Capacity expansion to drive growth…

Oil and Natural Gas Corporation Ltd (ONGC), specialises in the exploration and production of crude oil and gas. The company has joint ventures in oil fields in Vietnam, Norway, Egypt, Tunisia, Iran and Australia.

Key Highlights

Standalone revenue from operations fell 3.1% YoY to Rs. 33,717cr in Q3FY25, owing to a fall in oil price. Crude oil realisation was USD 72.57 per barrel (-10.6% YoY) while gas price realisation was USD 6.50 per mmbtu (flat YoY) .

Standalone crude oil production rose 2.2% YoY to 4.92 MMT, while natural gas production grew a marginal 0.2% YoY to 4.97 MMT, reflecting a reversal in declining trends.

ONGC has set oil and gas production targets of 42.44 MMToE for FY25, 44.51 MMToE for FY26 and 45.61 MMToE for FY27.

At the operational level, EBITDA in Q3FY25 rose 11.1% YoY to Rs. 17,043cr, driven by a fall in employee benefit expense and other general expenses.

As a result, EBITDA margin increased 640bps YoY to 50.5% from 44.1% in Q3FY24.

Reported standalone PAT declined 16.7% YoY to Rs. 8,240cr, because of a fall in oil prices and an increase in depreciation on carrying additional property.

OUTLOOK & VALUATION

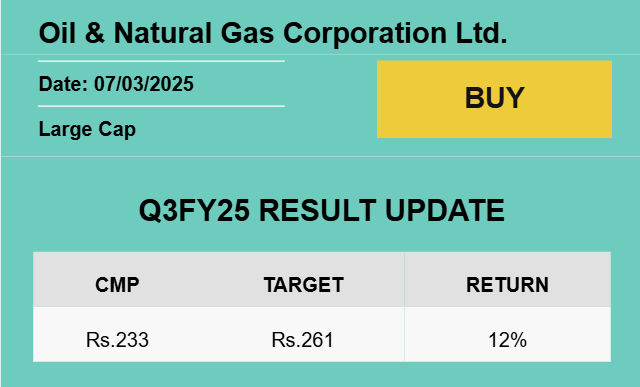

ONGC demonstrated consistent volume growth, supported by the ramp-up of production at 98/2 unit, despite muted financial performance. Future prospects are bolstered by its collaboration with BP, which is expected to drive further production expansion. Besides, the absence of SAED provides a significant boost to profitability. The management’s strategic focus on deepening its presence across the oil-to-chemicals value chain further strengthens long-term growth prospects. Therefore, we reiterate our BUY rating on the stock with a rolled-forward target price of Rs. 261 based on the SOTP valuation.