We have a constructive view on the equity market for 2022. The economic growth for 2022 is very vibrant however, the market outlook has moderated. In the context of a robust economic outlook the equity market should typically perform good. However, elevated dynamics can have an effect in the short-term. Today, we are in a phase of consolidation due to FIIs selling and moderation in the retail activity. We anticipate the market to strengthen post the ongoing time and price correction. We don’t see a big correction in the market, rather a consolidation within the bull rally and there are pockets of good opportunities. Apart from the fall in number of buyers like FIIs and Retail investors, areas of concern in the near-term are high valuation of the broader market, impending state elections and change in investment pattern. The buying opportunities are in Capital goods, Manufacturing, IT, Pharma, Telecom, Private Banks, Tourism and Entertainment.

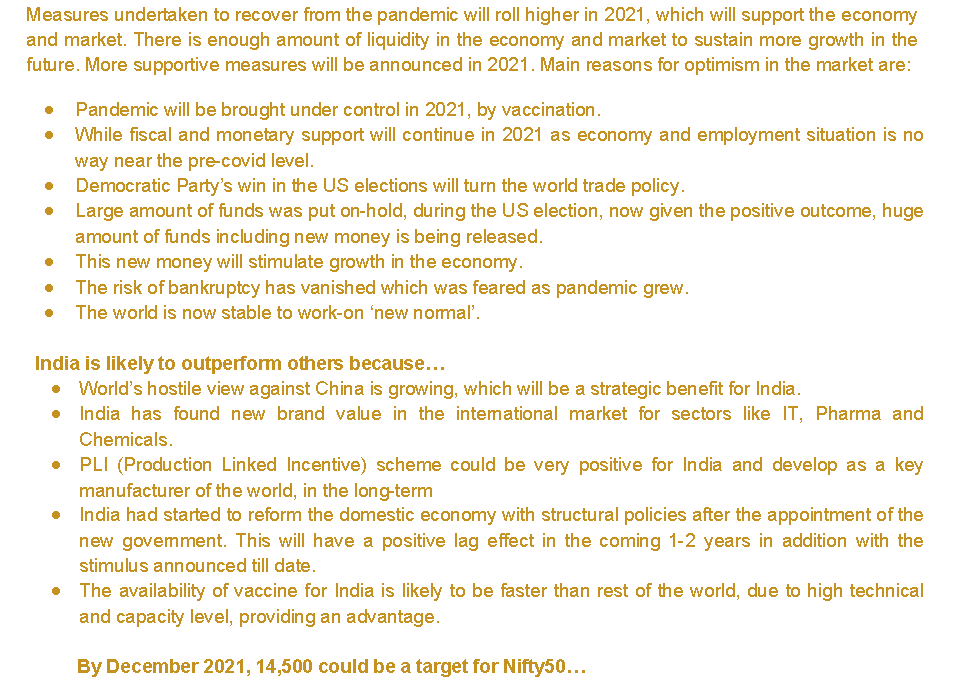

This is what we had highlighted in January Geojit Insights article for 2021 outlook:

Actual 2021 performance

All the above factors did help the actual performance of 2021 to be much better than anticipated due to strong vaccination drive, further re-opening of the economy and high inflows from both FIIs and DIIs. Global rally was supported by the world’s biggest ever monetary and fiscal support, including for households. FIIs pumped in money while cascading effect of profits brought retail investors to equity market supported by strong IPO market.

The ongoing consolidation

The super performance took India equity market dynamics to an elevated level. India is the best performing emerging market (EM) in the world and these dynamics have been consolidating in the last two months. The current sell-off is triggered by rapid rise of FIIs selling due to hawkish world central bank’s monetary policy and Omicron restrictions, cautious view on Indian market due to high valuation compared to peers and drop in retail inflows. We feel that we are reaching the last phase of this consolidation in terms of price correction. Some pockets have become fair however the overall market is still trading at the upper hand which will continue to have an effect of the broad market, in the short-term.

Our outlook for 2022

* Valuation has started to moderate. However, we are still trading at the upper band of valuation. Currently, Nifty50 index is valued at about 20x on a 1-year forward basis from a high of 22.5x, compared to the 5-year average of 18.5x, which can continue to affect the performance in the short-term.

* Market sentiment has weakened. However, we do not foresee a deep price erosion in the future and presume this correction as a part of the bull rally.

* We expect India to trade at a premium valuation compared to other EMs due to high growth and reform orientation.

* A consolidation has already started from an all-time high dated 19th October 2021, and this has made the equity outlook for 2022 better.

* Pockets are looking attractive on a long-term basis for Manufacturing and Capital Goods, as valuation and growth outlook are better compared to the broad market.

* In a cautious market, defensives like IT, Pharma, Telecom and FMCG look good both in terms of earnings stability and valuation.

* Investment opportunity in new growth sectors like renewables, power, sugar, tech-based and online businesses are good while availability in market is low, and valuations are expensive. A wait and watch strategy can be adopted in these segments in the near-term and can have a decent weight in the portfolio.

* The ongoing concern of FIIs selling, drop-in retail investors activities due to negative market trend, Omicron related restrictions to affect economic recovery and this will continue to affect the market in the short-term.

* However, economic outlook is solid with robust growth rate forecast which will bring decent earnings growth in 2022-23, limiting downside risk.

* FIIs are concerned about premium valuation of India compared to EMs and upcoming important state elections. We feel that India is bound to trade at premium valuation due to high growth and reforms. Impending state elections concern, which will end by April 2022, is short-term in nature.

Strategy

The start to 2022 may look volatile but outlook looks more robust in the latter part of the year. From the all-time high to low dated 20th December 2021, Nifty50 and Nifty500 have corrected by 13% and 12% respectively. More than 300 stocks of Nifty500 index are trading between -20% to -60%. We do not anticipate a further deep correction in the equity market from here, other than short-term volatility. Indian economy is supported by strong outlook and forecasted to be the best performing large EM, justifying the premium valuation. We should take opportunity from this correction which may have a further price correction of maximum 5% to 10% or/and a time frame of one to two quarters, for the broad market. For an investor, it is time to start nibbling into the stocks and sectors highlighted above. Small investors can do SIPs with a focus on upcoming areas. A risk averse investor can have a balanced portfolio through investments via direct stocks and mutual funds.