Higher cost impacts…recovery ahead

Mold-Tek Packaging Ltd. (MTEP) is one of the leading manufacturers and suppliers of high quality airtight and pilfer proof containers/pails in India for paints, lubricants, food and FMCG.

Key Highlights

Revenue grew by 15.2% YoY, driven by a 16.5% YoY increase in paint volume, primarily led by the ABG group. However, excluding ABG, overall volume from this segment declined due to weak demand from Asian Paints.

Net profit declined by 4% YoY, and was below expectations due to higher employee costs, other expenses, and deprecation.

The newly launched pharma segment is progressing well, with 39% capacity utilisation.

We revise our EPS estimates down by 23.5% and 27.5% for FY25E & FY26E due to earnings miss in 9MFY25 and higher overheads.

The long-term outlook for MTEP is improving, led by the launch of new products, pharma packaging, strong client acquisition, a healthy balance sheet, and a RoE of 15% (avg. 5 years).

The earnings miss is primarily attributed to lower volume uptake in the paints segment (excluding ABG Group). However, we expect a recovery from FY26 onwards, with volume growth projected at a 13% CAGR over FY25E-27E.

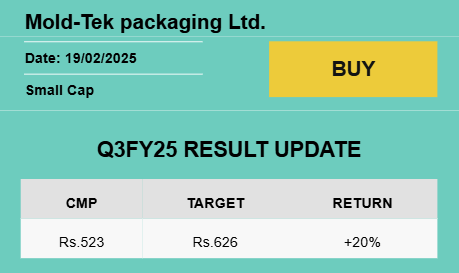

OUTLOOK & VALUATION

We anticipate earnings to grow by 24% CAGR over FY25E-27E. We believe that the earnings miss is on account of subdued volumes from the paints segment (~50% of sales) and has already factored in the stock price (42% correction in the last 1 year). MTEP is trading at a 1-year Yr FWD P/E of 23x (37% discount from peak valuations), which provides comfort. We value MTEP at a P/E of 22x (~10yr avg.) as we roll forward to FY27E EPS and maintain “Buy” with a target price of Rs.626.

To read detailed research report