Every parent aspires to provide the best of everything for their children. And like most parents, you might be saving regularly to ensure a bright future for your child. However, savings alone is no longer enough, as spiraling cost and bludgeoning inflation rate make it increasingly difficult to meet this goal. Today raising a family requires financial planning and sound investment decisions. With a clear idea of what it involves you can effectively plan for your children’s future.

Every parent aspires to provide the best of everything for their children. And like most parents, you might be saving regularly to ensure a bright future for your child. However, savings alone is no longer enough, as spiraling cost and bludgeoning inflation rate make it increasingly difficult to meet this goal. Today raising a family requires financial planning and sound investment decisions. With a clear idea of what it involves you can effectively plan for your children’s future.

Rising cost of education

Clearly the cost of education in India is rising much faster than the inflation. According to National Sample Survey Office (NSSO), over the past decade, the average annual private expenditure for general education (primary level to post graduation and above) shot up by a staggering 175 percent while during the same period, the annual cost of professional and technical education increased by 96 percent.

It is estimated in the current scenario,assuming an average running inflation rate of 8.5%, a four-year engineering course that costs Rs 15 lakh today is likely to increase to Rs.22.6 lakh in ten years’ time. By 2039, the same would cost more than Rs 50 lakh!Higher education abroad or MBA from well-known B-school would mean exhaustion of the limited savings.

Estimated change in tuition fees of premium education institutes over the next 20 years are as below:

Even though parents are aware of the need to create a corpus for education, most of them find it difficult to estimate the costs they would incur. But self-funding your child’s educationis do-able, if you have a clear idea of what it involves and more importantlythe discipline to make sound financial decisions.

There are several child plans on offer, from market-linked and traditional plans to plans with regular and lump sum pay-outs among many others.Here are a few investment plans you can consider to invest in your child’s education.

1. Mutual Funds exclusive scheme for children under solution oriented:

Mutual funds are an ideal option available to beat inflation and create wealth in the long term.The biggest advantages of investing into mutual funds are that they are managed by professionals and provide a wide range of benefits such as liquidity, tax benefit and diversification across stocks and sectors. Based on ones respective risk appetite, return expectations and investment horizon, parents can choose to invest in equity or debt-oriented hybrid funds. Mutual funds have exclusive scheme for children under solution oriented schemes.Most of these are hybrids which are equity oriented or debt oriented. The equity and debt allocation of these schemes are 65:35 or vice versa. Investments can be made as a lump sum or through Systematic Investment Plans (SIP). Investing through SIP route will reap better risk adjusted returns to achieve your long term goals for your child.

Advantages:

- Higher returns over the long term i.e. 15 to 20 years

- Investor will get personal accident insurance coverage in some schemes.

- Well-diversified portfolio (fund are invested equity, debt, money market instruments) spreads the risk

- Investments can be made by parents/grandparents

Disadvantages:

- Do not offer fixed guaranteed returns as they are subject to market fluctuation

- Constant reviewing is required

- Not recommended for short term as schemes with equity exposure are not suited for short term

Today many fund houses provide children’s plans and these schemes in total hold around Rs.7452 crore AUM. More over the mandatory lock-in period will save your goals from getting impacted by bad decisions in times of volatility.

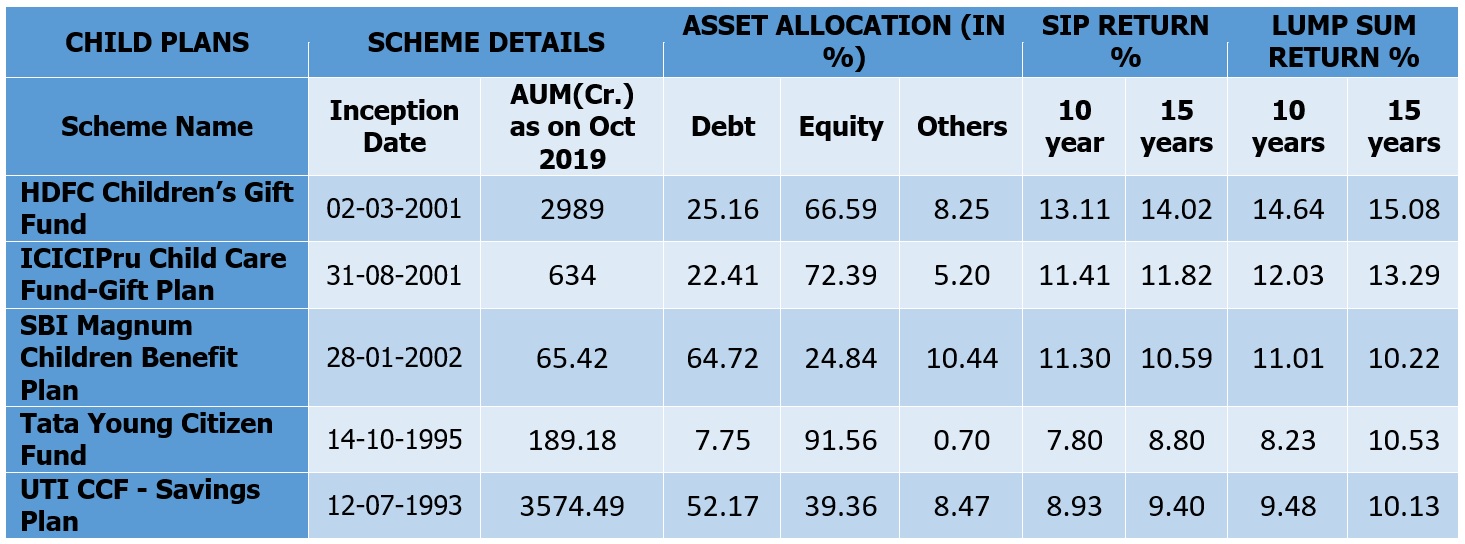

Currently, fund houses such as Axis, HDFC, SBI, ICICI PRU, TATA, and UTI provide children’s plan.The below table shows the performance of some Children’s plans:

Apart from the children’s plans, you can also invest in other diversified MF schemes to meet your child’s educational expenses. One option you can consider is an ELSS or an Equity Linked Savings Scheme as it helps you save for your child’s needs while providing a tax benefit under Section 80C of the Income Tax Act. You can get tax benefits of up to Rs 1.5 lakh annually by investing in this scheme.

2.Child Insurance Plan:

As a parent, it is your responsibility to ensure a secure future for your child even in your absence. Though, it is always advisable to keep insurance and investment needs separate, parents should take adequate term insurance so that they can ensure that the future of their child remains safe, in case anything happens to the parent. If one wants a life insurance product that offers both insurance and investment, child insurance plans are useful.

Child Insurance plans are basically insurance-cum-investment products. The parent(s) are covered in a child insurance plan and the child is the beneficiary in case of untimely death of the parent(s). A lump-sum payment is made on the death of the policyholder, but it does not end there as the policy also ensures that the child gets the money at specified intervals as planned under the policy.Its inbuilt premium waiver rider ensures that the plan continues even after the parent’s demise. Like mutual fund investments, based on risk appetite and time horizon one can select equity, balanced, debt fund’s portfolio.The companies offering child policies are HDFC, ICICI, AVIVA, MAX LIFE, SBI LIFE, KOTAK etc.

One such child policy you can consider is Child ULIPs (Unit Linked Insurance Plans). It is a type of plan where the insurance company invests a part of the premium in debt and equity instrument, and the balance amount is utilized in providing an insurance cover.U LIPS also allow you to switch your portfolio between debt and equity based on your risk appetite.The average return given by these ULIPs are 9.5 % for the last 10 years. The premium paid towards them are eligible for deductions under Section 80C and Section 10(10D) of the Income Tax Act.

Advantages:

- Secure the child in the absence of the parent(S) for rest of his/her life

- Can invest according to your needs and risk appetite.

- Tax rebate of up to Rs. 1.5 lakhs under sec 80 C of income tax act

- Alternating between funds is permitted and is not subject to taxation

- Offers flexibility in terms of making pay-outs, so that the child receives maximum pay-out when most required.

- Partial withdrawal is possible

Disadvantages:

- Investments are subject to market risk

- Administrative charges, mortality charges etc.are applicable and can substantially reduce the returns

- Switches are chargeable for each transaction

- 5 year lock in period.

- Surrender charges are hefty during the initial years.

3. Public Provident Fund (PPF):

PPF is a savings scheme offered by the Government of India that offers attractive interest rate and returns that are fully exempted from Tax. Ithas a lock-in period of 15 years with an option to extend the investment for a block of five years multiple time with or without contribution.The current interest rate is 7.90% and interest rate on PPF account is notified by the central government every quarter.

The PPF accounts can be opened in a post office, nationalised banks and major private banks. One can open a PPF account for your child at an early age and the when accountcompletes its mandatory lock-in period, the maturity amount can be used to fund his/her higher education or marriage later on.

Advantages:

- Guaranteed returns as set by the government every quarter

- The interest earned is completely tax free in the hands of investors

- Contributions eligible for tax exemption up to Rs1.5 lakh under 80C of IT Act

- Partial withdrawal from a PPF account is allowed after seven years of opening the account

Disadvantages:

- 15 year long lock in period

- You can open a PPF account in the name of a minor, but annual contribution to your and to the minor child’s PPF account should not exceed Rs.1.50 lakh in a financial year

- NRI, HUF cannot open aPPF account

- One can surrender the account and withdraw the amount during an emergency only if the account completes a minimum of 5 years

4. Sukanya Samridhi Yojana

Sukanya Samriddhi Yojana is another good government-backed savings scheme which is a part of the “Beti Bachao, Beti Padhao Yojana”. It can be opened by the parents or legal guardians of a girl child below the age of 10 and can be opened for a maximum of two girl children in one family.Parents can open only one account per girl child. It offers an interest rate of 8.4 percent (compounded annually) which could be reviewed and revised by the government every quarter.

Advantages:

- Better returns compared to other government schemes

- Accounts mature after 21 years since the issuance of the account or on the day of her marriage, whichever is earlier.

- Tax benefit offered under sec 80C of the IT act

- Minimum of Rs.250 can be invested and maximum of Rs. 1.5 lakh annually

- Amount can be partially withdrawn once the child reaches 18 years or completes graduation.

- Account will stand closed if the girl child gets married before the completion of 21 years tenure.

Disadvantages:

- Investment plan restricted to girl child only

- Interest rate are not fixed for the entire tenure. It may vary every year depending on market trends which may or may not be attractive.

- Scheme does offer some flexibility in terms of withdrawal. It has an investment period of 15 years and maturity period of 21 years which may not be useful for those who are looking for shorter investment options.

- The growth of corpus is restricted, as the interest rates are controlled by government.

- No online transfer facility

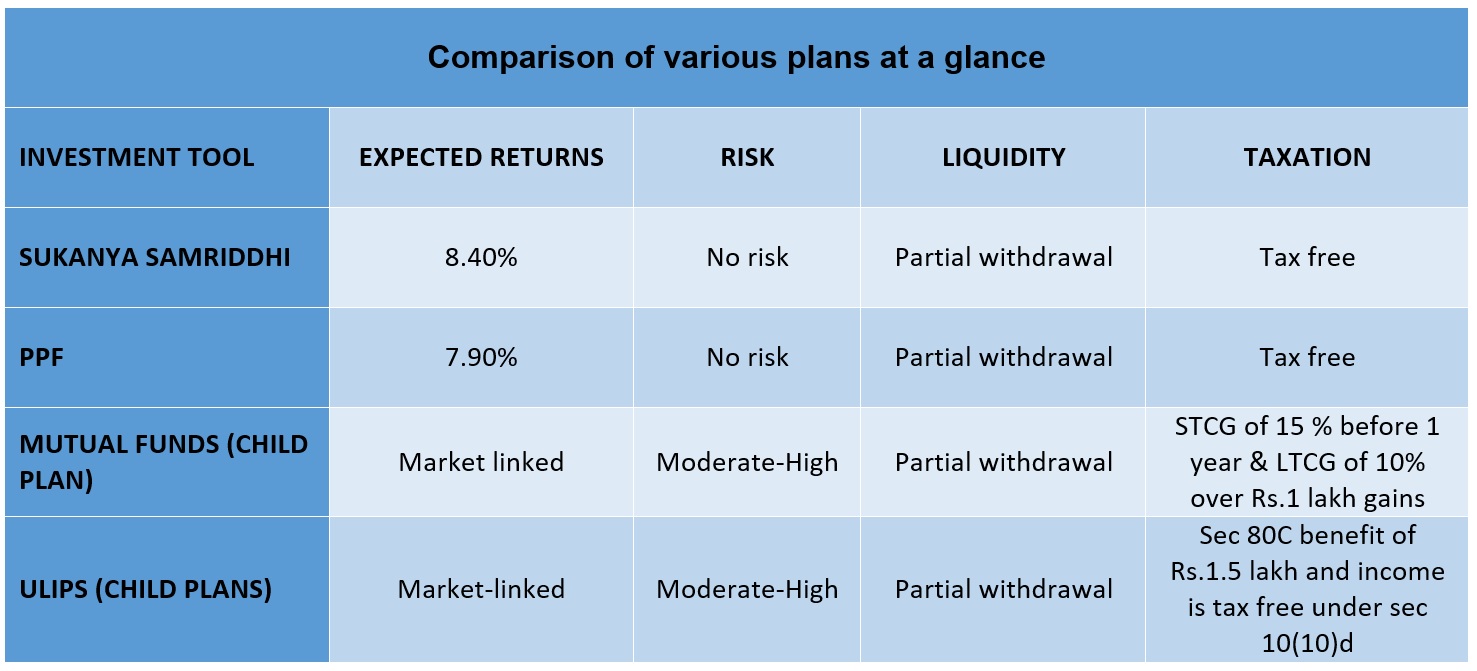

When investing for your child’s future, instead of blindly picking a ‘child’ product, try and understand what it offers before deciding. You should also consider the safety, then returns and the tax liability that may arise from such investments. Another important point to remember is to review your investment once in six months. It is also advisable to shift your corpus from equity oriented funds to safer products when you achieve your target corpus or a couple of years from achieving your goal, in order to safeguard your investment. We would also suggest that you seek professional advice before investing.