Divi’s Laboratories Ltd (Divi’s) manufactures and sells generic active pharmaceutical ingredients (APIs), intermediates and custom synthesis projects for innovators primarily in Europe and the US. Its manufacturing and research and development facilities are located in Andhra Pradesh and Telangana.

OUTLOOK & VALUATION

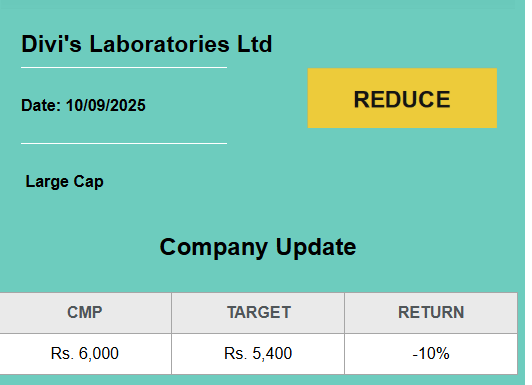

The company’s outlook remains positive due to growth drivers such as increased traction from global innovators, a healthy pipeline of RFPs, expansion of scientific and technological capabilities, and steady growth in the nutraceutical business. Management highlighted persistent pricing pressures in generics and higher cost escalation compared to custom synthesis, weighing on margins. Regulatory delays of 12-24 months for peptides, contrast media, and Kakinada approvals restricted near term revenue conversion. Divi’s also faces the risk of losing business related to sacubitril/valsartan (Entresto), adding to competitive pressures. The company is also trading at a premium valuation. Therefore, we downgrade our rating to Reduce on the stock with a target price of Rs. 5,400, based on 45x FY27E adj. EPS.

DOWNLOAD REPORT