| Outperforming its industry peers |

| Brigade Enterprises Ltd. (BRGD) is one of India’s leading property developers, with over three decades of expertise. Since its inception, Brigade has completed 280+ buildings, amounting to over 90msf. of developed space across a diverse real estate portfolio. |

| Key Highlights |

| In Q3FY25, Brigade reported strong pre-sales (63% YoY / 46% QoQ), primarily driven by Brigade Gateway, Hyderabad. Area sold in the quarter stood at 2.19msf (+29% YoY) with realization improving by 26% YoY. In the quarter, the company posted ~25% YoY revenue growth owing to higher revenue recognition from residentials, supported by leasing and hospitality sectors, marking 12% and 16% YoY growth, respectively. Brigade has a pipeline of 12msf for the next four quarters across Bangalore and Mysore regions, where ~4msf are expected to launch in Q4. The retail and office segments showed steady occupancies at 95% and 99%, respectively. Further, the retail mall consumption improved 8% YoY, primarily due to the festive season. |

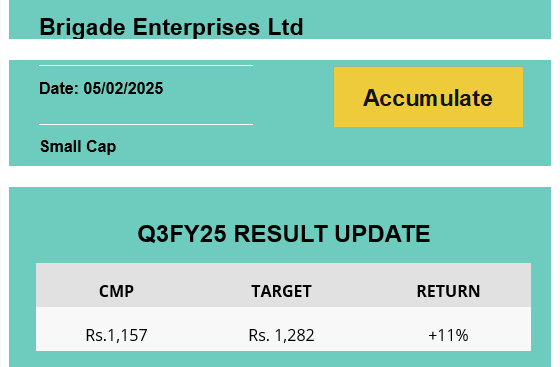

| OUTLOOK & VALUATION During the quarter, Brigade demonstrated robust pre-sales and realizations in the residential segment, surpassing its industry peers. Looking ahead, the company is expected to do well across all segments, supported by a strong residential pipeline and substantial capex of ~714cr in the leasing segment. Despite potential approval delays, considering the strong operational performance of the company, we upgrade our rating to Accumulate with a revised target price of Rs.1,282, based on NAV per share. |

To read our detailed research report, click here.