| Robust momentum, positive outlook ICICI Prudential Life Insurance Co Ltd (IPRU), a joint venture between ICICI Bank and Prudential Corp Holdings, offers life, health and pension products. |

| Key Highlights In Q3FY25, first-year premium and single premium witnessed a YoY growth of 19.0% and 77.6%, respectively, As a result, net premium income rose 23.5% to Rs. 12,261cr. In 9MFY25, net premium increased 14.5% YoY to Rs. 30,890cr, driven by increase in the total number of policies sold, reaching 458,423 (+14.4% YoY). In 9MFY25, the annualised premium equivalent (APE) increased 27.2% YoY to Rs. 6,905cr, driven by a shift in customer preference towards its unit-linked products, supported by the current market buoyancy. Value of new business (VNB) rose 8.5% to Rs. 1,575cr 9MFY25.The VNB margin for 9MFY25 stood at 22.8%, compared with 26.7% in 9MFY24. The decrease is primarily attributable to changes in the underlying product mix during the period. Subsequently, profit after tax (PAT) rose 43.2% YoY to Rs. 325cr in Q3FY25, driven by the company’s robust topline performance. 9MFY25, the Retail Weighted Received Premium (RWRP) grew 31.4% YoY to Rs. 5,536cr, mainly attributed to outperforming both the private sector and the overall industry over the past five quarters. |

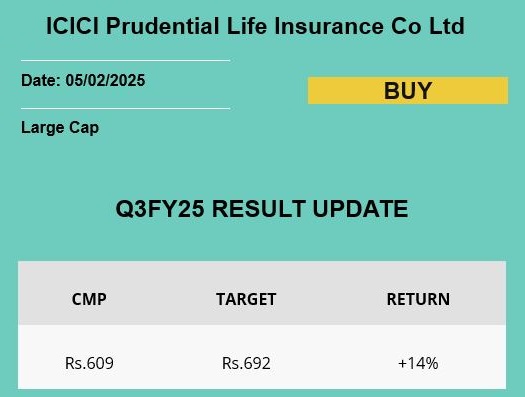

| OUTLOOK & VALUATION The Indian government’s proposal to increase the limit in the insurance sector from 74% to 100%, this expected to attract significant capital and enhance technical capabilities, these measures are expected to strengthen the company in long term. Considering these factors, we have upgraded our rating on the stock to BUY from HOLD, based on 1.50x FY27E P/EV, with a rolled forward target price of Rs. 692. |

To read our detailed research report,