Capacity expansion to cement growth

ACC Limited, which is a part of Adani Group, is a leading Indian cement and ready-mix concrete producer with 20 manufacturing sites and 99 concrete plants, serving customers through a nationwide network.

Key Highlights

In Q3FY25, the company’s consolidated revenue rose 20.6% YoY to Rs. 5,927cr, on the back of increase in sales volume.

Also, the company’s Optimised Fuel Basket strategy achieved a 10% YoY reduction in kiln fuel cost to Rs. 1.68 per ‘000 kcal from Rs. 1.86, owing to the use of low-cost imported petcoke and synergies accrued from group companies.

The company has made progress in increasing green power consumption and alternative fuel and raw material (AFR) usage as well, with green power and AFR consumption rising 5.7 pp to 18.7% and 0.4 pp to 9.6%, respectively.

EBITDA increased 23.3% YoY to Rs. 1,116cr and EBITDA margin improved 40bps YoY to 18.8%, owing to strong topline growth, cost optimisation measures and logistics cost reduction.

Outlook & Valuation

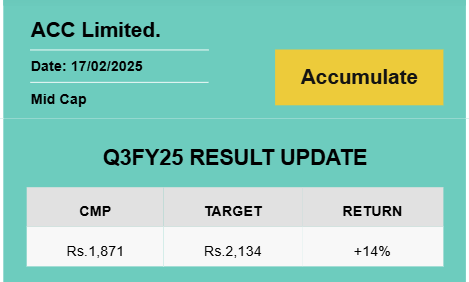

The company delivered strong Q3FY25 results, driven by volume growth and cost optimisation initiatives, with focus on operational excellence, synergies between group companies and expected continuation of digital initiatives improving profitability. The company is well-positioned to capitalise on growing cement demand, driven by government spending and construction activity. Therefore, we reiterate our ACCUMULATE rating on the stock, with a target price of Rs. 2,134, valuing the company at 9x FY27E enterprise value /EBITDA.

To read our detailed research report