Inflation

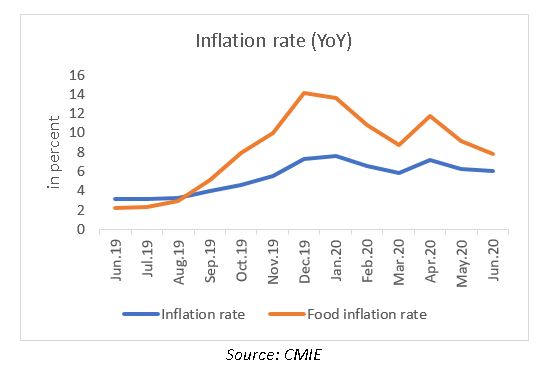

- In June, inflation rate as measured by Consumer Price Index (CPI) was at 6.1 percent, breaching the upper band of 6 percent under the inflation target framework of the RBI.

- Food inflation rate moderated to 7.9 percent

- Inflationary pressure on vegetables eased to 1.9 percent (YoY), and for pulses & products it declined to 16.7 percent (YoY). Egg, fish and meat registered a slight increase in the prices at 15.41 percent (YoY) compared to 15.29 percent (YoY) in May.

- Core inflation (inflation excluding food and fuel) has risen to 5.1 percent in June’20

Industrial Output

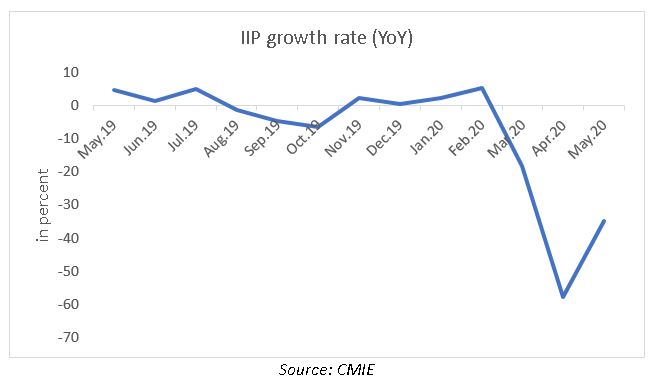

- Index of Industrial Production (IIP) recorded a contraction of 34.71 percent in June. However, the performance was better than in May when the contraction was at 56 percent.

- Mining and quarrying registered a contraction of 21 percent, whereas manufacturing contracted by 39 percent and electricity by 15 percent in May’20.

- Core sector output contracted by 15 percent in June’20, compared to a contraction of 22 percent in May’20

- Manufacturing PMI in June’20 remained below the 50-mark at 47.2.

External Sector

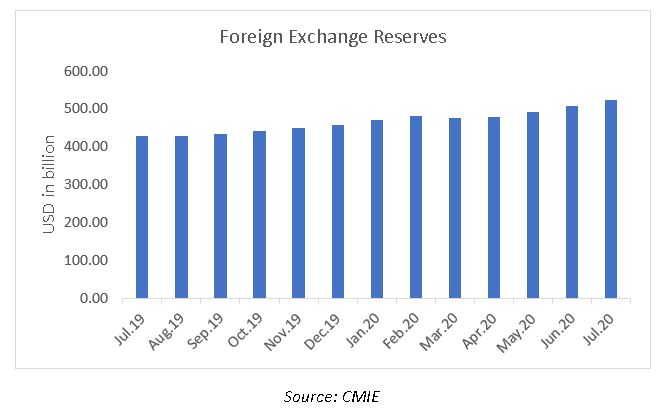

- As on 24th July’20, India’s forex reserves reached a historical high of USD 523 billion.

The surge in forex reserves can be attributed to the spike in FII inflows and savings in import bill.

- Rupee strengthened against USD in July’20 at Rs 74.99 per dollar compared to Rs 75.73 per dollar in June’20.

Foreign Trade

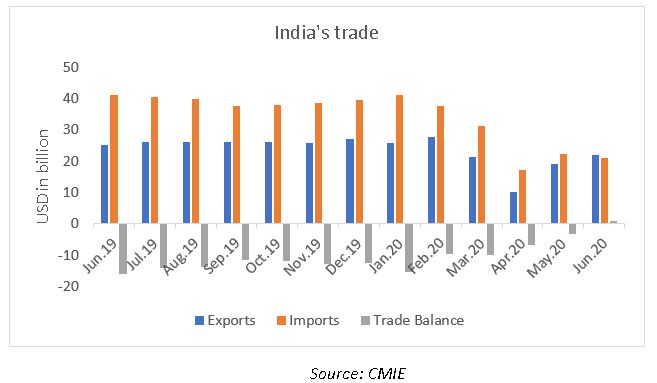

- India turned trade surplus to the tune of USD 790 million in June’20.

- In June’20, exports registered a contraction of 12.5 percent (YoY) whereas imports contracted by 48.5 percent (YoY).

Capital Market

- In July’20, SENSEX rose by 7.71 percent to end the month at 37606, whereas NIFTY rose by 7.5 percent to end at 11073.

- FIIs/FPIs remained net buyers in the Indian market with the net investment in equity and debt market at USD 0.62 billion

- The net investment by mutual funds in equity and debt market stood at USD 3.03 billion in July’20

- The 10-year G-sec yield stood stable at 5.8 percent in July’20.

Fiscal Scenario

- Revenue receipts of the Central government up to June’20 stood at Rs 1.5 lakh crore, which is 7.4 percent of the budget estimate for FY21

- Revenue expenditure stood at Rs 7.2 lakh crore making it 28 percent of the budget estimate for FY21. Capital expenditure up to June’20 stood at Rs 88.2 thousand crores, which is 21.4 percent of the budget estimate.

- Fiscal deficit up to June’20 stood at Rs 6.6 lakh crore making it 83.2 percent of the budget estimate for FY21.

Data as on July 2020