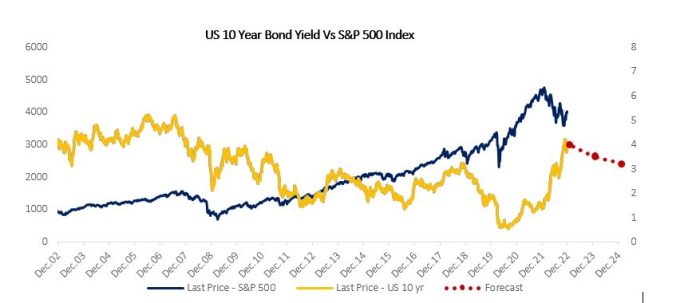

The chart above depicts the 20-year data of US 10-year bond yield and S&P500 index. It describes the relationship between the stock market & interest rate. For a long period, S&P500, the most diversified index in United States, had a strong & prolonged bull run, supported by the down cycling interest rate. A fall in interest rates lowers the yield on bonds while increasing it for equities. This is because corporate profits improve due to a drop in interest cost and an improvement in the future outlook, led by better capex opportunities. Household spending increases due to cheaper consumer financing. Similarly, higher government & private capex improves the economic outlook, leading to a re-rating in stock market valuation. Overall, it drops the attraction of the debt market and boosts the equity market, igniting inflow of funds.

To elaborate the relationship based on the above prescribed chart, the interest rate was in a high range of 3% to 5.4% during 2002 to 2007. During that period, the stock market moved positively in-line with the economic outlook & the stock’s valuation. We had the global economic crisis of 2008 when the interest rate peaked in July 2007. The crisis led to a sharp fall in the stock market & interest rates too; both moved in the same direction for a period of about 1.5 years. S&P collapsed by about 60% while Fed rapidly cut the interest rate to zero to support the economy. Post-crisis, the US 10year bond yield was volatile with a negative bias for a period of 4 to 5years, proceeding to a low of 1.5% in 2012. This corrective monetary policy led to a strong bull ran from 2009 to 2014.

By that time, the economy had stabilized, and rate of recovery slowed. Market bond yields had also slowly increased to a range of 2% to 3%. In 2014 – 2016, both the factors began to have an impact on stock market for about 1.5 years. But not much since the Fed continued to have an accommodative policy.

Post the consolidation, the economy started to perform well from 2017 onwards. Both the interest rate & stock market started to move positively in tandem till Sept 2018, when the yield increased to 3.2%. Again, when the market’s bond yield increased to the high band, the stock market got volatile, with a total correction of 20% for a period of 14 months till Dec 2018. In 2019, the stock market started to do well when the interest rate began to correct from Sept 2018 onward to a low of 1.5% in Sept 2019. The stock market was not affected until the impact of the pandemic in Feb 2020, with a total correction of 35% in a span of less than 2 months.

The pandemic caused a sharp correction in both interest rate & stock market. Again, the Fed cut the effective interest rate to zero percent. US 10yr bond yield collapsed to 0.5%, triggering the next rally. In 2022, the S&P 500 corrected by 27% when interest rates & inflation started to increase rapidly creating risk of a recession. The sticky nature of inflation is forecasted to stay put interest rate high above 3% in 2023 & 2024, which will have a short-to medium-term impact on the stock market.

Inference is that stock market dislikes high interest rate and benefits when low. On a long-term basis, interest rates and equity market have an inversely proportional relationship. The higher the interest rate, greater the negative effect on the equities, and vice versa. In between, short to medium-term rates of 1.5% to 3%, the negative correlation reduces and even turns positive, moving in tandem based on the trend of the economy, earnings growth, fund flow, and valuation. The S&P500 grew at a CAGR of 7.6% for 20 years, even after factoring in the 16% fall during the year.

First published in The Economic Times