By Anand James

By Anand James

M for Midcaps or Marvel?

Trading in mid-small cap stocks is akin to seeing Marvel super hero movies like Iron Man, Ant-Man, Avenger series etc. The gains and losses are relatively huge, and so are the surprises and disappointments. While the stocks move as if there is rage, fury, purpose, they often leave you excited, if not exhausted. But, beyond these obvious similarities, this analogy throws an interesting insight into our investment decisions.

Most of us at times, and some of us most of the time, are spoon fed into an investment decision by the expansive moves of mid cap stocks and their similar upside potential, in the same lines as our emotions are spoon fed by the sound and the size of the characters and canvas in the Marvel cinematic universe. It is an educating experience, to switch off the sound, and you are left with the task of observing motion much more closely, to understand the plot, and to keep you interested. In “A Quiet Place”, a 2018 American film, the plot follows a family who must live life in silence while hiding from creatures that hunt exclusively by sound. In other words, in the absence of sound to spoon feed you into what and how to emote, you become more engaged, the camera angles and lens usages become more intelligent, mostly out of necessity, while the viewer is encouraged, if not compelled, to be much more alert and observing. Stretching this allegory to investments, “A Quite Place” approach would be similar to investments based on Nifty; for its low expectations towards the dramatic. Let us hold that thought there and see which of these two investment approaches would be relevant, given the present situation.

Where we are

By the third week of April 2018, Nifty was seen stretching higher for the 10th straight session, registering the longest winning streak in over three years. The ease and swiftness with which such an up move unfolded was largely due to two reasons. One, the low base, from where it was bouncing off. Within the first three months of the year, Nifty had fallen nearly 10 percent, small caps nearly 20 percent, while some popular names like Bharti had fallen over 30 percent from the peak. Second was the turn in trader’s sentiments. The start of a new financial year, and the expectations for a good earning season, gave markets a highly welcome distraction, allowing the bear grip to loosen, lifting prices. It also helped that the events mentioned above also coincided with Nifty approaching the psychological level of 10k and also the 200 DMA. But it is not as if, there have not been any obstacles. In fact, obstacles have been aplenty which would have worried even the most optimistic of traders. Brent Crude is comfortably above 70, the highest in six years, eclipsing the positivity from the easing CPI numbers in the last couple of months. Tensions surrounding Syria, North Korea etc. keep jolting markets every now and then, but the cracks have not been steep or sustained, at least not yet. Meanwhile the exchange of tariff blows between US and China has kept markets guessing if it will expand into a full fledge trade war involving more countries, while on the domestic front, upcoming elections have deprived markets of clarity towards reform measures.

The market may never come down

If we can just cut out the clutter from the above paragraph, all that remains is “volatility”. In fact seasoned traders see more opportunity in times of such volatility or periods dominated by repeated start-stop moves. Not a bad time for the long term investor either, as he will have multiple opportunities to average or accumulate his favourite stocks. But we, at least most of us, are eternal worriers, and fear that markets will embark on a long term downtrend, as soon as we put our money in. There are two simple reasons why this is not the case, and that markets will almost never collapse.

Firstly, as a cheap source of finance, the stock market has few competitors, if at all any, while also complementing other financial institutions like banks and NBFCs. Even for governments stock market is important for disinvestment, attracting FDIs etc. Why, the depths that even foreign markets go to maintain link with Indian stocks is reflected by how Singapore responded to the stoppage of data feed by Indian exchanges to SGX. The new contract that is expected to trade in SGX from June is understood to have no reference to Nifty on any of the days, expect for the expiry date, when the contract will expire on the Nifty’s price. This is as much as a clever financial engineering, as much as it is an evidence of how important Indian stock index is. So a clean and vibrant stock market is in every body’s interest, and supports the view that the juggernaut of stock market should roll on, in perpetuity. So in a way, stock market is not the barometer, but the fulcrum of Indian economy.

Secondly, Nifty has never, in the past 17 years, had successive years of decline, ensuring that it has always been on an upward slope in the long run. Will history repeat? It did not, for Gold though. History led us to assume that gold will give returns above inflation at least, for ever. We broke off from that belief in 2011 and the commodity has been on a downtrend ever since. But the reason why Nifty could repeat history and continue stretching higher is that its stocks keep on getting included and excluded depending on performance among other criteria. Since 1990, the index has seen 235 such changes, the latest being the addition of Bajaj Finserv, Grasim Industries and Titan Company to the index in April 2018, replacing Ambuja Cements, Aurobindo Pharma and Bosch.

So the closest way to play an everlasting stock market idea (first argument) is to base the investment decisions on the Nifty (the second argument), as we can trust the index managers to keep on weeding out poor performers and adding the out performers. How do we go about this? Buying one share each of Nifty 50 stocks could set you back by around 1 lakh, so that may not be the cup of tea for all. A Nifty future contract can be bought at just a fraction of that amount, but its short expiry nature and MTM requirements may mean that not many will be interested. Nifty ETFs that are priced at 1/10th the rate of Nifty are better options; while Nifty based mutual funds bring in all the conveniences, plus the ability to be systematic.

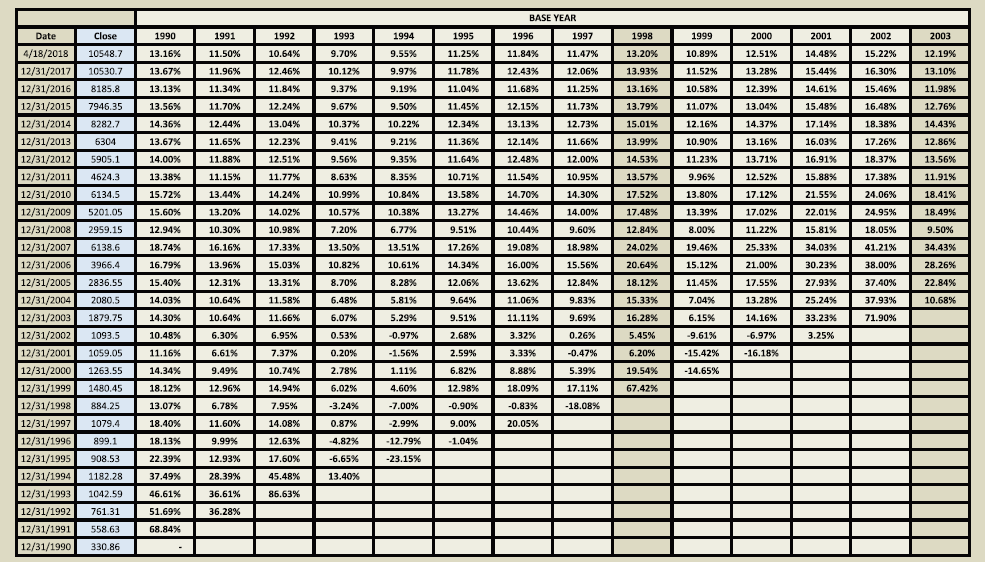

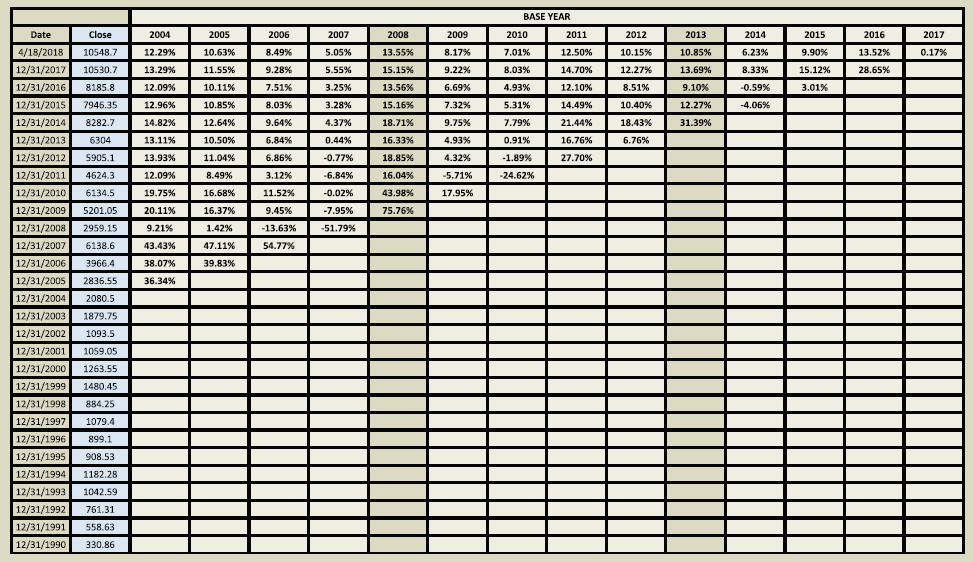

The table below shows the CAGR (returns, expressed in terms of Compounded Annual Growth Rate) since 1990s, giving you a sense of the returns over long periods. They are certainly not exciting, but they are decent and have remained steady over a reasonable period of time.

A quiet and efficient way to invest

Deciding between Nifty based investments and other approaches should never get to a matter of choice, especially through uncertain periods like these. As long as finances permit, the former is a must. It adds stability to your portfolio while helping you hone your investment skills as there is array of information publicly available for these stocks being popular. Ideally, it is the surplus left after such allocation that should go into clever investments, or into characters like the mid-small caps.

Dear Mr. Anand,

I went through your detailed write-up and I must say, I was fascinated with your in-depth knowledge of the market. However, the excel sheet with figures that you had pasted below was not readable, because of its fond size. If there is an option to look at in a zoom manner, please guide me as to how I could zoom the chart.

Thanks and regards,

CHRISTIE

(a new customer to Geojit) and my Geojit id is GQC112

Hi, Thank you for writing to us. we will share the graph to your email.