that you have already built, and the replenishment is the returns that this corpus is expected to earn each year. If we draw out lesser than the replenishment rate, the money inflow can continue forever. Otherwise, this may have a maturity date. So the investment corpus, the expected rate of return, the asset allocation based on your risk appetite and the corresponding withdrawal amount needs to be planned out. This is where a financial / investment planner can help out in successfully planning out the required investment and SWP amounts.