Cautiously Optimistic Outlook

Granules India Ltd. (Inc.) is a vertically integrated, high growth pharmaceutical company headquartered in Hyderabad, India. The company manufactures Active Pharmaceutical Ingredients (API), Pharmaceutical Formulation Intermediates (PFI) and Finished Dosages (FD).

Key Highlights

Granules recorded revenue of Rs.1,138cr for Q3FY25 against Rs 1,156cr for the same period last year, reflecting a degrowth of 1.5%.

EBITDA de-grew 8% YoY to Rs.230cr, and the EBITDA margin declined by 143 bps to 20.2%, due to the halt of production in the Gagilapur facility, PAT has also exhibited a degrowth of 6% on a YoY basis.

The Gagilapur facility, was hit with an Official Action Indicated (OAI), by the US FDA, the company has undertaken remediation efforts, and has resumed operations after one month of stoppage from the plant. The OAI can escalate into a warning letter (which is far more prohibitive), if the FDA is not satisfied with the remediation efforts of the company.

The company will benefit from the phase 2, Genome valley facility which is expected to be commissioned by Q4FY25. Also the company continues investing in research and development efforts, and is building a pipeline of high value molecules, with a focus on backward integration, especially in the oncology and CNS segment.

During the quarter, GIL has received approvals for Bupropion SR Tabs and Lisdex amphetamine Chew Tabs in GPI.

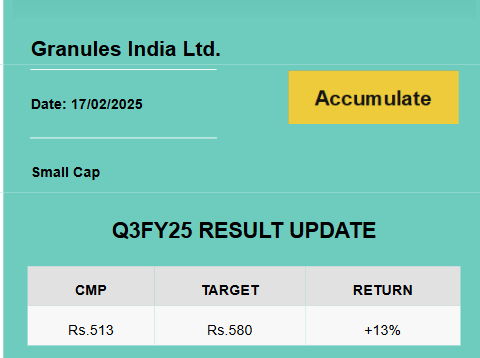

Outlook & Valuation

We remain positive about the company’s long-term profitability and growth prospects owing to new product launches across geographies, a focus on backward integration, and increased market share in existing geographies. The OAI classification can act as a major headwind to our rating if it escalates into more serious regulatory classifications. However, we value Granules India at a PE of 20x FY27E EPS, arriving at a revised target price of Rs. 580, thereby maintaining our accumulate rating.

To read our detailed research report,