By Anu V Pai

By Anu V Pai

In the recently concluded India Rubber Meet 2018 at Kochi, India, the Association of Natural Rubber Producing Countries (ANRPC) put forth a grim outlook on natural rubber prices for the coming year. According to Jom Jacob, senior economist at the ANRPC, the prevailing supply-demand fundamentals and certain other factors are to keep the prices down in 2019.He also added that a recovery in natural rubber prices was unlikely until 2022 owing to the production potential factor, which is supposed to stay unfavorable for natural rubber prices.

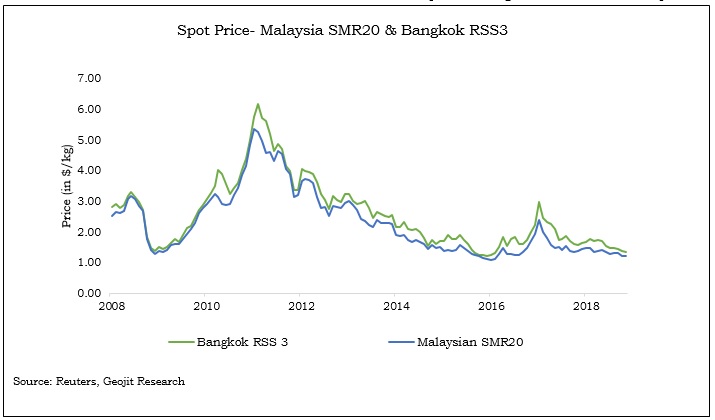

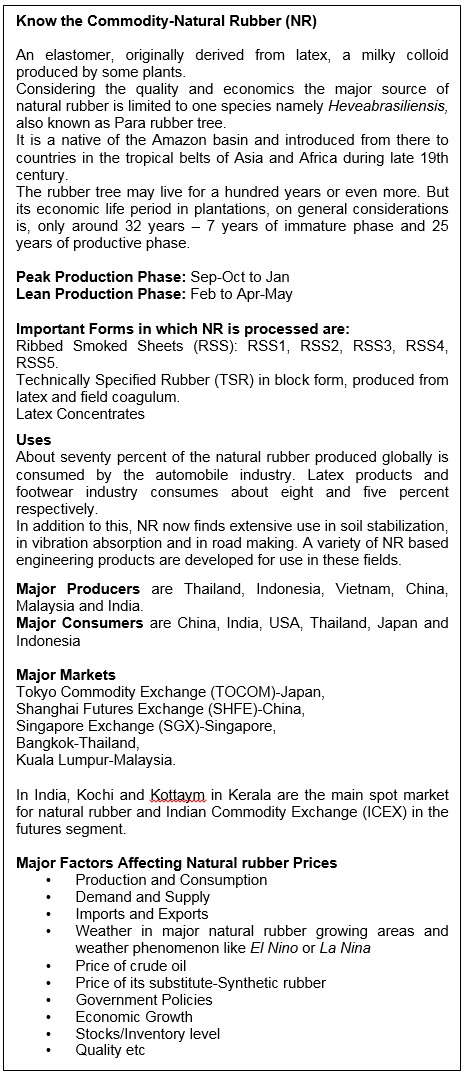

Presently, natural rubber in the major international market is drifting near more than two-year lows. Tokyo Commodity Exchange (TOCOM) rubber futures, which generally act as a benchmark, hit 26-month low, and is about 71 percent down from the record peak. In Thailand, the top producer of natural rubber, Bangkok spot price is lingering at its weakest level since March-2016, declining over 77 percent from the all-time high of TBH198.55/kg in February-2011. The situation is not different in Malaysian market as well.

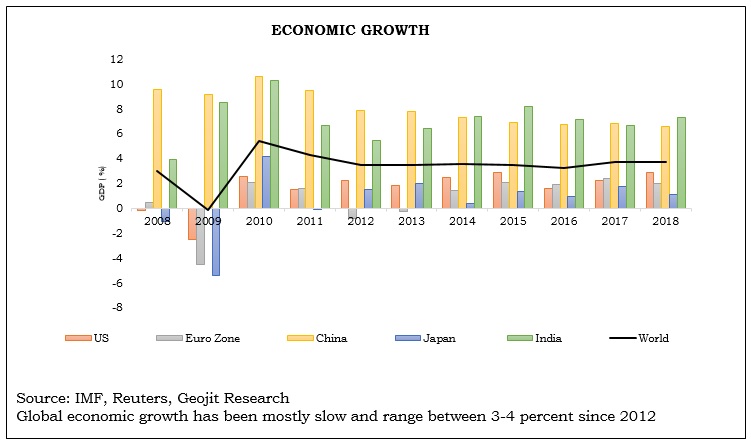

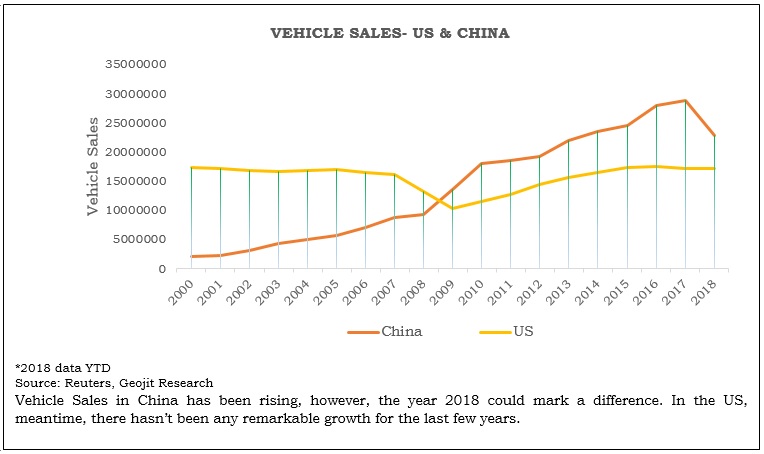

Natural rubber has been whirling under the stronghold of bears since 2011. The downturn in natural rubber began in the same year in which it rallied to record highs. It scaled to all time high during February 2011, with TOCOM rubber futures hitting JPY535.7 a kg on supply constraints and robust demand. Natural rubber was trending higher since 2002. Even as the global economic meltdown put a break on the upward journey, it recovered swiftly in 2009. Monetary and fiscal stimuli by leading economies to bolster economic activity after the global economic slowdown raised expectations on demand. Rising auto sales and crude oil prices along with robust consumption demand revitalized the up-trend in natural rubber market. Crude oil and natural rubber have a positive correlation since the substitute of natural rubber -synthetic rubber- is produced from petroleum-based monomers. Meanwhile, expectation of lower production and unfavorable weather tightened the supply side, fanning the uptrend in rubber. Appearance of weather phenomenon-El-Nino Southern Oscillation (ENSO) cycle during this period had considerable bearing on production. There was a moderate episode of El-Nino (warm phase of ESNO) in 2009-10 period, which was closely followed by strong event of La Nina (cold phase of ESNO) during 2010-11 and a moderate one during 2011-12 due to which there were disruptions in production and supply.

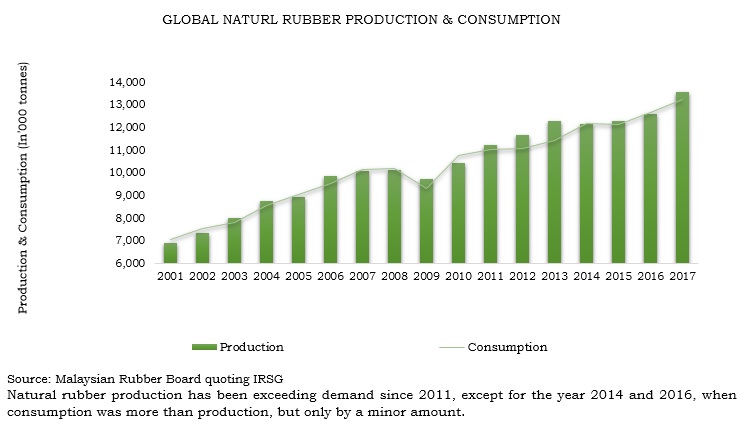

However, the rally started to fizzle-off on improvement in supply-side factors. Attractive prices had led to rise in production and expansion in the area under rubber cultivation. In the meantime, escalating geopolitical tensions, uncertain global economic growth outlook and the leading economies beginning to reconsider their stand on ultra-loose monetary policy started swaying the commodities, including natural rubber.

The slowdown in vehicle sales, decline in crude oil and other industrial commodities as well as burgeoning natural rubber inventories pressurized rubber prices to move south, with prices eventually hitting a seven year low in January 2016. Later, a brief recovery in prices seen towards the close of 2016 due to flood in Thailand, world’s top natural rubber producer, was short-lived and prices resumed its downtrend.

In the meantime, there were several attempts by the leading natural rubber producing countries to stabilize the market and to support prices, in the form of export restrictions, cutting down of illegal plantations etc., which were mostly unsuccessful in providing the desired results.

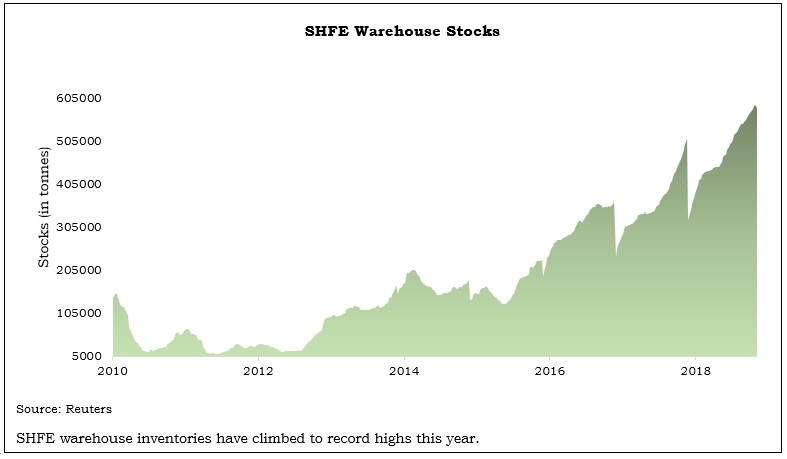

At present, the predominant factors driving prices are worries over demand from the top consumer China, swollen stocks and expectations that market will be well supplied. World stock of natural rubber has been rising. According to various reports, global natural rubber stocks amounted to 3589 kilometric ton in 2017, of which China’s share was 49 percent. The share has grown to 60 percent so far in 2018. Total stocks in China has been consistently rising since 2010. Inventories in the warehouses monitored by the Shanghai Futures Exchange (SHFE) have shown a significant jump in 2018: from 383 kilo metric tons in 2017 to a record high of 551 kilo metric tons so far this year.

In addition to these factors, the worsening trade relations between the US and China has aggravated concerns over demand from the top consumer, further burdening an already frail market. The recent economic indicators released from China are probably signaling that the trade spat has begun to affect economic activity, igniting fears of a slowdown in the world’s second largest economy.

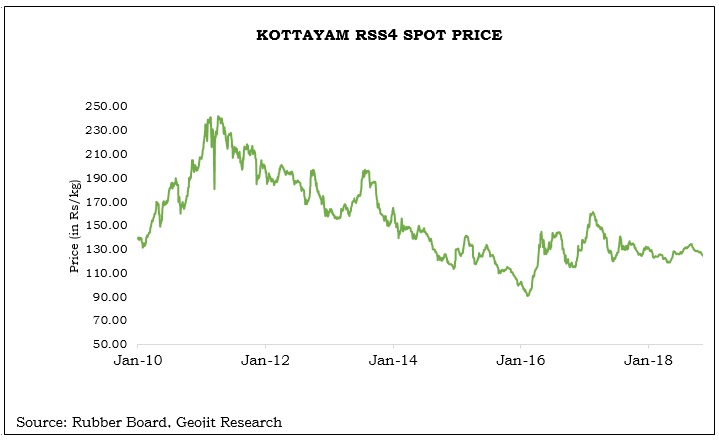

In the Indian market, meantime, since peaking to an all-time high in April 2011, natural rubber prices trended lower, hitting Rs.91 a kg in February 2016, its lowest level in seven years. While a brief bounce was seen thereof, natural rubber has held mostly in a range since then. Prices are, so far, down about 50 percent from the life-time high of Rs.243 a kg.

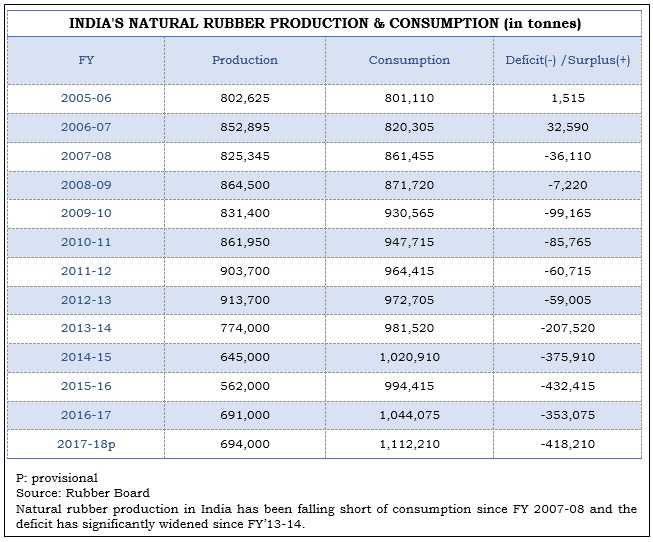

The decline in natural rubber in the Indian market has been relatively limited compared with the movement in the overseas market. Consumption staying robust in India despite dwindling production helped to limit steep declines.

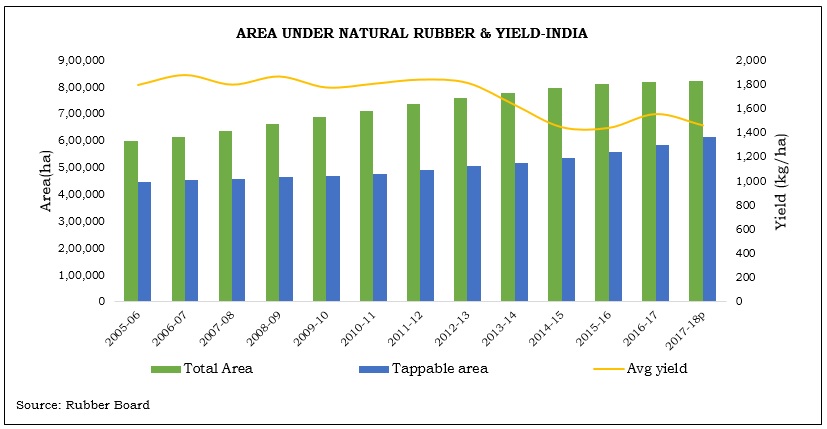

Despite rise in area and tappable area in India, the average yield is on a decline since FY 2013-14 and so was production, though a recovery was seen by FY 2016-17. Sustained weakness in natural rubber prices met with reluctance from the growers in Kerala, which contributes more than 80 percent of country’s total natural rubber production, to raise production. The attempt by the Kerala government in the form of “Rubber Production Incentive Scheme” in 2015 to support rubber farmers helped only to a limited extend.

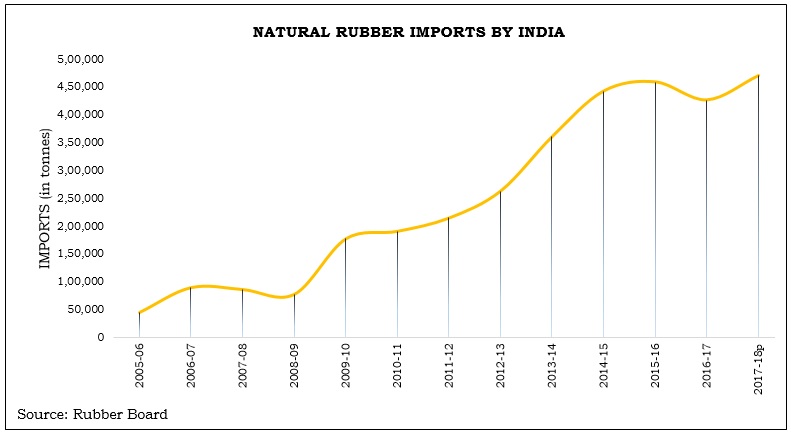

However, surging imports of natural rubber and subdued demand for local produce kept a lid on gains. Automotive tyre and tube sector, which consumes more than 65 percent of the natural rubber output, was relying on imported rubber to meet their requirements.

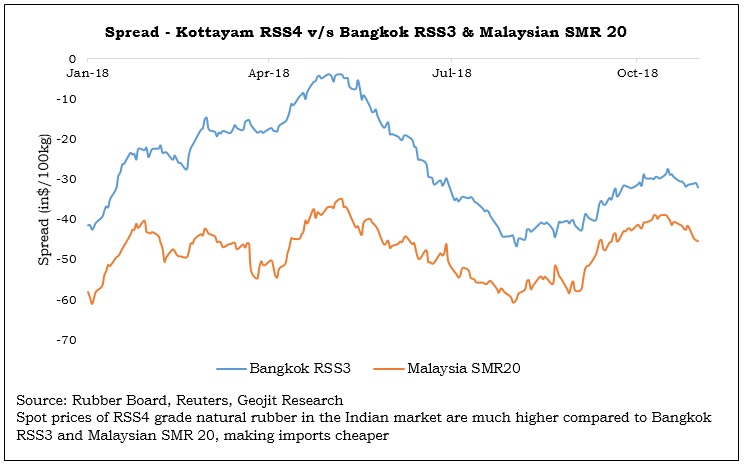

Natural rubber prices were much lower in the overseas markets, making imports cheaper. Importing natural rubber turned to more  viable as most of the time prices of local produce stayed at a premium to that in the international market. Despite raising duty or being restricted through selected ports, imports of natural rubber continued surging.

viable as most of the time prices of local produce stayed at a premium to that in the international market. Despite raising duty or being restricted through selected ports, imports of natural rubber continued surging.

Looking ahead, gloomy demand outlook in the backdrop of US-China trade spat, falling crude oil prices, bloated inventories in a market plagued by oversupply could abet the prevailing weakness. According to the ANRPC official, world production is anticipated to grow 5.8 percent to 14.696 million tonnes in 2019 provided the natural rubber prices remain at the current level.However, expectations that production may fall short of consumption this year could lend support to a certain extend. According to the ANRPC, production in 2018 is expected to be at 13.89 million tonnes, while consumption is seen at 14.21 million tonnes. In the meantime, weather and climatic condition in the major natural rubber growing regions will play a decisive role in determining prices. The World Meteorological Organization forecast “a 70 percent chance of an El Nino developing by the end of this year”, which could lead to drier conditions in major rubber growing regions in Southeast Asia, affecting productivity. A tilt in the supply-demand situation cannot be ruled out in the long run. Sustained decline in prices could make rubber cultivation un-remunerative, prompting farmers to slow down on replanting activities or shift to other crops. A considerable slowdown in new planting and replanting since 2013 will be a supportive factor. Also, various policy measures by leading natural rubber producing countries to stabilize the market, like temporary export restrictions, cutting down illegal rubber plantation etc are to cushion the prices and support the market in the long run.