The term ESG has caught the fancy of investors in the recent past and seems to be gaining more importance in the investor’s dictionary. ESG stands for Environment, Societal, and Governance. The effect of climate change, global warming, and the recent Covid pandemic have all had a bearing on the economy and society. This has in effect impacted the ways of doing business and companies are looking to adopt sustainable ways of doing business, not only for their well being but also to influence public opinion. Investors too are becoming more activist in nature and are realizing that they need to look at the company’s ways of doing business and invest their money in companies that focus on the environment and also have high governance standards; not just balance sheet strength and Return on Equity. Three styles of investing fulfill this: Environmental, Social, and Governance (ESG), Socially Responsible Investing (SRI), and Impact Investing. ESG looks at the company’s environmental, social, and governance practices, alongside more traditional financial measures. Investors who use ESG in their decision-making are able to invest sustainably while maintaining the same level of financial returns as they would with a standard investment approach. Socially responsible or Impact investing involves actively removing or choosing investments based on specific ethical guidelines. It puts a premium on positive social change by considering both financial returns and moral values in investment decisions. This strategy may also sometimes emphasize financial returns as a secondary consideration after the investors’ moral values have been accounted for in their decision-making. Used interchangeably, responsible investing is widely understood as the integration of environmental, social, and governance (ESG) factors into investment processes and decision-making.

There is a school of thought that companies scoring high on ESG criteria will also perform well over the long-term and will have better performance. These companies may be able to navigate future uncertainties better. ESG factors cover a wide spectrum of issues that traditionally are not part of financial analysis, yet may have financial relevance. This might include how corporates respond to climate change, how good they are with water management, how effective their health and safety policies are in the protection against accidents, how they manage their supply chains, how they treat their workers, protect human rights, address gender inequality and whether they have a corporate culture that builds trust and fosters innovation.

A lack of standardization in terminology has created confusion over how ESG investing and sustainable investing are different. In India, we see ESG investment fund managers usually exclude companies from sectors such as tobacco, alcohol, gambling, etc. However, that may not be true for global fund managers, where some of the tobacco companies for example, are not naturally excluded just because of their operational sector.

Why ESG?

- Choosing a company that scores high on ESG criteria may improve investment results. The various criteria may be used to identify companies with business models that are likely to face headwinds or tailwinds due to regulatory, environmental, demographic, or technological trends. Institutional investors are increasingly looking to ESG factors as a way to manage these risks and to achieve long-term sustainable financial performance.

- Although ESG differs in its definition, some investors consider ESG issues a means for aligning investments with their ethical, religious, or political beliefs. They have typically used ESG research to screen for controversial activities such as tobacco, weapons, alcohol, gambling, or fossil fuels, and to help exclude such activities from their investment universe. Unlike the ESG goal in the above point, where ESG factors are considered on the basis of their potential economic impact, value-based goals are intentionally aligned to match an investor’s beliefs.

- A third group of investors focuses on the impact of their investments on the world around them. These investors may seek to direct their capital toward companies that provide solutions to environmental or social challenges and/or are part of formal frameworks such as the UN Sustainable Development Goals (SDGs), monitor the extent to which their investments are generating positive social or environmental impacts alongside their financial returns.

According to a study by MSCI companies with a higher ESG rating were associated with:

- Higher Profitability: High ESG-rated companies were more competitive and generated abnormal returns, often leading to higher profitability and dividend payments, especially when compared to low ESG-rated companies.

- Lower risk: High ESG-rated companies experienced a lower frequency of non-systemic risk incidents. Conversely, companies with low ESG ratings were more likely to experience major incidents.

- Lower systemic risk: High ESG-rated companies have shown lower systematic risk exposure, showcased by less volatile earnings and less systematic volatility. Compared to low ESG-rated companies, they also experienced lower betas and lower costs of capital.

This is currently more apt for developed markets and may not be fully priced in for a developing market like ours.

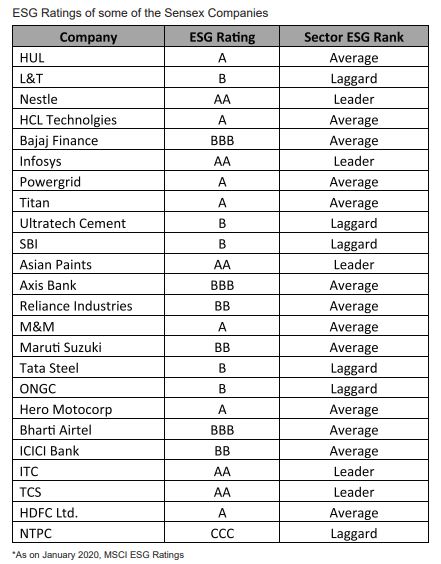

A note on how the rating works: In the automobile industry, M&M has an “A” rating while Maruti has a “BB” rating. Now, this has happened because Maruti is a laggard in labor-management and opportunities in clean technology while M&M was not a laggard in any of the key sectoral issues that they evaluated to arrive at the ratings. Also, ITC is a leader among 10 companies in the global tobacco industry. So if an investor does not mind having tobacco companies in his portfolio, he can consider ITC on the basis of ESG. Please note that this rating is a global comparison of companies as per their respective sectors and criteria.

The increasing importance of ESG considerations to assess the credit quality of companies is evident from the fact that Moody’s Investors Service had considered exposure to environmental, social, and governance (ESG) risks in 33% of its nearly 8,000 rating actions for private sector issuers in 2019. This was driven by factors including stricter environmental regulations, demographic and societal changes, and increased public awareness on issues such as climate change, sustainability challenges, diversity, data security, and income inequality. According to Moody’s, among sectors with the highest share of rating actions citing environmental considerations were those that they had previously identified as facing elevated environmental risk, including automobile manufacturers (61%), coal mining and coal terminals (48%) and regulated electric and gas utilities with generation (42%). About half of the references to governance issues cited financial strategy and risk management considerations, reflecting the board and management’s tolerance for financial risk and their approach to mergers and acquisitions, commodity risk management, leverage, and capital allocation. The second most frequently cited governance issue was board structure and policies and procedures.

What are the cons?

- These funds do not have any particular advantage over a regular well-diversified equity fund in terms of potential returns but are more about alignment with investor values.

- ESG takes money that can be invested into any company the fund manager believes will generate superior returns and force it into a smaller set of companies that pass through a particular filter.

- In India it may take a longer period for ESG to become mainstream as the penetration of equities is very low in comparison to global markets.

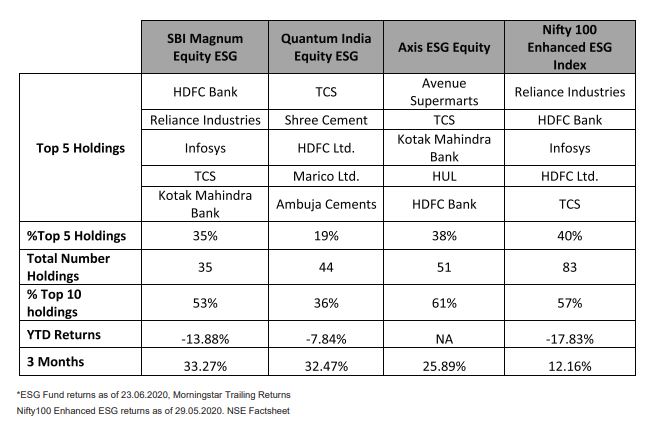

- There is concentration risk, as is evident from the NSE ESG index and some of the ESG based Mutual Funds where Top10 holdings in the fund account for around 60% of the total.

We also have ESG ratings on normal diversified equity funds, which can help an investor judge how ESG friendly the portfolio of a Mutual Fund is. Just as an example, Kotak Standard Multicap has an ESG rating of BB, as per MSCI ESG criteria. Some of the points were that 7% of the fund’s holdings receive an MSCI ESG Rating of AAA or AA (ESG Leaders) and 21% receive an MSCI ESG Rating of B or CCC (ESG Laggards). More interesting is the corporate governance analysis. The fund’s weighted average percentage of an independent board of directors is 57.9%, and its weighted average percentage of women on boards is 17.8%. You can see the ratings of most of the Large and Multicap funds here.

While most investors only look at the financial aspect of their investments, we are in an age where investors might also look for social and emotional aspects. ESG funds cater to this and allow the investor to express his opinion regarding positive environment, social or corporate governance practices. These funds will not have any particular advantage over a regular well-diversified equity fund, in terms of potential returns, but are more about satisfying investor’s values. According to Morningstar, Mutual Funds, and ETFs focusing on sustainable ways of doing business, raked in $20.6 billion of total new assets in 2019, which was almost four times the inflows in 2018. Although this was a small percentage of the total flow, this number shows the increasing investor interest in the theme. We will need to keep this in mind, since it may appeal to ESG conscious investors. This is a new category and clear benchmarks may not be available, and in its current form may not be ideal to form a part of our core portfolio. As this theme picks up more importance, especially post Covid-19, where the focus will be on how to build a better and more sustainable business, regulators and stakeholders alike will demand more ESG disclosures from companies. This means that this will definitely become a theme to look out for in the near future.