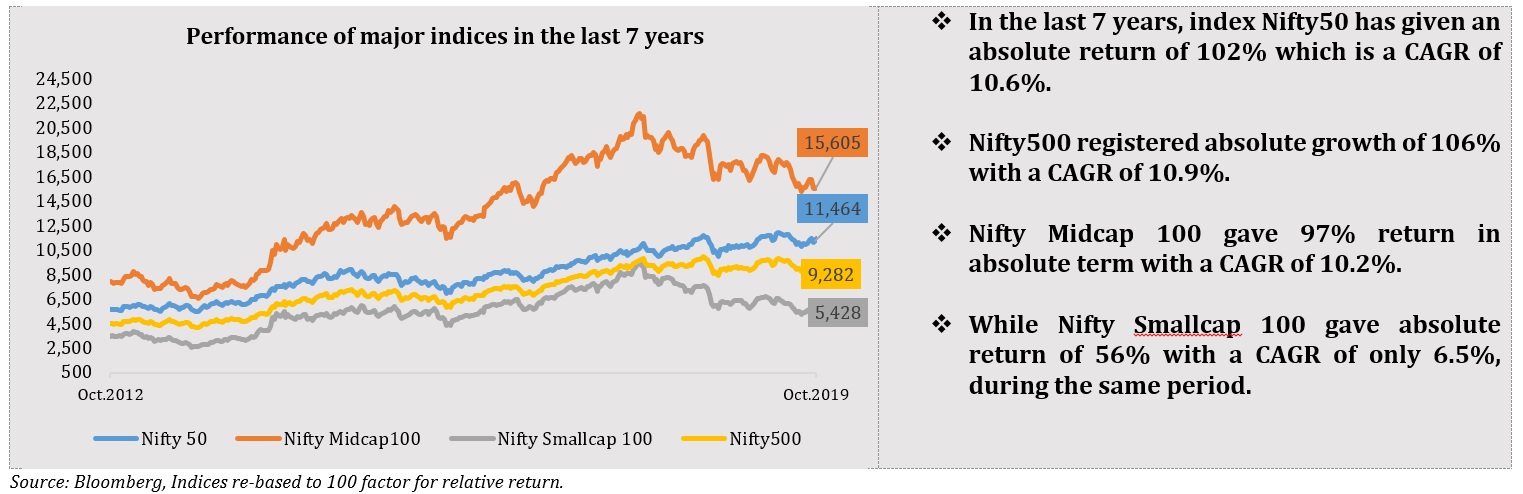

The performance of India’s key indices is CAGR of 10.9%, 10.6%, 10.2% and 6.5% for Nifty500, Nifty50, Nifty Midcap and Nifty Smallcap, respectively, in the last seven years.

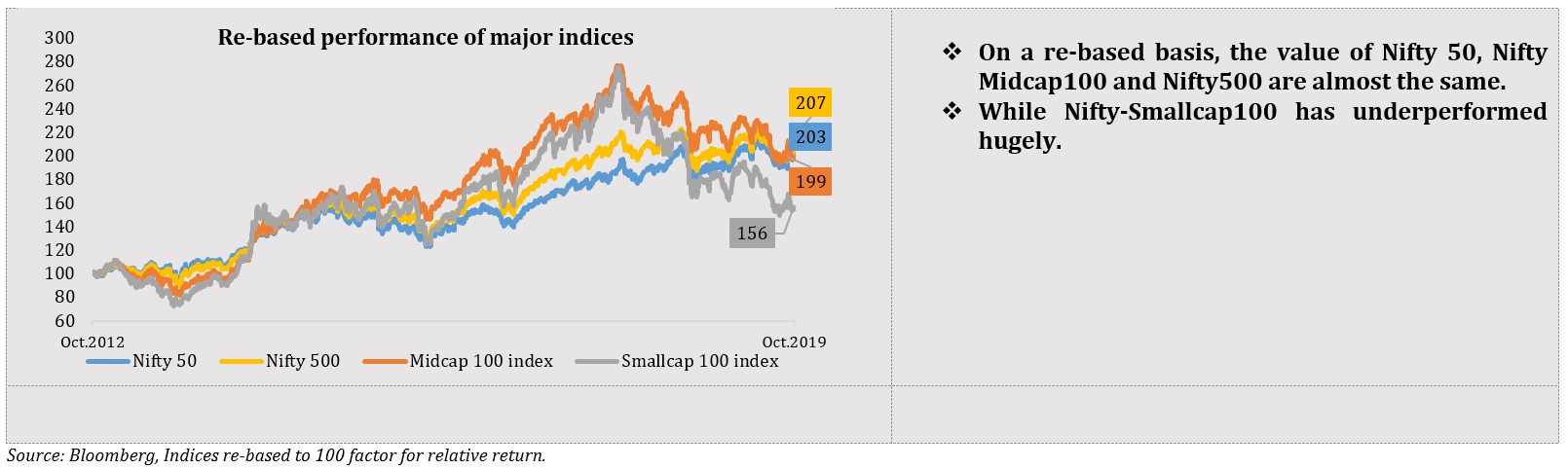

100Rs invested 7yrs back appreciates to Rs 207, Rs 203, Rs 199 and Rs 156 for Nifty500, Nifty50, Nifty Midcap and Nifty Smallcap today, respectively.

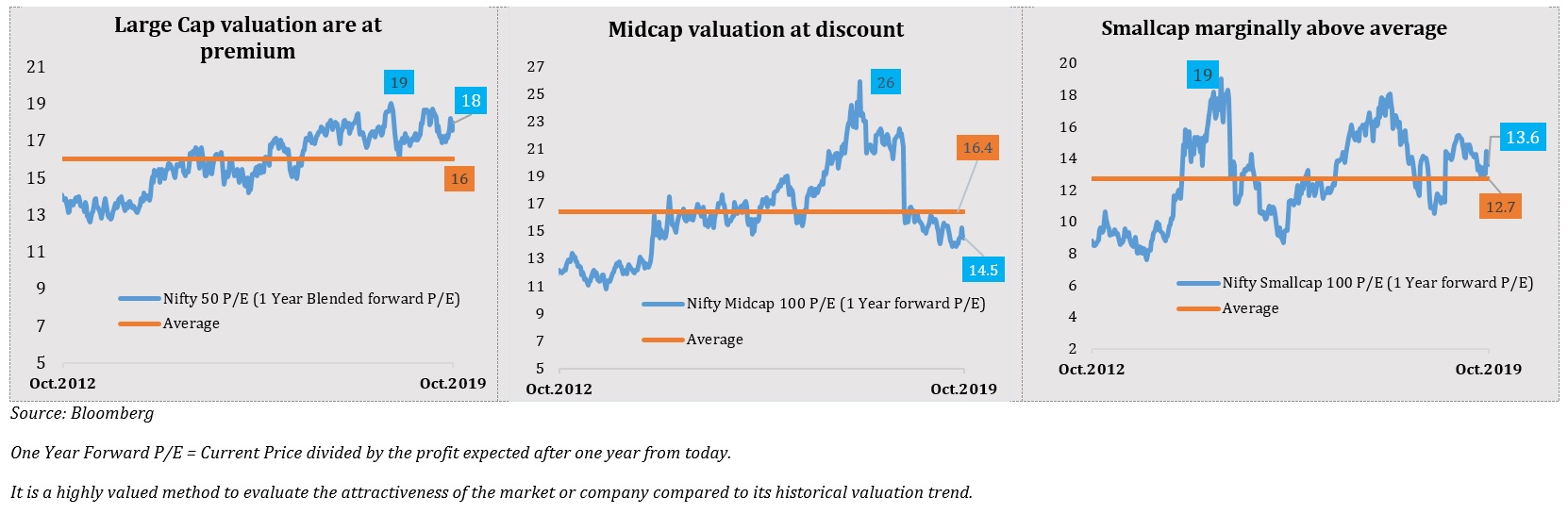

Valuation of one-year forward P/E, in the last 7 years…

In-terms of valuation, large cap is at premium, Small cap marginally above the average and Mid cap below the average making it attractive on long-term basis for Mid & Small caps.

- Index Nifty50 P/E (1 year forward) is at 18x, which is near it high of 19x, this is 13% premium to its seven-year average of 16x.

- Index Nifty Midcap100 P/E (1 year forward) is at 14.5x, 12% discount to its seven-year average of 16.4x.

- Index Smallcap100 P/E (1 year forward) is at 13.6x, 7% premium to its 7-year average P/E of 12.7x.

Dividend yield in the last 7 years…

In-terms of dividend yield the market is undervalued being near the 7 years average, making it attractive…

- Currently the Nifty50 dividend yield is at 1.3%, in line with the seven-year average dividend yield of the index.

- The Nifty Midcap100 dividend yield is at 1.4% which is slightly lower than the average dividend yield of the index’s 1.5%.

- The Nifty Smallcap100 dividend yield is at 1.5%, higher than the average dividend yield of 1.3%.