By Anu V. Pai

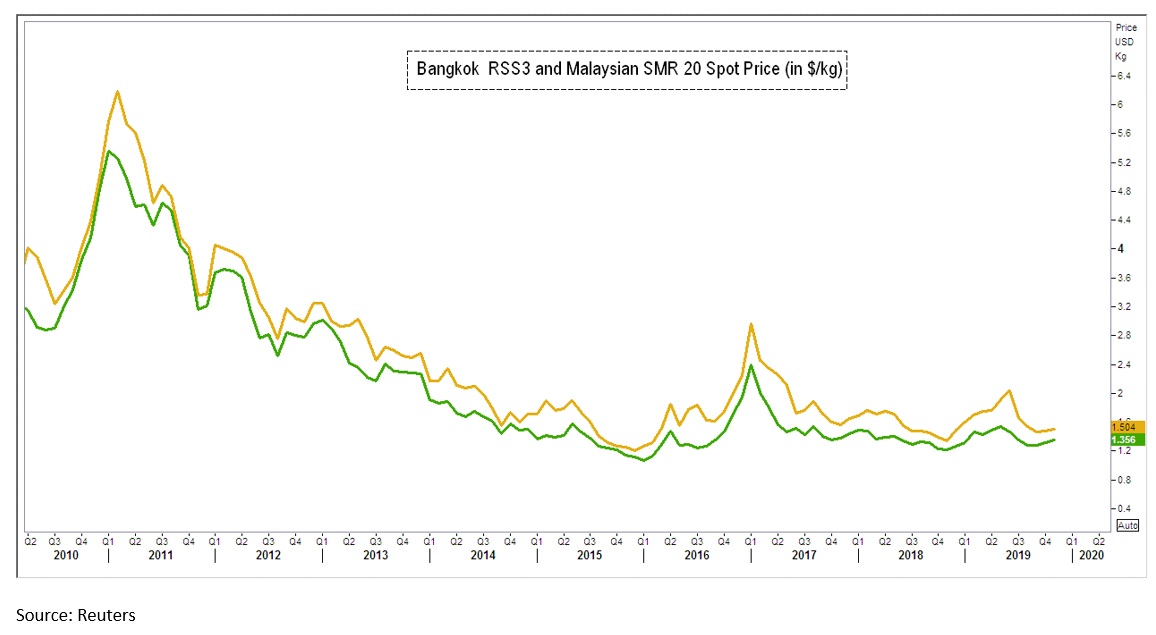

Natural rubber has been lurching in a bearish trajectory for a long now. On the Tokyo Commodity Exchange (TOCOM), prices are still down about 60 per cent from the record highs made in 2011, while in the major physical market of Bangkok, Thailand RSS3 grade rubber is down by more than 70 per cent. Considering the price movement for the last five years, barring the spurt seen towards that end of 2016 and early 2017, natural rubber has been trading mostly below $2 a kg in the major overseas spot markets. In the Indian market, RSS4 grade is currently down about 48 per cent from the record peaks, and since 2017, the commodity has been confined mostly to the range of Rs.160-115 a kg.

In 2019, natural rubber prices were seen edging higher in the first half, hitting a two year high, but bucked the trend and slipped to 10-months lows in October in both Bangkok and Malaysian markets (in US dollar terms). On TOCOM, following an initial rise to one year high, it slipped to 10-month low in October before bouncing back.

Production-Consumption

According to the Association of Natural Rubber Producing Countries (ANRPC), world natural rubber production and consumption during the first half of 2019 amounted to 5.85 million tonnes and 6.93 million tonnes respectively, with a deficit of 1.08 million tonnes, which was mainly due to the decrease in production in major producing countries like Thailand, Indonesia and China. Unfavorable weather, seasonal fall in production, relatively firmer crude oil price along with fungal disease spreading in parts of Indonesia and Malaysia led to a decline in production. The joint move Thailand, Indonesia and Malaysia to limit export through the Agreed Export Tonnage Scheme for four months from April affected the supplies.

While, ANRPC expects global supply of NR in 2019 at 13.81 million tonnes, with a decline of 0.5% from last year, the decline may be more with fungal disease spreading to certain major rubber plantation areas in Thailand, which is the world’s largest producer.

According to the International Rubber Study Group (IRSG), even as world natural rubber demand increased by 4.2 per cent to 13.78 million tonnes in 2018, under the IMF scenario, the demand is expected to grow at a slower pace, by 2.3 per cent in 2019 to 14.09 million tonnes and a further deceleration by 1.8 per cent expected in 2020. Even as production is seen falling, a slowdown in global economic growth, worries over demand from the top consumer-China, trade tussle between the US and China, low crude oil prices, falling automobile sales is currently upsetting the demand for natural rubber.

Slowing Economic Growth….

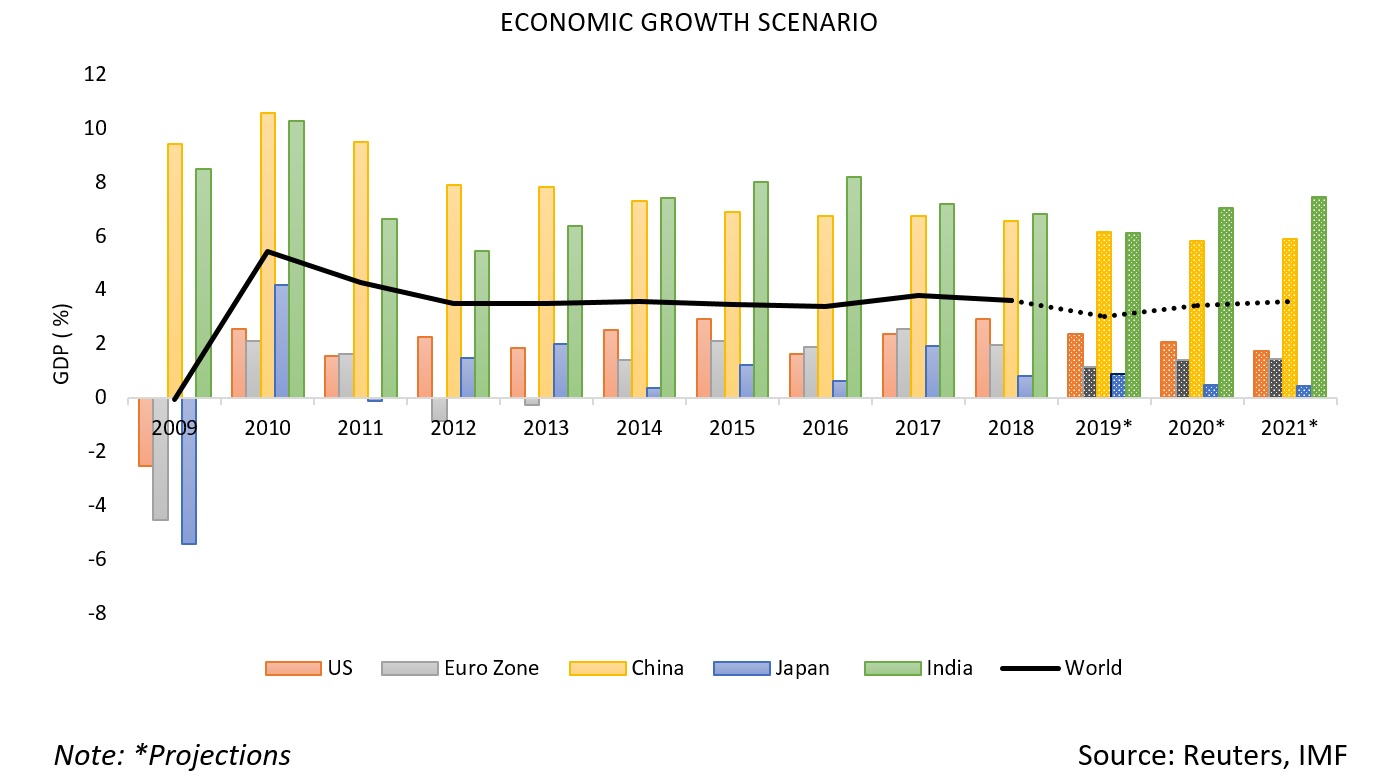

The global economy has been growing at a slower pace since 2011. The International Monetary Fund (IMF), in its World Economic Outlook (October) has downgraded the global economic growth outlook for 2019 to 3.0 per cent, its slowest pace since global financial crisis, predominantly on rising trade and geopolitical tensions. Moreover, even as IMF expects a modest expansion to 3.4 per cent is expected for 2020, it believes that unlike the synchronized slowdown that is currently being witnessed, the recovery is not broad-based and remains precarious.

According to the organization, “The weakness in growth is driven by a sharp deterioration in manufacturing activity and global trade, with higher tariffs and prolonged trade policy uncertainty damaging investment and demand for capital goods. In addition, the automobile industry is contracting owing also to a variety of factors, such as disruptions from new emission standards in the euro area and China that have had durable effects. Overall, trade volume growth in the first half of 2019 has fallen to 1 per cent, the weakest level since 2012.”

Lingering worries over Demand from China

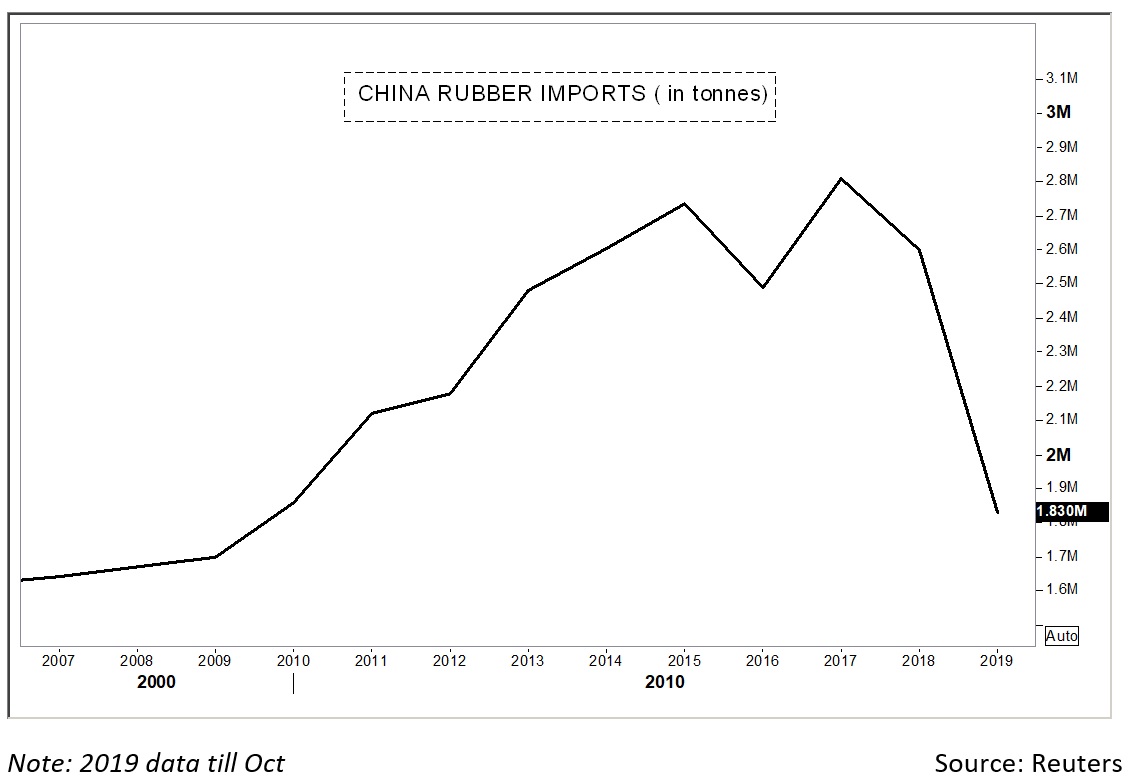

China is the world’s largest consumer of natural rubber and fourth largest producer. According to the IRSG, China consumed about 5.5 million tonnes of natural rubber in the year 2018, which constitute about 40 per cent of the total global consumption. In the meantime, its production is about 837000 tons in 2018, which accounts only about six per cent of global natural rubber production. China, therefore, rely heavily on imports to meet its consumption needs. Escalation of trade tensions between the US and China, the two major consumers of natural rubber is seen impacting its demand.

Natural rubber imports by China has been consistently on a rise till 2015 considering the data for the last 10-years in terms of volume. But since then, it has been rather wobbly, though it touched an all-time high in 2017. In the year 2018, natural rubber imports by China declined seven per cent on a year on year basis and is showing a similar trend till the third quarter of 2019. According to the data compiled from China’s National Bureau of Statistics, natural rubber imports by the country, including latex, from Jan-Sep were at 1.83 million tonnes, down by 1.08 per cent, compared to same period last year. According to the country’s General Administration of Custom’s preliminary trade data for October, rubber imports (both natural and synthetic) stood at 500000 tonnes, down by 8.4 and 8.6 per cent on month-on-month and year-on-year respectively.

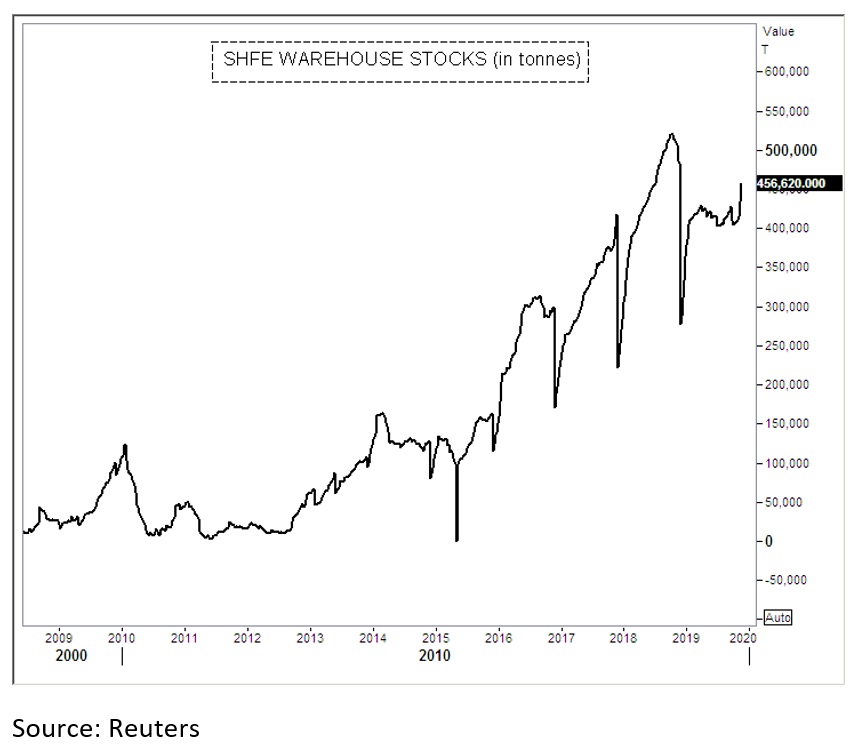

While imports has been showing a declining trend, natural rubber stocks in China’s Shanghai Futures Exchange warehouse are high. According to the data from the exchange, as of November 15, stocks on warrant were at 456620 tonnes.

Meanwhile, China’s biggest trader of rubber the state-owned Chongqing General Trading Chemical Co., which constitute about one third of the country’s rubber supply, suspending operations due to liquidity issues has badly affected the market sentiments.

Slowdown in Auto-Sector………

A slowdown in automobile industry is also dampening the sentiments in the natural rubber market. The performance of automobile industry highly influences the demand for natural rubber as about 70 per cent of the natural rubber produced worldwide is consumed by the tyre sector. Moreover, rubber is used in auto-parts like bumpers, hoses, etc. According to International Organization of Motor Vehicle Manufacturers (OICA), automobile production in the 2018 dipped in 2018, by 1.71 per cent on year on year basis. Various reports and available data suggest that the year 2019 is a difficult one as well.

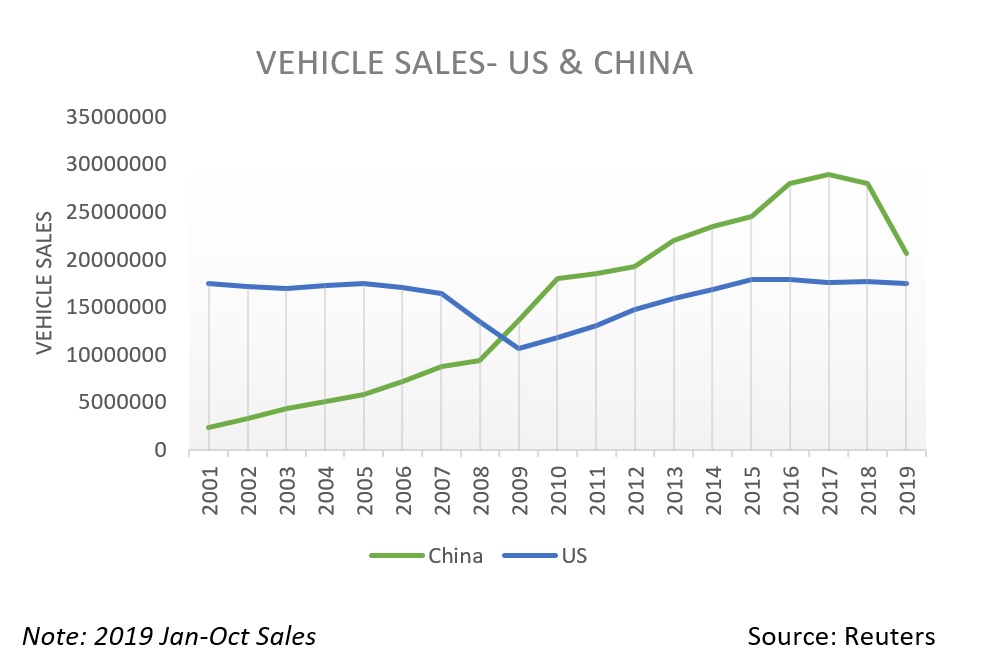

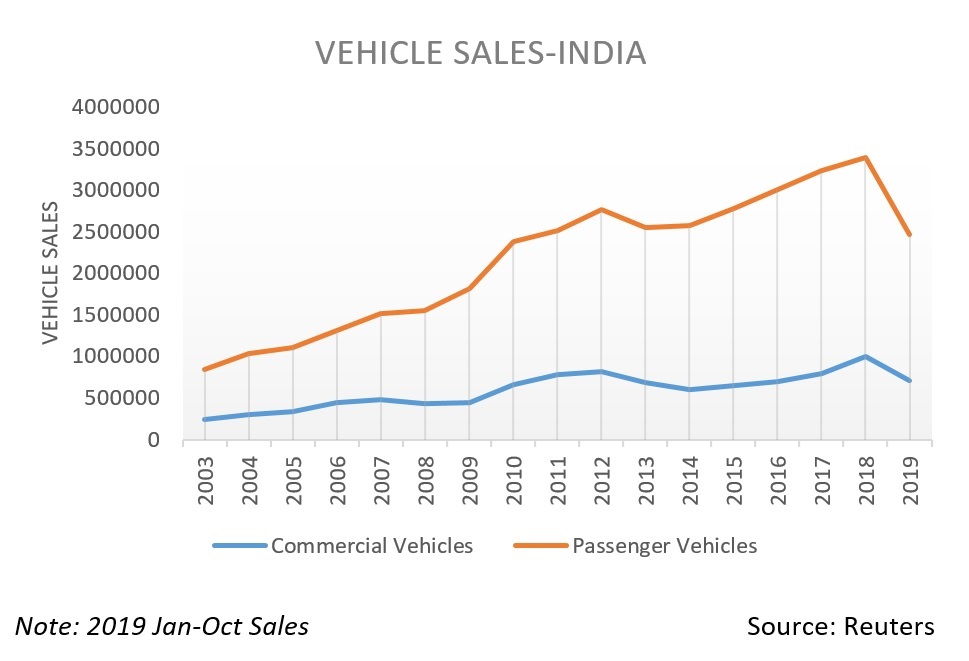

While China and the US are not only the top consumers of natural rubber, they are also the biggest auto-markets in the world. European Union, Japan and India are the other major markets. For China, the biggest market for automobiles, sales are expected to decline for the second consecutive year according to the China Association of Automobile Manufactures (CAAM). The Association expected a five per cent decline in year on year basis in 2019 after registering a contraction in sales in 2018, for the first time since 1990. For the first nine months of this year, the production and sales of automobiles were 18,149,000 and 18,371,000 units respectively in China, down 11.4% and 10.3% year on year. The production and sales of passenger cars were down 13.1% and 11.7% year on year for Jan-Sep period while that of commercial vehicles were down 2.1% and 3.4% year on year. Amidst slowing economic growth and trade tensions with the US, implementation of new vehicle emission standards is also seen affecting demand. New vehicle sales in the US for Jan-Oct period declined 1.1 per cent and a similar trend in seen in Japan and India as well.

Indian Scenario

Natural rubber prices in the Indian market has been trading relatively on a firmer note compared to the overseas market. RSS4 grade natural rubber climbed to more than two-year high in June this year before slumping to one year low in October. Apart from cues from the overseas market, improvement in production, expectations of higher imports, slowdown in automobile sales and tepid demand in the country is influencing the natural rubber prices local market. According to the Rubber Board, natural rubber production during April-September 2019 was 308,000 tonnes, with an increase of 11.2% as compared to the same period last year. The Rubber Board has been putting efforts to raise the production through adoption of holdings and rain guarding. Better prices this year compared to previous years may also have contributed to increase in production. Meanwhile, consumption decreased during April- September 2019 to 567, 120 tonnes, by 7.6% as compared to April- September 2018. Imports were seen declining as well by 13.9% during April-September 2019 compared to same period last year and are forecast to be at 415000 tonnes for FY 2018-19.

Looking forward, with global economic situation staying cloudy and the US-China trade stand-off continuing, there exist uncertainty over demand, making the outlook for natural rubber not so promising. However, supply disruptions, weather, fluctuations in crude oil prices, and changes in trade policies etc. will influence the natural rubber in coming days.