Like most people from middle class families, Arjun thought stock market investing was not meant for ordinary people. Terms like ‘Saving’ and ‘Investing’ were associated with depositing money in bank accounts, postal deposits, chit funds, and LIC. But during the last five years Arjun has been investing every month through Systematic Investment Plan and has seen his money grow. This has instilled confidence in him.

Like most people from middle class families, Arjun thought stock market investing was not meant for ordinary people. Terms like ‘Saving’ and ‘Investing’ were associated with depositing money in bank accounts, postal deposits, chit funds, and LIC. But during the last five years Arjun has been investing every month through Systematic Investment Plan and has seen his money grow. This has instilled confidence in him.

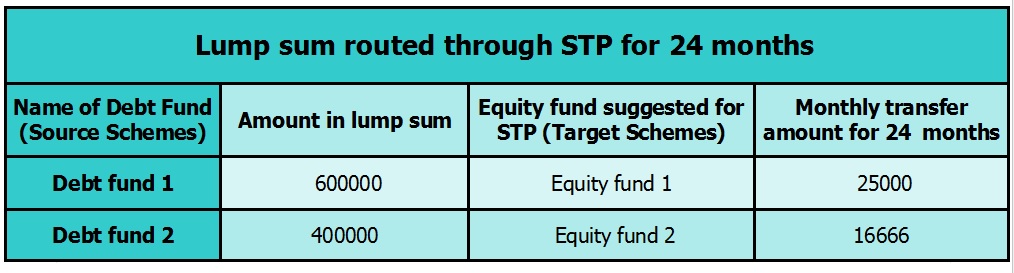

Arjun now wants to invest Rs 10 lakhs. He wants to invest this in Mutual Funds but is wary about making lump sum investment because of potential risks/unpredictable markets. So he decides to talk to a financial expert on Systematic Transfer Plans to mitigate risks.

ARJUN: I have heard about Systematic Transfer Plan. Could you explain about it?

MANOJ: You already know that, by investing ‘systematically’ in equities one can earn good returns even in volatile markets. STP is an effective tool when you want to invest a lump sum amount but want to avoid the risk of timing the market.

STP works just like SIP. While SIP allows you to transfer funds from savings to a mutual fund plan, STP is an automated way to transfer funds from one mutual fund scheme to another scheme of the same mutual fund house.

It is a smart strategy when you have a lump sum money to invest. First you invest in a debt fund (low risk fund) and use the STP option to systematically transfer a variable or fixed amount of money at regular intervals into a target equity fund. You can make these transfers on a daily, weekly, fortnightly, monthly or quarterly frequency.

This way you can earn a little extra on the lump sum invested in a debt mutual fund than parking your money in savings or current account, and at the same time get the benefit from the volatility of the market through systematic equity fund investments.

ARJUN: Is it an effective tool for risk mitigation?

MANOJ: Yes it is. Let me explain with an example. In your case you have Rs.10 lakhs to invest into equity. But it is not advisable to do it in one go as you cannot gauge where the market is heading. So you can choose to invest the entire amount in a debt fund, as it is less risky than equity, and then you can choose to transfer a fixed amount say Rs 25,000/month into a chosen equity fund/balanced fund. So by spreading your investment across around three years you can average out the market, get good returns and mitigate your risk through STP.

Illustration:

ARJUN: How do I start STP?

MANOJ:Firstly, based on your risk profile, investment horizon, current allocation to equities, and the market view you have to decide on whether you should do a STP or lump sum investment. If you decide on STP, choose the mutual fund house. They will invest the money in their debt fund and transfer an amount decided by you into a target scheme of your choice in the same fund. The STP will stop automatically, when you do not have adequate funds to transfer from one scheme to the other.

You can enrol for this service by using a one-time registration with the same AMC. Once registered, the fund will automatically transfer from the source fund to the target fund on the predetermined date.

ARJUN: How often do I have to transfer funds? And can I choose the amount to be transferred?

MANOJ: There are various types of Systematic Transfer Plans.

In a Fixed STP, you can decide to transfer a fixed amount from one mutual fund scheme to another, as per your financial goals.

In Capital Appreciation STP, only the profit from debt/source fund is transferred to the equity/destination fund. The original lump sum amount invested is protected.

Flexi STP is flexible as you can choose to transfer different amounts from the source fund to the target fund based on market conditions. Here you can specify a regular SIP amount and a multiplier to this, to be invested at different market levels/ when the market falls.

ARJUN: Are there any features of a Systematic Transfer Plan that I should be aware of?

MANOJ: Some of the key features are:

- There is no standard minimum investment amount to invest in the source fund.The fund house define the minimum investment amount for STPs, but as per the SEBI guideline, you need to make at least six capital transfers from one mutual fund to another.

- While there is no entry load, SEBI allows fund houses to charge exit load up to 2%. The exit load is calculated based on investment tenure and fund type. So choose source funds that has no exit load. Normally low maturity funds such as liquid and ultra-short term fund in the debt category have no entry and exit load , these are recommended for parking the lump sum money for STP.

You should also be aware of the tax implications on the transfer. The transfer from one mutual fund to another through STP is considered as a redemption from one fund and a fresh purchase in another. This redemption is usually taxable. The money transferred within the first 3 years from a debt fund is subject to short-term capital gains tax (STCG). But even with this tax aspect, the returns earned would be higher than those in a bank account.