As expected, Reserve Bank of India (RBI) in its first bi-monthly monetary policy for 2019-20 has gone in for a rate cut, slashing the repo rate by 25 basis points. The Central Banks across the globe has turned dovish and with its back to the back rate cut, RBI has also joined this league. For instance, the Federal Open Market Committee (FOMC) in its March statement indicated that there will be no rate hike this year.

As expected, Reserve Bank of India (RBI) in its first bi-monthly monetary policy for 2019-20 has gone in for a rate cut, slashing the repo rate by 25 basis points. The Central Banks across the globe has turned dovish and with its back to the back rate cut, RBI has also joined this league. For instance, the Federal Open Market Committee (FOMC) in its March statement indicated that there will be no rate hike this year.

The US Central Bank also revised GDP growth projection for the US economy downwards at 2.1 percent compared to 2.3 percent in its last December meeting. The inflation rate in the US is projected at 1.8 percent below the target of 2 percent. The same is the case in the Eurozone area with inflation rate and GDP growth rate projection lowered at 1.4 percent and 1.2 percent respectively. The falling prices and slowing growth are the two major factors that are pushing the Central Banks across the globe to turn dovish.

The situation in India is also not different. Though inflation rate has reached a five-month high at 2.86 percent for the month of March, RBI has lowered the inflation rate projections to 2.9 – 3 percent for H1FY20 from 3.2-3.4 percent projected earlier. The inflation rate in the country is within the permissible level of 2-6 percent, nevertheless, falling prices is an area of concern. The Central Bank has also revised the GDP growth rate of the country to 7.2 percent for FY 2019-20 lower than 7.4 percent projected earlier.

Is India facing rural distress?

There has been a continuous fall in the inflation rate from September’18 onwards before climbing up in February’19. The falling prices are more worrisome when the composition of Consumer Price Index (CPI) which is used to calculate the inflation rate in the country is considered. Food and Beverages has a weightage of 45.86 percent in the total basket of goods and services used in the construction of CPI. It shows that the movement of food prices greatly influences the movement of overall CPI in the country. Food inflation has mildly picked up in March after registering negative growth rate consecutively for five months.

Inflation Rate vs Food Inflation Rate (YoY)

The falling food prices signal rural distress in the country. In India, the rural economy is still predominant with a share of around 70 percent. Around 64 percent of the rural workforce is employed in the agricultural sector producing 39 percent of the total rural output. Thus, falling food prices could be a relief to the consumers but it won’t work well for rural India. For instance, tractor sales considered as a proxy to understand how well the rural economy is performing registered a 14.97 percent decline in March’19 compared to March’18. A slowing rural consumption could also negatively affect the growth prospects of the FMCG sector. Thus, a weak rural economy can have ripple effects that could push down other economic activities in the country.

Industrial outlook

Industrial growth measured by the Index of Industrial Production (IIP) is also not giving a glossy picture. IIP registered the lowest growth rate (YoY) in the last twenty months at 0.08 percent for the month of February. Manufacturing sector accounting for 77.63 percent share in IIP, registered a negative growth rate (YoY) of 0.31 percent in February. The YoY growth rate of mining and quarrying also dipped to 2 percent in February from 3.92 percent in January, whereas electricity has shown a marginal improvement in the growth rate from 0.94 percent in January to 1.18 percent in February.

Based on the category of goods, it could be seen that both intermediate and capital goods continue their negative growth (YoY) in February at -8.84 percent and -4.89 percent respectively. It should be noted that intermediate goods have registered negative growth (YoY) for the fourth consecutive month. The growth rate of primary goods having the largest share in IIP registered a YoY growth rate of 1.17 percent in February compared to 1.39 percent in January. Infrastructure/Construction goods also registered a decline at 2.38 percent in February from 6.8 percent in January, whereas consumer goods registered a marginal improvement during the same period.

Investment Scenario

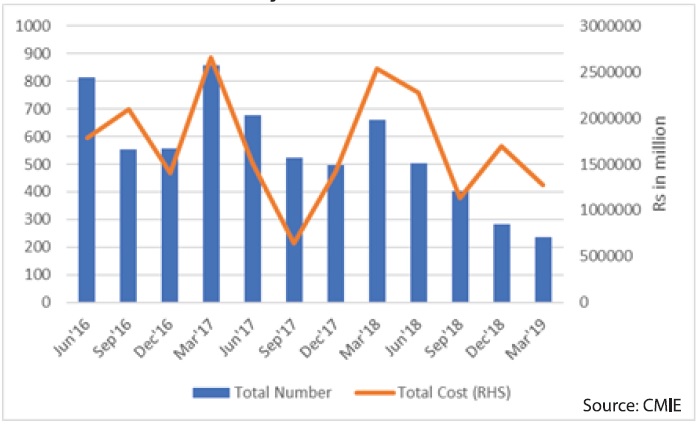

The sluggish growth of private investment in the country is an area of concern that was also mentioned in the monetary policy statement. Private investment is the need of the hour considering the unemployment situation in the country. The number of new investment projects announced in the last quarter of FY 2018-2019 was 237 registering a decline of 16 percent from the previous quarter. It also recorded a decline of 64 percent compared to the total new private investment projects announced in the last quarter of FY 2017-18.

New Private Investment Projects

In a similar line, the total cost of new investments announced in the last quarter of FY 2018-19 registered a decline of 25 percent from the previous quarter. The total cost of new investment projects announced stands at Rs 1268863.6 million, 50 percent lower than the last quarter of the previous fiscal year.

Considering the weak performance of various macroeconomic indicators, RBI has acted in the right direction by lowering the interest rates. Rate cut could lead to increased liquidity in the market. The increased liquidity could be a boost to both domestic consumption and investment. With the global economy slowing down, there is a need to concentrate more on consumption-led growth rather on export-led growth. In this aspect, RBI has taken the right step, improved access to cheap credit to India Inc and retail consumers would spur the consumption and investment growth that would be reflected in the overall growth of the country.