In the near term, the Indian market is expected to trade in a narrow range between 24,800 to 25,250 with a negative bias. Key support at the lower level is 24,500, and on the higher side, resistance is at 25,500. This is led by the confirmatory bias of the bazaar, looking forward to the upgradation of future earnings based on the Q1 results and reduction in tariff risk based on a firm inference from the upcoming US trade deal.

As said market has a positive bias towards both the factors, hence maintaining the overall optimism in India trading near the 3-year high valuation of 21x forward P/E. Heightened selling by FIIs in India compared to other EM peers due to premium valuation is leading to deep underperformance in the near term. On the other hand, while DII inflows remain constructive, following the consistent accumulation over the past two to three months, the pace of buying has moderated, led by a muted start to the Q1 earnings.

Q1 Earnings Review

Q1 results commenced on a subdued note, primarily due to weaker-than-expected performance from the technology sector. Lately, some good sets of numbers, especially in sectors like banking and cement, have provided a boost to heavyweights. Midcap’s earnings have also just started, and they are on a positive note. Broadly, based on the initial data, the total revenue growth of Indian corporates is at +5% with a 10 to 12% earnings growth, providing a positive outlook as the overall results are in line. Hence, the market has a view that this trend can deepen in H2 (July to Dec) based on a good monsoon, reduction in inflation (input cost), rate cuts, and a rise in consumption demand. This could be positive for Midcaps.

What impacted market in H1?

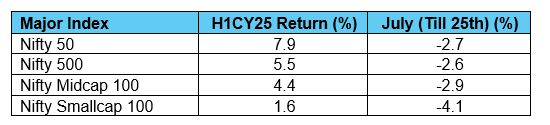

These were the two key factors i.e., the downgrade in domestic earnings (lower earnings growth compared to high valuation) and the trade war, which affected the overall performance of H1 (January to June). The trend improved post-April as the risk started to subside. Hence, as the risk further subsides, we can expect a better half in CY25.

H2 has started on a muted note after a good April to June period. H1 was more positive for large caps, while for H2, there is a good chance that midcaps could outperform due to improvement in earnings outlook, reduction in risk, and premium valuation of large caps. That’s why the market is trading on a volatile note, in a narrow range in anticipation of more details, which is expected to sustain only in the near-term, from Q1 and the trade deal. Lately, the volatility has increased as DIIs’ buying has moderated while FIIs’ selling continues.

First published in Mint