Based on parameters, Indian market is expensive

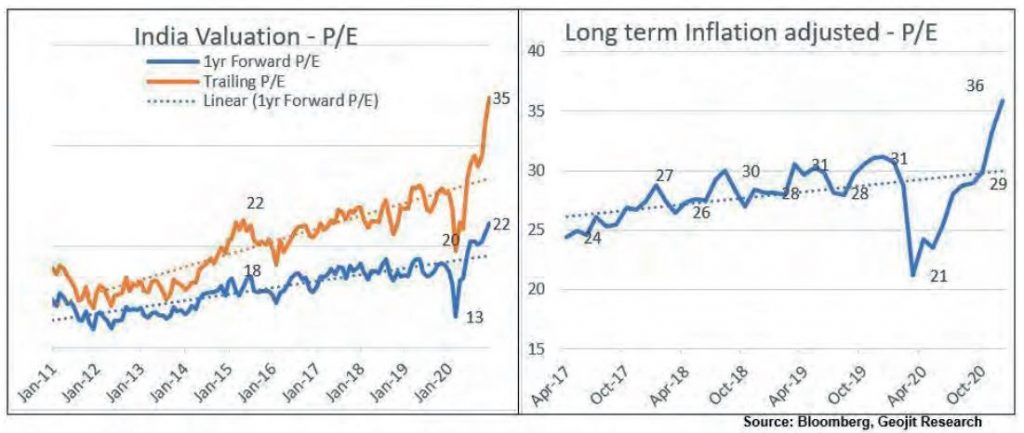

Firstly, let us understand the valuation level of the Indian market to assess the gravity of the disparity. Based on historic methods of valuations like price to earnings ratio (P/E), the Indian market is very expensive. On trailing PE, we are 35x and on the one-year-forward basis, we are at 22x, as on 31st Dec 2020. This is respectively 41% and 70% above historical averages, which is highly overvalued.

India has been in the grip of rigid retail inflation for a long period, which has distorted the valuation of the stock market. For stocks which are impacted negatively by inflation, the valuations are low, and for companies and sectors which benefit from inflation, the valuations are high. To normalize the effect of high inflation, the standard trailing P/E should be adjusted by the long-term inflation rate. By using the long-term price to earnings ratio using the 10 year average real EPS, the P/E falls to 36x. Then historic premium valuation of trailing P/E ratio declines hugely from 70% to 28%. This shows that the valuations of the market continue to be elevated but they are not hugely excessive as feared earlier.

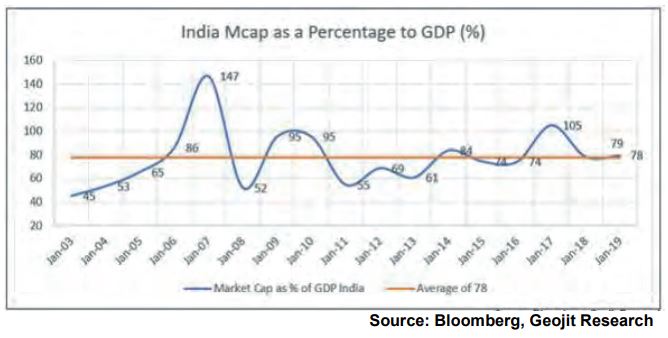

In-terms of Total India Market cap to GDP ratio, we are not so expensive

Why is the market valuation so high?

The reopening of the economy has brought a high amount of pent-up demand and new avenues of business for technology, healthcare, and home and office needs as per the ‘new normal’. Fiscal stimulus, accommodative monetary policy, and a high amount of cash in the hands of consumers have facilitated corporates earnings growth. The EPS growth of Nifty 50 is expected to jump by 23% in CY2021 and is expected to stay buoyant for the next three years with a CAGR of 26%.

This economic growth and fall in systematic risk (like global financial and country risk) have re-rated the stock market. For example, total funds or assets in the hands of total US Banks increased from USD 4 trillion to USD 8 trillion between March 2020 to December 2020, which increased liquidity in the financial market, reduced risk, and multiplied confidence.

Double benefit of high growth and liquidity

The benefits will continue to support stock market with low interest rate

Fiscal and monetary measures are bound to stay liberal. Covid-19 has triggered a global health crisis, which will impact public behavior for a long-time. Governments will have to maintain supportive fiscal measures, especially till employment rises to a normal level. For example, unemployment in the US is high at 6.7% compared to 3.5% before Covid –19. As a result, the interest rate in the economy will remain attractively low, with a positive bias on a short to medium-term basis.

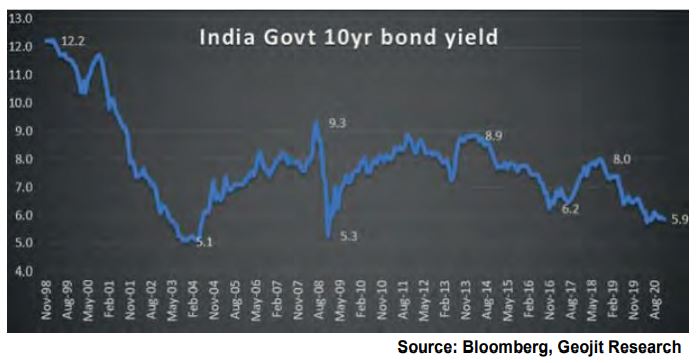

In India interest rate has been on a declining trend before the Covid-19 period and reduced faster post-Covid. However, the interest rate has been stuck in recent months due to high inflation, which is expected to ease in 2021.

The reducing trend of India interest rate…

World’s leading central banks and RBI will have to maintain an accommodative stance with low-interest rates and high liquidity in the banking system. This will be very important for the equity market, to maintain buoyancy. An important factor to determine the future interest rate will be inflation and global risk as both will impact global bond yield.

The reducing long-term trend of India inflation

In India, CPI was rigid during 2019 and 2020. It was high even during the Covid period when GDP collapsed by 25% in Q1FY21. This was mainly due to disruption in supply chains impacting food prices and high excise duty on fuel prices. This anomaly can reduce substantially if reforms brought by the three agriculture laws become successful in controlling food prices. RBI has a strong hope that the inflation rate would be maintained at the long-term target of 4%.

Globally, the key factors impacting the interest rate will be inflation, bond yield, and change in liquidity. Firstly, about inflation in the US, CPI has been tepid for a long period of 10 years. This may be due to modern trends like e-commerce and rising productivity due to modern technology, leading to a drop in prices. As per the forecast, CPI is expected to remain low in the medium-term. FED has a target of 2% while the current rate is 1.4%.

Regarding bond yield, along with inflation, an increase in risk defines the trend of bond yield. As far as factors like political risks go, they have dropped substantially post the US presidential election. At the same time, financial risk has also reduced due to fiscal, monetary, and political developments. But this can rise in the short to medium terms due to concerns over rising NPAs and debt. This can also alert country-wise risk due to the weakening fiscal position of economies in some emerging markets, which may impact countries like India.

Lastly, change in liquidity, will definitely impact the market because it has been an important factor for the sharp rally since the 2020 March low. A slowdown in monetary support will dry the flow of funds to equities. It can also increase the interest rate and bond yield, leading to shift of money from equity to debt.

Having said that, the interest rate is unlikely to shoot up but may remain steady over a period of one to two years, depending on the normalization of the economy and financial market. Liquidity will reverse only after the normalization of the economy. During this transitory period, high earnings growth and low-interest rate will support bring liquidity and help the stock market. There are areas in the stock market that are overbought and overvalued. Shifting to the segments of high quality will be the ideal strategy to maintain profit and stay above the benchmark.

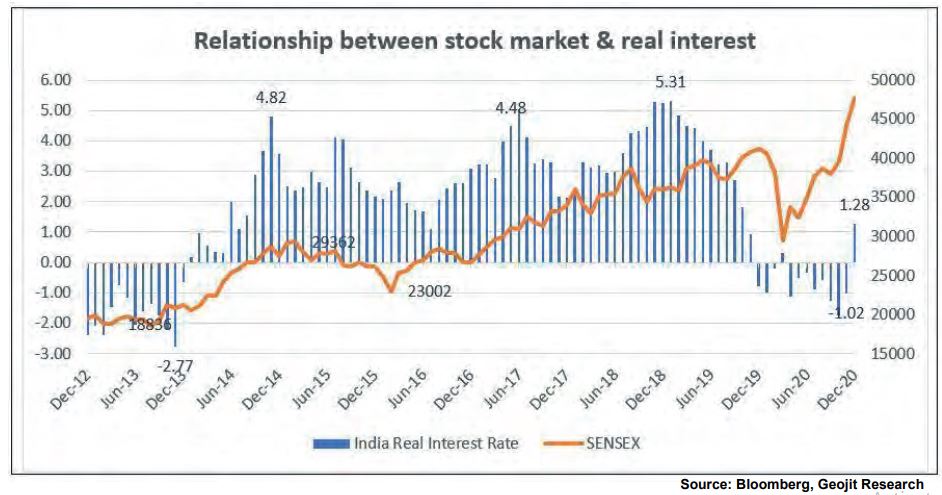

Relationship between real interest rate and stock market

Real interest rate, is the difference between the current yield of government 10-year bond minus monthly CPI, which is the real profit or value reaction of capital or to the investors. Below is the chart on a monthly basis.

A long-term negative real interest rate is bad for the economy and investors. A growing economy never stays at the negative real rate for a long time, because the economy is expected to improve in the future. Stock market performs well or starts to do well, in a negative real interest cycle, because, the stock market will be undervalued and the economy will be poised for growth recovery.

The transitory period, when a negative real interest rate moves to a positive rate, is also good for the market because of improving economics. This is exactly the phase India has just started in December 2020 and will stay put in 2021. During 2020, India was in a negative real interest rate, as shown in the chart above. Higher real rate and profit, which is the main reason to do business, improve the prospects of equity. Going forward factors like a drop in high inflation, an increase in the interest rate and better economic demand will be positive for the stock market.

High liquidity support, which was really required when the pandemic broke out, has created an overbought position in the stock market that has resulted in the rally of the last 10-months. Overvaluation is also due to low earnings, which will improve in the future due to economic gains. We are moving to a more profitable economy that will support the stock market on a medium to long-term basis. We may have corrections in the short-term, which are also desirable; else it will make the market more expensive and vulnerable. Expecting a correction of 10 to 15 percent will be a decent rationale and good for the market to stay bullish on a long-term basis.