by Anu V. Pai and Vinod T. P.

The year 2020 was a tumultuous one for the global economy. The least expected turn in the form of spread of Covid-19 pandemic across the globe in the beginning of the year and subsequent lockdown in many countries literally paused the global economic activity during the first half of the year, creating chaos in the commodity and equity markets across the globe. As the year 2020 culminates, global economy is slowly limping back to normalcy, though the threat of another wave of spread of Covid-19 pandemic is prevailing.

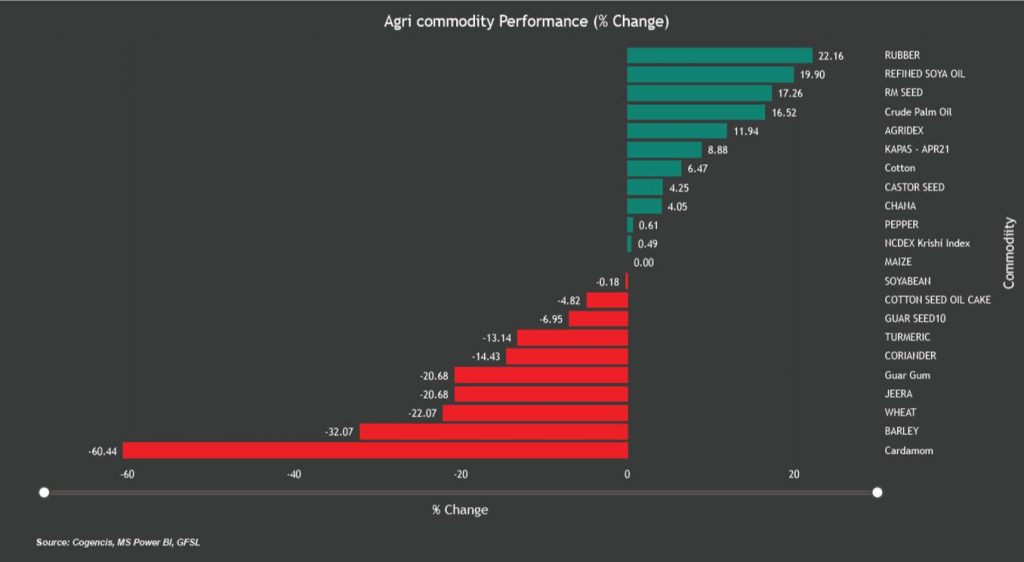

How agri-commodities fared in 2020

As the year 2020 is coming to an end, it has been a roller coaster ride for agriculture commodities as it was not insulated from the impact of the pandemic. But it seemed to be relatively limited in certain agriculture commodities due to its essential nature. While the first half of the year was rather painful, gradual unlocking and resumption of trade, transportation and other economic activities led to a recovery in many agriculture commodities. NCDEX Agri Index has gained more than 10 percent and is probably poised to end the year on a positive note.

Among the exchange traded commodities, natural rubber is the top gainer this year. Revival in demand, following gradual unlocking of economies and resumption of economic activities as well as fall in production in some of the major natural rubber producing countries like Thailand and Vietnam due to unfavorable weather, floods and fungal infestation lifted the commodity from multi-year lows hit during April 2020.

In the oil and oil seed complex, except soybean, all moved to a greener turf following the initial fall in the first half of the year. Amongst these, Mustard seed, Refined soy oil and Crude palm oil rallied the most. Crude palm oil had plunged in the first half of the year as lockdown imposed by various nations interrupted global trade. In the latter half, prices revived due to fall in production along with lower stocks. Higher domestic consumption of edible oils on back of festival demand supported the prices as well. In the case of refined soy oil fall in output in U.S along with lower stocks bolstered the prices to all time high. The lower global stocks have triggered a significant rise in process of most domestic edible oils such as sunflower oil, mustard oils etc.

Mustard seed prices rallied to a record high after a brief panic sell off witnessed in the first quarter of the calendar year owing to concerns over spreading of coronavirus and subsequent closure of spot markets owing to nation-wide lockdown. Later, prices recovered due to shortage of supplies in the market along with fall in output. Rise in demand for mustard oil for households and banning of blending of mustard oil with other oil pushed the prices higher. But, major gains were trimmed in the mid of November on expectation of bumper mustard seed output owing to higher rabi acreage during this season.

In spite of normal monsoon during this year, Soybean prices rose after corrective selloffs in the first quarter of the year owing to nationwide lockdown. Then, it moved higher in the second half due to concerns over fall in global soybean outlook along with lower stocks. However, major gains were arrested as hike in minimum support price (MSP) and good monsoon favoured increase in acreage with an expectation of rise in output. But, heavy floods in key growing areas like Madhya Pradesh and Maharashtra accelerated the worries over fall in soybean output supporting the upward journey in prices. Meanwhile, lower global edible oil stocks and worries over fall in output in Brazil owing to drought pushed up the prices higher.

Castor also declined in the first half of the year due to lower demand in the domestic market amid higher output. Moreover, lower export demand for oil from China also weighed the sentiments. Now, prices have revived on expectation of lower kharif output and higher export demand for castor oil from China.

Movement in spices complex was rather a jaded one. Broadly, jeera, coriander and turmeric were held in range. Forecast of higher production in 2020-21 season and favorable weather led to a retreat in cardamom prices from the record highs. Jeera on NCDEX has been varying in thin range during the year. The front month futures were mostly held inside Rs.15100-Rs 12800 per 100 kilograms after the slump in the beginning of the year. Estimate of higher production in last rabi season and ample stocks kept gains under check. In the meantime, turmeric is poised to post losses for the third straight year. Turmeric futures on NCDEX had tested a six year low during May-June before bouncing off. Prospects of higher production in the kharif season and ample stocks maintained downwards pressure on the yellow spice. Coriander, is set to post yearly losses as well after posting gains for the last two years. The demand for the spice is subdued as rabi planting is under way.

In the cotton complex, cotton prices fell sharply in the first half of the year. With expectation of rise in global output amid higher global stocks followed by disruption of supply weighed on prices. Lower domestic consumption coupled with lower exports also pressurized the prices. Later it regained on back of fall in global output in U.S. and Pakistan along with rise in global and domestic consumption supported the major gains. While the bi-product, cottonseed oil cake witnessed a roll-coaster ride which fell sharply in the initial months of the year due to lower demand for cake and expectation of higher cotton output. Later retreated on lower arrivals in the spot market and firm demand from poultry industry.

Among the other commodities, chana is set to end the year on a positive tone. Following a rather lackluster performance in the first two quarters of 2020 on higher stocks with the NAFED and fall in demand due to the nationwide lockdown, a sharp rise was witnessed in chana prices. It climbed to a three year high in October as demand revived. Rise in minimum support price (MSP) too supported the sentiments. However, with the commencement of rabi sowing, it retreated from the three-year highs as acreage jumped considerably compared to last year. In the meantime, guar complex is set to post yearly losses. Guarseed fell to three year lows in March 2020, while guargum plunged to 10-year low on NCDEX following the sharp declines in crude oil prices and pandemic induced lockdown which affected the export demand for the commodity. While, both witnessed a recovery from the multi-year lows, in tandem with recovery in oil prices and on demand from the confectionary sector demand, with rising cases of coronavirus and prospects of re-imposition of restrictions in many countries is raising concerns over demand from the oil sector.

Monsoon, sowing and other developments…

India received above normal monsoon for the whole year with a delayed exit in the past four years. The monsoon season witnessed a timely and strong start in Kerala, but rainfall was below normal in July. Later, monsoon winds re-gained strength in August and stayed above average till the end of the season. According to IMD, India received weighted average rainfall of 957.6 mm during the monsoon season with a 9% higher than the long-period average of 880.6 mm.

With a good and wide distribution of rainfall, kharif sowing was robust in most parts of the country. Area under kharif crops were up by 5% on year at 111.7 mln ha. However, there were some pockets with unusual and heavy distribution of rainfall which destroyed some standing kharif crops in many growing states. Among these, soybean and cotton are mostly affected. But, yield is unaffected. The government has pegged kharif food grain output at nearly 1% higher year-on-year basis at 144.52 mln tn in its first advanced estimates released by the Agriculture Ministry. Rabi sowing has begun and is progressing well. Farm Ministry data on 18 December showed a 4.7 percent rise in area to 56.5 million hectares compared to same period last year. Area under wheat, mustard and pulses like chana, masur and moong have shown a considerable rise. In its first advance estimate, the government set a target of 151.7 million tons for rabi food grain output this year, against production of 153.3 million tons the previous year.

In the meantime, on the policy front, Government of India enacted the three new farm acts namely Farmers’ Produce Trade and Commerce (Promotion and Facilitation) Act, 2020, Farmers (Empowerment and Protection) Agreement on Price Assurance and Farm Services Act, 2020 and Essential Commodities (Amendment) Act, 2020 aimed to increase investment and growth in the agri sector, allow farmers to sell their produce outside the AMPC mandis, deregulation of many commodities from the “essential” list etc. The Act have been widely acclaimed at home and abroad as historical and long overdue. However, some experts and stakeholders, including farmers, have expressed their concern been protesting against them and seeking their withdrawal.

As another year unfolds, the threat of coronavirus pandemic is far from over. The lingering corona virus pandemic crisis continues to create uncertainties in the market. However, progress in vaccine development has provided relief to a certain extent. A successful development of new vaccine could probably bolster the economic recovery and there by demand for the agriculture commodities. Apart from the pandemic related issues and the underlying fundamental factors, weather especially impact of the LaNina phenomenon, government policies, export-import policy and demand, US-China trade relations, kharif/rabi harvest etc could influence the domestic agriculture commodity prices in coming days.