Uncertainty is a normal for financial markets. But heightened uncertainty is rare and chaos is rarer still. These are chaotic times. Under heightened uncertainty and chaos markets tend to be bearish. But during the last five years, stock markets have been bullish delivering excellent returns to investors.

What are the likely market trends going forward?

The last five years have been exceptional with unprecedented, unexpected events and developments. The first shock was the pandemic COVID-19 which triggered global recession in 2020. Before the global economy could limp back to normalcy Russia invaded Ukraine in 2022 and a war in Europe, which was totally unexpected, broke out. This war and the supply chain disruptions caused by the pandemic caused high inflation globally and central banks had to implement hawkish monetary policy causing convulsions in the stock and currency markets. By the time inflation was tamed, the Hamas-Israel conflict broke out. The terror attack in Pahalgam led to a short conflict between India and Pakistan. With the war in Gaza still raging, Israel attacked Iran rendering West Asia a geopolitical hot spot, and crude oil spiked by more than 10 percent.

How did these chaotic developments impact stock markets?

COVID-19 did impact stock markets globally; but markets staged a dramatic turnaround after the COVID crash. MSCI World Index more than doubled from the low of around 1850 to 3900 by mid- June 2025. S&P 500, too, more than doubled from about 2480 in March 2020 to around 6000 in mid-June 2025. Nifty has been one

of the star performers: more than tripling from the COVID low of 7511 in March 2020 to around 25000 by mid-June 2025. This is in sharp contrast to the poor return delivered by the Shanghai composite which only crawled up from 2700 in March 2020 to 3360 by mid- June 2025.

Triggers for the rally

The sharp rally in the market has been triggered by the sharp turnaround in the economy and corporate earnings from 2021 onwards. India had the best growth turnaround among large economies with GDP growth rates of 9.7 percent, 7.6 percent and 9.2 percent for FY22, FY23 and FY24 respectively. Corporate earnings grew impressively at 24 percent CAGR during FY20 to FY24 providing the fundamental support to the rally.

Growth and earnings slowdown

GDP growth slowed down to 6.5 percent in FY 25 and earnings growth dipped sharply to 5 percent in FY25 rendering valuations expensive. Nifty at 24500 is trading at about 22 times FY26 earnings. This is higher than the long-term (last 10 years) average of 18.5 times. This premium valuation can trigger FII selling at higher levels putting a cap on the upside to the rally.

Strong macros, but weak micros

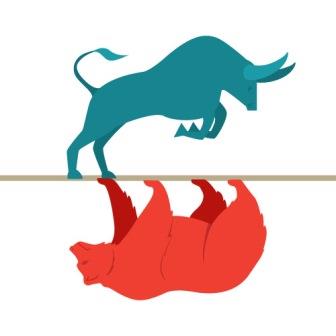

Strong macros is India’s strength. GDP growth, fiscal and current account deficits, inflation, forex reserves and growth-stimulating fiscal and monetary policies are all favorable. However, the micros -corporate earnings- are the weak spot. A sustained rally can happen only if the micros improve. This will take a few quarters more. Therefore, the bull is likely to pause for some time. Investors need expect only modest returns in 2025.

First published in Economic Times