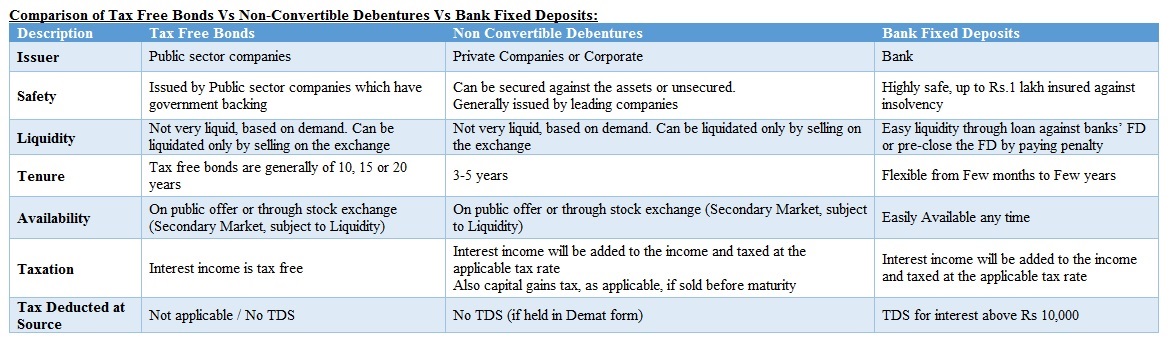

At a time when returns on fixed deposits (FDs) are not attractive and volatility in equity markets is rising, companies have raised good money through Non-Convertible Debentures (NCDs). The main attraction being high return to investors looking for secure investment options.

So, what are NCDs?

Non-Convertible Debenture is a type of debt instrument issued / offered by companies for raising capital. They usually, come with multiple tenor or duration to choose from and with corresponding fixed Interest / Coupon rate.

Why this name? Unlike convertible debentures, NCDs cannot be converted into equity shares of the issuing company at a future date.

Types of NCDs:

Secured NCD: Secured NCD is backed by the assets of the company and if the company fails to pay the obligation, the investor holding the debenture can claim it through liquidation of these assets.

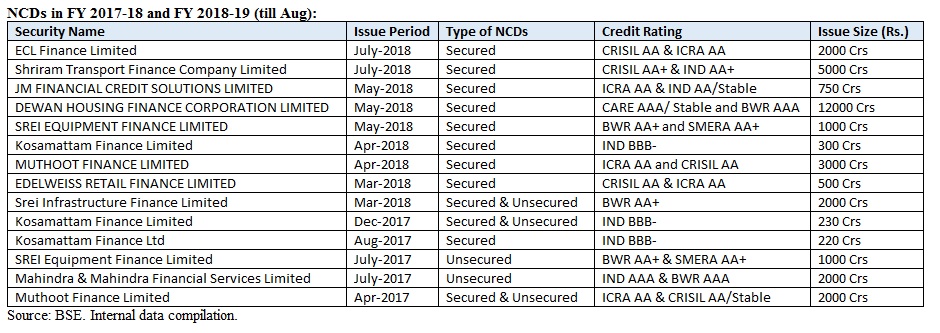

Unsecured NCD: Contrary to the Secured NCDs, there is no asset backing in the case of unsecured NCDs. However, any company seeking to raise money through NCD has to get its issue rated by agencies such as CRISIL, ICRA, CARE and Fitch Ratings.

Importance of Credit Rating in a NCD: Credit rating of an NCD is a third party assessment of the quality of instrument in terms of its credit performance. Some of the leading credit rating agencies in India are CRISIL, ICRA, and Fitch, Brickwork Ratings. It is advisable to buy NCD which has a good Credit Rating. These ratings can be AAA (good rating), AA+, AA & AA-. Credit Rating necessarily is not a guarantee of sorts. Higher the rating, Lower would be the Interest Rates, in a given period and Lower the rating, higher would be the interest rate, and higher would be perceived credit risk. Credit rating is mandatory for NCD public issue.

What factors to look for: Though it consumes time, read the Prospectus as that is the most reliable and primary source of vital information about a company. Of course the first point to look for is the Credit Rating and the Interest rates on offering and the tenure. Other key factors an investor should check should be the Company’s Management, their financials and key ratios, level of existing debt and it’s nature, track record of past interest servicing and repayments (if available), nature of industry / sector they operate.

Categories: Typically NCD public issue comes with 4 categories as Retail Individuals / HUF, Non-Retail Individuals / HUF, Corporates and Qualified Institutional Bidders. Investors can apply under the category as applicable to them. Going by the recent issues, Resident Individuals and HUFs applying upto Rs.10,00,000 are classified as Retail and those applying more than Rs.10,00,000 are called Non-Retail. NRIs are not permitted to apply for NCDs. These thresholds though are subject to change as per the communication from issuers or lead managers to the issue, from time to time.

Allotment: Allotments are made on First Come – First Serve Basis. Which means if an issue gets fully subscribed, the issue will be closed for further subscription ahead of the issue period. It’s called Early Closure. ‘First Come – First Serve’ is decided on Day-Wise basis (and not time). Hence if an ongoing issue gets over-subscribed on a day and the issue gets closed, that particular day’s bidding will have chances of pro-rata allotment. All successful bids till the previous day will have chances of full allotment. When it is a NCD public issue, though if the overall issue is fully subscribed, issuers usually give importance to Individual investors’ and hence would wait for reasonable near full or full subscription on this category, before announcing the closure.

Deemed Date of Allotment: The date on which the Board or Bond Issue Committee approves the Allotment of NCDs. All benefits relating to the NCDs including interest on NCDs shall be available to Investors from the Deemed Date of Allotment. The actual allotment of NCDs may take place on a date other than the Deemed Date of Allotment.

Mode of Issuance: NCDs could be allotted in Demat form or Physical form (Non-Demat), as opted by the investors. Some issues might come with compulsory Demat allotment only.

Interest: NCDs pay a fixed interest to the holders and it is denoted in % per annum. Issues come with pre-defined Frequency of payments like Annual, Monthly, Cumulative, etc to choose from. It would be paid on the Interest payment dates as announced and informed in the issue document. Record date is usually 15 days prior to the relevant Interest payment date. In Cumulative option, which functions like zero coupon instruments, the interest amount (equivalent to the implied interest rate) would be paid along with the face value or principal amount.

Listing of NCDs: Post issue, NCDs would be listed in leading stock exchange(s) like BSE or NSE or both unlike FDs (at present), and this is a pull factor for investors. Since they are listed, it provides an early exit window for investors who wish to do so, subject to available Liquidity. Though may not be like a highly traded stock, many NCDs have a reasonable depth and participation in the secondary market. Another advantage is, as bond prices are inversely proportional to interest rates, in a declining interest rate scenario, listed NCD prices might rally, as their coupon becomes attractive, thereby providing holders of NCDs with capital appreciation opportunity. If investors get an opportunity and choose to exit at a higher price to the face value, such profits are called Capital Gains. Investor, whose name is identified in the books of issuer as on the Record date, would be eligible for Interest.

Ways to apply: Investors can apply through a physical application, and submit duly signed forms at the authorized collection points or branches. Or through the Trading account, if they have one through any stock-exchange member. Most of the top full-fledged financial advisory firms provide an option to bid Online through their customer care portals / call centers. For all the valid forms and orders received, Bidding will be done in the Stock-Exchange platform between 10 AM to 5 PM (though cut-off timings might differ on closing day or stipulated by exchange or members accordingly).

Investment Advisors take on NCDs: Investors can consider investing in high rated NCDs by companies with good management track record and efficient end use of funds. Since they offer a fixed interest rate, NCDs can provide stable cash flows for the chosen tenure. They are especially attractive in a declining interest rate scenario, as one would be in a position to lock-in the offered rates. Investors can diversify their Debt / Fixed Income portfolio by allocating say 10% to 20% of the kitty. It’s a good choice, as they tend to optimize the overall fixed income portfolio’s returns. That said, investors should not go over-board on allocation into NCDs.

Posted: September 2018

Can purchase muthoot LTD non convertable debenture.. procedure to buy debenture

NCDs can be subscribed to, during the period it is open for public subscription. Alternatively, since many NCDs are listed in a stock exchange (BSE/NSE/both), one can look at buying them through the secondary market route as well, provided they get liquidity. Price may not be the Face Value (usually Rs.1000) in secondary market. Hence one should be watchful on the price. Higher the price paid, lower would be the effective yield.

Very informative. Thanks.

There is a risk involved when the NCD ratings are downgraded due to non payment of interest or inordinate delay in paying the interest. Investor may stuck with the investment as some of the NCDs cannot be withdrawn prior to maturity. Any thought on this?

You are right. This is called credit risk or default risk. Rating is a first level check point while looking at an NCD. It is possible that Ratings can change (especially downward) post investments, in some cases and it could affect the timely payment of interest and capital. Hence one should not park beyond a certain % of fixed income portfolio into NCDs. If we look at the industry historically, such default instances were low or negligible.

Great and very very informative article. Thanks Geojit for sharing..

very good information

I think for long term Capital gains it should be 3 years.

Please clarify

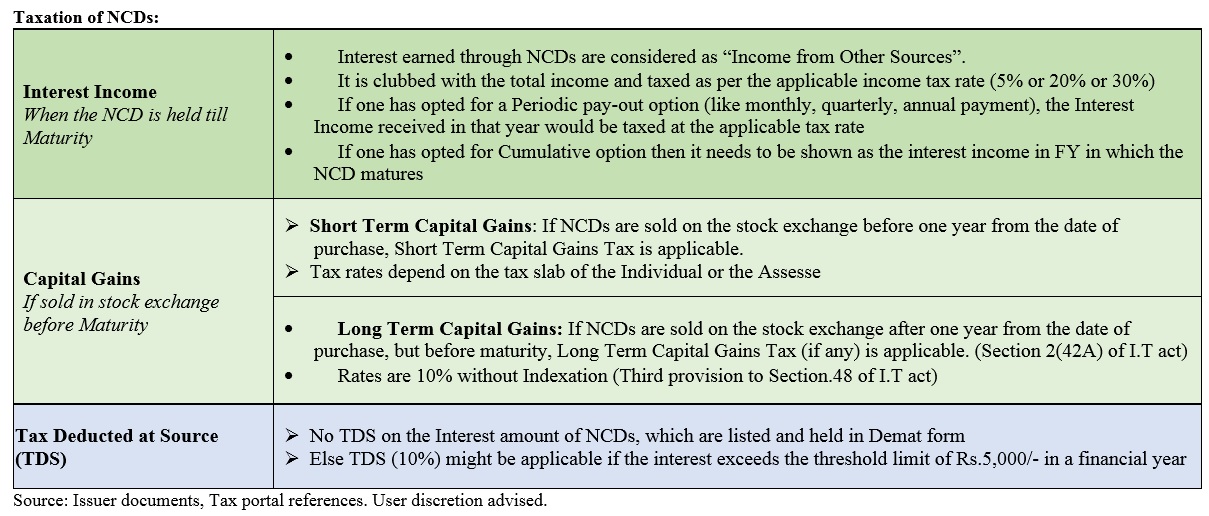

As per the provisions of Section 2(29A) of the IT Act, read with Section 2(42A) of the I.T. Act, a listed debenture is treated as a long term capital asset if the same is held for more than 12 months immediately preceding the date of its transfer.

Source: Income Tax India and Issue documents.

Well explained…very informative and posted at the right time..thanks

Excellent article. Can you please clarify if cumulative option for ncd is held till maturity what will be tax treatment? Will it be LTCG? Or diff to be added in income as interest income?

When you hold NCDs till maturity, it is redeemed at the issue price so there is no capital gain. The interest income should be added to the total income and is taxed as per slab in the financial year in which the NCD matures.

Listed NCD held for more than year qualifies as Long Term. Hope same is applicable in following cases : 1) Listed NCD with cumulative option or other wise bought from market and held for more than a year till redemption 2) Listed NCD (cumulative or otherwise) alotted in initial issue, held for more than a year and sold in market

According to the IT Act, a listed debenture is treated as a long term capital asset if the same is held for more than 12 months.

Hence, in both the scenarios, it is treated as long term.