Equity experience depends on how and when we look at our investments

Equity experience depends on how and when we look at our investments

People start investing in equities prompted by various sources and triggers – ranging from their own awareness to being informed by friends, relatives or an external inspiration. Given the industry experience, the possibility of a new investor entering the market is more skewed towards the sentiment, “someone told me that equities are good”. The obvious point being: is it good in the short-term or long-term? What that ‘someone told’ depends on their experience and what we evaluate and understand depends on our ‘knowledge’, which eventually will become our experience.

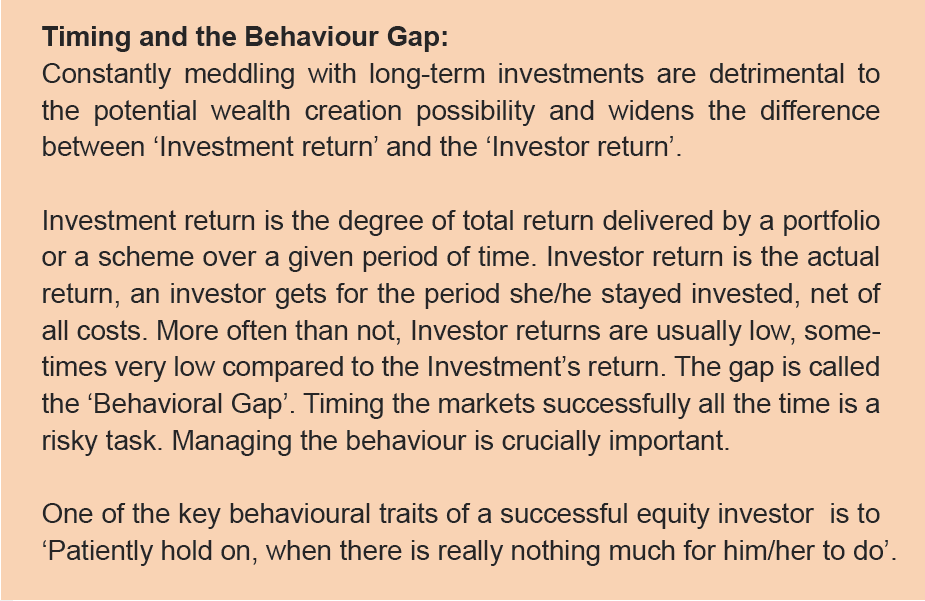

Successful and experienced investors say that equity investments are good for long-term and have the potential to deliver ‘X%’ returns on an average. While the statement nudges beginners to try equity as an asset class, what they eventually forget, are the key words – ‘delivers in the long-term’ and ‘X% returns on an average’. After making the first investment, they expect equities to perform at the average rate, almost daily or every month. In reality, equity investments fluctuate, in fact every moment during the day and might deviate from the average, many times, up or down.

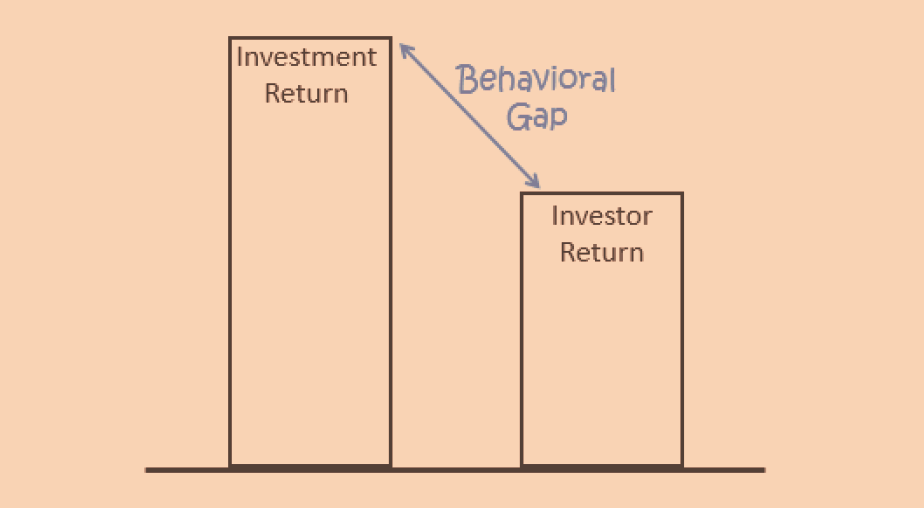

To gain some perspective, see to the below charts: An Equity Index if watched Daily, Monthly, Yearly and in long-term.

As can be observed from the above charts, the market (read Sensex) is in constant fluctuation on a daily basis. Sometimes it rises and at other times it drops like nine pins. Markets are highly volatile in the short-term, but gradually smoothens out in the long-run.

If you were to look at the market on a daily basis, between Jan-1993 to Sep-2018, during 47% of the trading sessions markets were down. But in the cumulative 25+ years, Sensex grew 15 times from 2500 odd levels to around 38000. Volatility narrows as the investment interval expands. Data shows that, if an investment is held for 1 year, the probability of profit is 70% and if it is held for 5 years, the probability of profit increases to 93% and 10 years to 100%. Also, the standard deviation (a measure of volatility on returns) drops from 29% in 1 year to 4% over 10 years. These are on Daily Rolling basis, meaning, covering any-day-to-any-day of a period under study.

Long-term goal’s portfolio? See less … VISUALIZE More!!

We invest in equities with an expectation of capital appreciation in the long-term. Equity, as an asset class,is well suited for planning for goals that are 5-10+ years away, like children’s education, contingency, retirement, etc. We should constantly visualize the goals and keep the planning and act towards attaining them.

The first and foremost, a long-term investor needs to understand that they need not worry or react to all the news and market volatility on a daily basis. In a way, equity investing has the blessing of being knowledge intensive. It brings along, a great opportunity to know many things about the economy, the policies, the corporate and the impact of these on prices. As rightly said by the Father of Value Investing, Benjamin Graham, “Markets are like voting machine in the short-term. But in long-term it’s like a weighing machine.” In the short-run, the market records a lot of sentiments, emotions, reactions, etc on a variety of news. But eventually, in the long run, it weighs and oscillates towards the market fundamentals: corporate earnings and economic growth.

To take an example: we deposit some amount in a five year bank fixed deposit. Typically we wait till maturity and either we take the money for some use or renew it for another term at the then prevailing interest, which might be higher or lower than the previous rate. In between, do we call the banker every day to know what’s happening to our FD?

On the other hand, when we invest some amount in equities for a goal that is lined up, say 7 or 10 years later, we start bothering about returns soon after the investment. Thanks to various tech facilities, we can track the investments any time we wish. We start watching the markets and investments daily. That’s not an issue per se. The problem is when we start evaluating the investments and think that we should react to all the news and events.

Unlike FD, since equity investments are subject to market fluctuations and returns are variable in nature, the probability of returns historically over different time frames could be one of the guiding notes for setting the expectations.

Segregate the portfolio into long-term and short-term

Once investors get into equities they usually expand the spread of allocation into various sub-options. A key suggestion here is to segregate the portfolios into long-term and short-term buckets and make sure it is never mixed up. The allocation weight must be tilted higher on long-term goals or investment portfolios.

Waiting is different from ignoring

While it is good to have patience and hold onto the long-term investments, it is equally important to periodically review the performance of schemes / investments. It is always good to take the help of professional advisors, who can help investors to successfully navigate the journey.

Many new investors, in the recent 3-4 years, have taken the mutual funds route to invest and participate in equities, especially through Systematic Investment Plans. While markets have been rallying overall, 2018 particularly have been a more volatile year with global and domestic issues hitting the nerves and 2019 is expected to witness some more volatility on account of general elections and global developments that may come along.

We all start off with the objective of capital appreciation in the long-term, but the key is to align the behavior too. What investors should be strictly focused on is their goals and asset allocation. SEE less of volatility … VISUALIZE MORE of wealth creation!!