Suzlon Energy is a vertically integrated wind turbine manufacturer and O&M service provider with over 20.9GW of installed capacity across the globe.

OUTLOOK & VALUATION

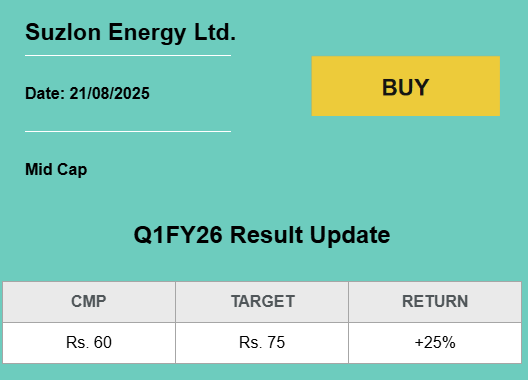

Suzlon began FY26 on a strong note, with higher capacity utilization driving improved margins in the wind turbine segment. Backed by a robust 5.7 GW order book, we project a 42% CAGR in revenue over FY25–27E, supported by management’s guidance and strong delivery momentum. Enhanced utilization is expected to unlock volume leverage, leading to a 117 bps margin expansion, primarily from the WTG and forging businesses. With earnings forecasted to grow at 43% CAGR and ROE rising to 27.1% by FY27E, the stock appears undervalued at 27x FY27 EPS. Suzlon’s ALMM compliance and backward integration offer a strong competitive moat, but sustaining margin discipline remains key to preserving pricing power. Factoring in execution risks, we revise our valuation multiple to 35x (from 38x earlier) FY27E EPS of ₹2.2 to arrive at a target price of ₹75, upgrading our rating to a BUY recommendation.