By Avnish Jain-Head Fixed Income, Canara Robeco Mutual Fund

Avnish Jain has over 21 years of experience in Treasury and Fixed Income Markets. At Canara Robeco AMC, Mr. Jain overseas and is instrumental for overall investment strategy as well as execution for all the fixed income funds. Having extensive experience on the dealing side, he follows active investment management style.

Like any other markets, fixed income markets are not immune to volatility. Interest rates exhibit two way movement driven by myriad of factors, both local as well global. In the recent past, Interest rates have moved northwards impacting short term fixed income returns. However, we believe, that the current market yields are pricing in a lot of the negatives which may not eventually materialise.

Let us examine some of the key concerns faced by fixed income investors today:

- RBI is more hawkish than before and may start raising rates: Since 2014, RBI has been following a flexible inflation targeting network, implying that the RBI has to achieve a pre-determined inflation target within a narrow band. The current target is 4% within a band of 2% i.e. the inflation range is 2%- 6%. The fact that the RBI is guided by numbers and current upswing in inflation may wrongly imply that the next step may be a rate hike. But, one needs to look beyond just the head line numbers and identify the components which are at work. I will discuss these in a bit, but first just to put things in perspective, while the RBI is targeting inflation, it has to do it in a manner keeping growth in mind. Growth, as we all know, has disappointed in the last few readings and this could be due to sticky interest rates in the economy. If growth continues to disappoint, RBI is more likely to turn accommodative rather than tighten monetary policy.

- The RBI’s concern on inflation is valid with rising food prices, hardening global crude prices, possibility of domestic fiscal slippages, impact of HRA, et al: Let’s address these one at a time.

- Rising Food Prices: Food inflation has always been volatile as Indian agriculture is largely rain-fed and supply management becomes important. Recent rise in prices of certain food articles has caused higher food inflation but as seen in the recent past the government has tried to manage supply side issues thereby not letting inflation to go out of control. The RBI understands this and knows that food inflation cannot be handled by raising rates but rather through efficient supply management.

- Global Crude Prices: India’s oil import bill is large and hence any rise in crude prices is inflationary. Although prices have firmed up as a result of OPEC deciding to cut production, at higher crude prices a lot more US shale production comes online and caps further price increases. This is already happening and we expect crude prices to remain in the current range which means no adding to inflation in the big way. Further the OPEC Bloc is already discussing exit strategies which may mean that they are comfortable with current oil prices.

- Government Fiscal: There is a worry that the central government may back track on its fiscal deficit target of 3.2% of GDP for FY18 as committed by it under the FRBM Act. The past track record of the government does not suggest so. However, even if it is believed to be so, the fiscal deficit number of around 3.5% for this year is already in the price and any positive surprises will only lead to a rally in bond prices. In absolute terms though the net borrowing of the government has only been on a declining trend in the past couple of years. The net market borrowings of central government have fallen from Rs.5074.45 billion (FY2013) to Rs.4067.08 billion (FY2017). It is expected to be Rs.3482.26 billion in FY2018.

- Impact of HRA: The salary hike as implemented under the CPC, had impacted inflation to the extent of 35 basis points as noted by the RBI. One thing to note is that increase in HRA does not actually lead to increase in rents or house prices and is statistical in nature. The RBI had earlier indicated that this will not have a bearing on the inflation outlook but even if this is taken into consideration, not only does it have a one-time impact, the base effect of this would be seen in lower inflation in the next fiscal. This impact is also largely in the current market yield.

- But, the US Fed and ECB are raising rates which will impact the currency and interest rates in India: The US Fed and ECB have drawn the path to a gradual increase in rates over the coming months and years and this is based on the assumption that growth and inflation in their economies will pick up soon. While we are seeing unemployment rates falling there, we are yet to see widespread growth; and inflation seems elusive. Also, the correlation between US interest rates and interest rates in India seems to have broken since Great Financial Crisis (GFC) of 2008, when US and other developed economies embarked on its quantitative easing program leading to lower rates, wherein India starting seeing high inflation leading to rate hike cycle from 2010. Another interesting data is that US FED started hiking rates from Dec’15 when repo rate in India was 6.75%. So while US hiked rates 4 times by 25 bps to 1.25%, RBI cut rates 3 times by 25 bps to the current 6%. This clearly brings out disconnect of Indian rates with US since the GFC.

- What will happen if FIIs pull out from Indian debt markets? They have invested more than equity markets in the current calendar year: Indian debt market has attracted huge capital flows this year. The reason for this is not just the fact that India offers one of the highest real interest rates but also due to strong Indian economy coupled with political stability. The Indian economic fundamentals viz. comfortable current account and fiscal deficit, limited overall debt and an even lower reliance on foreign debt, stable currency, strong foreign currency reserves, a strong central bank and reform oriented government, all add up to why foreign flows have been exceptional. Add to this the recent upgrade of sovereign credit rating by Moody’s coupled with improvement in ranking from 130 to 100 in the ease of doing business has boosted confidence of global investors. Moreover, while Indian equities is owned 25% by foreigners, in case of Indian debt it is less than 5%.

In a nutshell, adoption of inflation targeting framework by RBI and various reforms carried out by the government are likely positive for rates over medium to long term. This is also a learning from long term rate trends seen in developed economies, which adopted inflation focus as a primary tool for managing monetary policy whilst keeping an eye on growth dynamics. So while, in the short term, there may be rate volatility, over long term it is expected that rates should continue to soften.

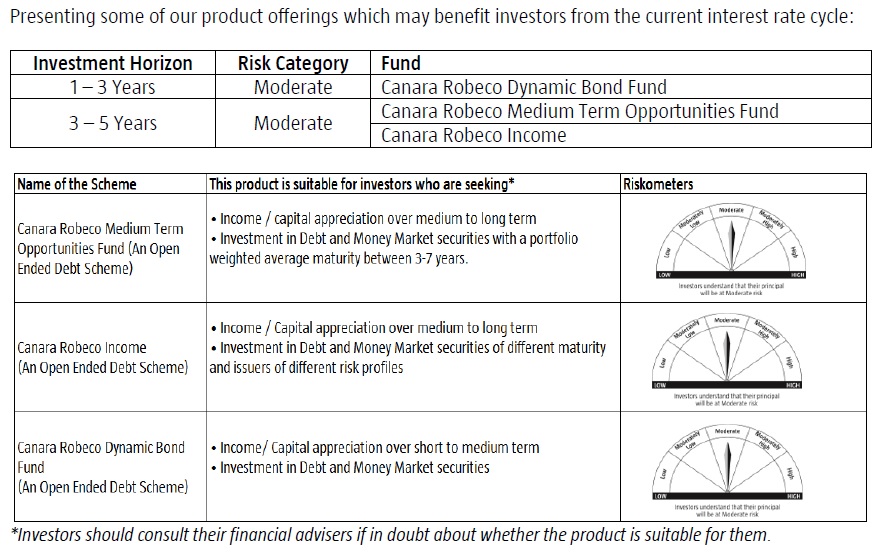

Advice to fixed income investors:

In the current environment, we see merit if an investor can look at moderate to high maturity bucket; such as income and dynamic bond funds; which are attractive in terms of their risk-adjusted returns. We suggest matching risk appetite and investment horizon to fund selection.