Lower realisation drags margin, expect to rise

Sagar Cements Ltd. (SCL), established in 1985, is a south Indian cement manufacturer with a capacity of ~10.5MT (South-8MT, Central-1MT, East-1.5MT). SCL has a total captive power capacity of 96.96MW.

Key Highlights

Q3FY25 revenue declined by 16% YoY to Rs. 564cr with volumes dropping by 2% YoY and realisation declining by ~18% YoY (excluding incentive).

EBITDA fell by a 57% YoY as EBITDA margin declined by 610bps YoY to 6.7% (improved from 4.2% in Q2FY25). EBITDA/tonne fell by a 41% YoY to Rs. 273 (improved from Rs. 172) owing to lower realisations and volumes.

The company reported a net loss of Rs. 54cr in Q3FY25 (vs loss of Rs. 11cr YoY and loss of Rs. 57cr QoQ).

SCL commissioned 6MW Solar Power at its Gudipadu Unit and is planning another 29.5MW by FY28 towards achieving its target of 50% green power mix by FY30 (currently 14%).

The process of clearance of land monetization of 107 acres (Rs.4cr/acre, part of the Andhra Cements acquisition) is progressing and expect to complete by ~1.5 years post approval (expecting approval by Q1FY26).

OUTLOOK & VALUATION

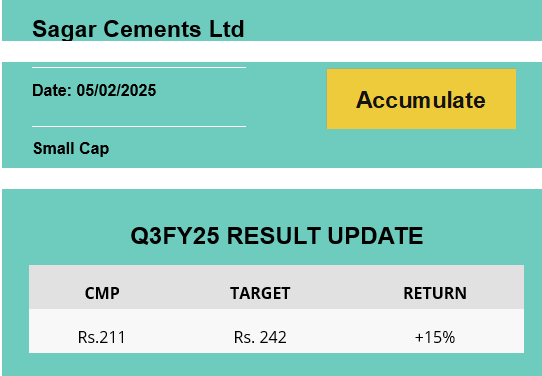

Demand is expected to pick up given the recent acceleration in government infrastructure & housing projects, which will also support realisations. Cement capacity expansion plans are underway at Dachepalli (0.75 MTPA), Jeerabad (0.5 MTPA) and Gudipadu (0.25 MTPA) to take the total to 12 MTPA by FY26 end. Going ahead with the rising utilisation rate, expect EBITDA per ton to improve on account of lower power & fuel expenses and operating leverages. Operating leverage itself should add ~Rs.200-300 EBITDA/ton and expected price increase will contribute further. The company has capex plans for ~Rs6bn over FY25-28E. The current net debt is at Rs.13bn (D/E– 0.8x) and SCL expects deleveraging to start in FY26 and we value SCL at 10x FY27 EV/EBITDA (2Yr avg=~10x) to arrive at a target price of Rs. 242 (earlier Rs.250), maintain Accumulate rating considering the expected improvement in margins and recent correction in stock price.

To read our detailed research report