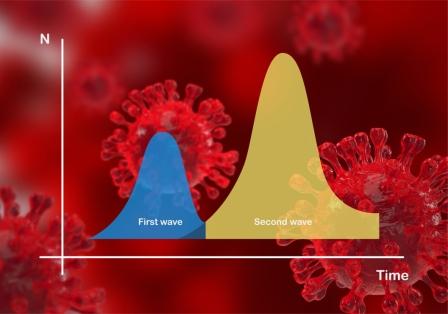

The Indian economy was showing signs of recovery in early 2021 after being hit by the Covid-19 pandemic. Post the recessionary phase, the Indian economy registered a growth rate of 0.41 percent in Q3FY21. Improvement was also evident in the performance of other high frequency indicators. However, the economic recovery got seriously impacted as the second wave hit the country. Various states enforced lockdowns of varying severity that negatively impacted economic activities.

Last year, the economy was dealing with a severe supply shock. The imposition of national lockdown impacted the movement of goods and services. For instance, even when the economic output was registering a sharp decline, the domestic economy witnessed price levels rising. In Q1FY21, India’s GDP growth rate contracted by 24 percent whereas the inflation rate as measured by Consumer Price Index (CPI) registered a growth of 6.57 percent in the same quarter. The combination of declining economic output and rising inflation has even initiated a debate on whether the economy would enter a stagflation trap. The supply disruption caused by the national lockdown mainly contributed to the rising inflation rate. Thus, the economy was dealing with severe aggregate supply shock than aggregate demand shock. The stagflation scenario has been a major hurdle for both the government and the central bank.

In the current scenario, with the second wave, demand shock is taking the grip on the economy. To quote the RBI bulletin “the biggest toll of the second wave is in terms of a demand shock – loss of mobility, discretionary spending and employment, besides inventory accumulation”. As per the RBI bulletin, aggregate supply is less impacted in the second wave. According to economic theory, a demand shock is a sudden event that increases or decreases demand for goods or services temporarily. A positive demand shock increases aggregate demand and a negative demand shock decreases aggregate demand.

Economic uncertainty along with the fear of high health expenses would force everyone to cut down spending. There will be a fear of more job losses, climbing up of unemployment rate and lower income growth in the economy. As per the CMIE survey, unemployment rate in April’21 was at 7.97 percent compared to 6.5 percent in March’21. In such an uncertain atmosphere, one could also witness a change in the composition of consumer spending as people will be prioritising their spending. The general tendency would be to save more and consume less. Yet, the depleted savings of Indian households is a cause of concern as the country is dealing with the second wave. As per the estimates of the RBI, household financial savings as a percent of GDP after touching the unprecedented high of 21.0 percent in Q1FY21, regressed closer to the pre-pandemic level at 10.4 percent. The increased household savings in Q1FY21 contributed to the pent-up demand that pushed the economy to the recovery path. It is estimated that the household financial savings rate would go further down in Q3FY21. Similarly, household debt to GDP ratio rose sharply to 37.1 percent in Q2FY21 from 35.4 percent in Q1FY21.

Amidst the second wave, there is pressure on both the government and Central bank to announce new measures to support the economy. However, unlike the last year, there is limited space for both the government and central bank to come up with new measures. Yet, the Central Bank announced few measures to support the ailing economy. For instance, to support lending, the Governor announced Special Long-Term Operations (SLTRO) for small finance banks and categorised lending to MFIs as priority sector lending. Similarly, restructuring scheme was announced by the RBI governor that could bring some relief to the borrowers.

The external environment India has to deal with is different from that in the last year. The developments in the global economy are not favourable for the Indian economy. Last year, most of the economies were dealing with an unprecedented crisis. Central banks across the globe came up with loose monetary policy measures, including quantitative easing in some advanced economies. Presently, inflation is making a return in some developed economies, especially in the US. In such a scenario, the change in the monetary policy stance could be an added challenge for the domestic economy. To deal with this external shock, there should be a strong domestic economy. Vaccination drive is a major step in this regard.