C&I to drive growth for WTG and O&M segments

Suzlon energy is a vertically integrated wind turbine manufacturer and O&M service provider with over 20.9GW of installed capacity across the globe.

Key Highlights

Suzlon announced a third repeat order to the tune of 204.75 MW from Jindal Renewables, making them its largest C&I customer. The total orders from Jindal Renewables now stand at 907.20 MW.

Q3FY25 consolidated EBIT margins expanded by 119 bps driven by WTG margin expansion of 909 bps. Forging and foundry businesses staged a 704 bps YoY expansion. However, this was offset by OMS business margins, which saw a 533 bps decline as Renom’s full consolidation affected the margins.

Management has revised down the expectations for WTG installations to the 3.5GW -4GW range from the earlier expectations of 4.5 to 5 GW installations.

In order to meet the increase in demand in the future, management stated that they have made a significant ramp-up in capacity to over 4.5 GW with revamped Pondicherry and nacelle facilities. They have also added new blade lines in Madhya Pradesh and Rajasthan. Net worth & net cash position as of December 2024 stood at Rs. 4,914 Rs.4,914cr. & Rs. 1,107, respectively.

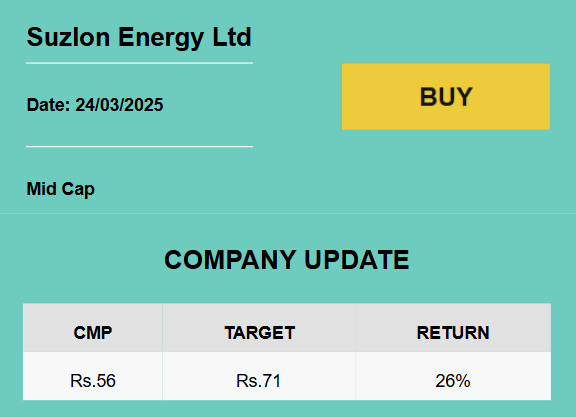

OUTLOOK & VALUATION

We expect order inflows to remain strong in the near term and the C&I portfolio to expand further in the mix. WTG deliveries have been robust, but installation pace is satisfactory due to execution issues like transmission delays and land-related challenges. 9MFY25 installation/deliveries ratio is at 0.25X, indicating a slack in installations. Hence, we cut FY26E/27E revenue estimates by 10%/21%, respectively, to be in line with the guidance and to account for this execution risk. However, we forecast margin expansion of 70bps as higher EBITDA contributions and improving profitability of the WTG segment due to better project mix can drive consolidated EBITDA margins. Suzlon’s PAT is expected to grow at a 30% CAGR in the FY25-27E period. Therefore, we value the stock at a 40X PE multiple on FY27 EPS to arrive at a target price of Rs.71.