By Anand James

By Anand James

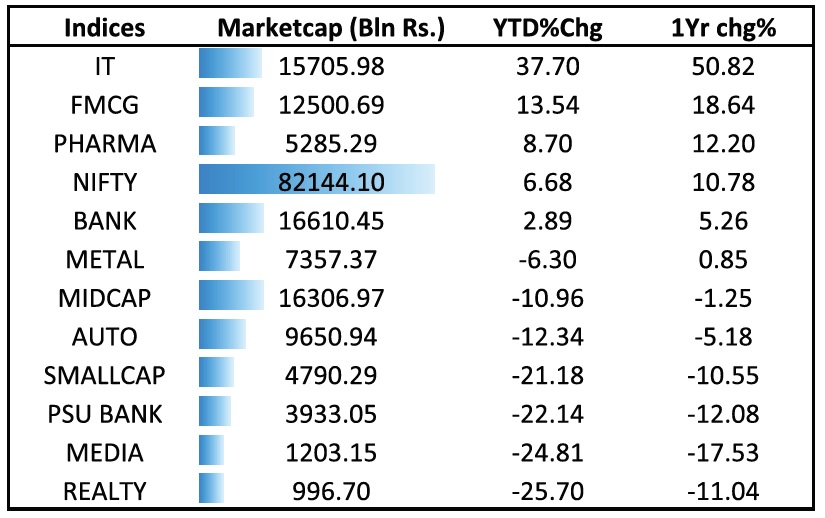

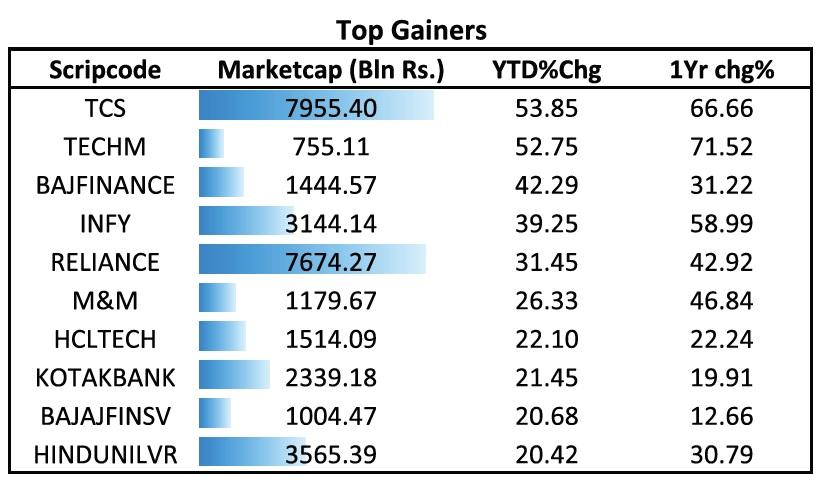

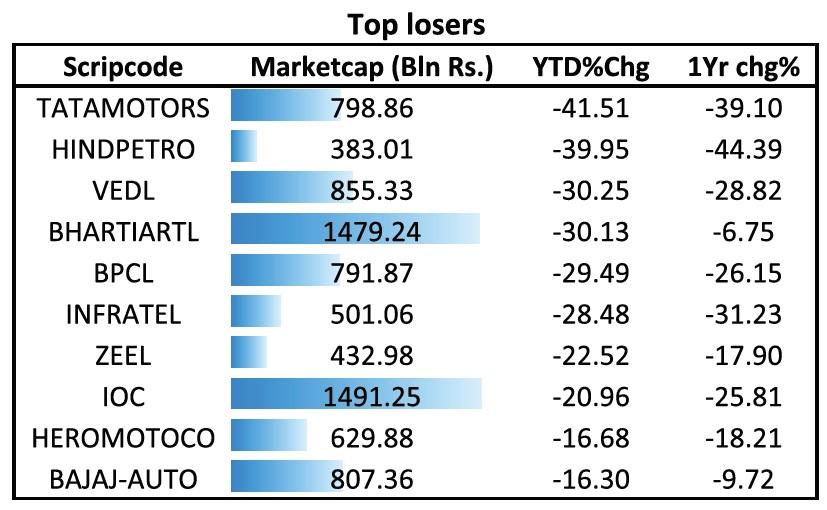

Elections are round the corner, and conspiracy theories are hot favourites among the topics during discussions over tea or beer. One on stock markets is that the government is lifting markets to record peaks, to retain power. In fact by August 2018, Nifty, the benchmark index had risen over 18 percent from the year’s low. Some other period, this argument could have found some traction, but common investor is not buying this argument this year, as, stocks in general have largely underperformed index. After all, for a majority of normal investors, index stocks constitute only a small portion of their stock portfolio.

Now, where does the folly lie? Well, stock selection could have been better, an advisor would say. And you would agree, and beat yourselves for it, or scout around for good stock advice. My bad… your bad… But, when your stocks or portfolio continues to lag Nifty month after month, you also begin to have a look at the benchmark against which you are comparing.

Is Nifty for real? Is it fixed? It is indeed fixed; in a way. The correct term would be “maintained’. Part of this maintenance process is by way of ensuring that the list of 50 companies have certain characteristics, a few among those are listed below:

- The security should have high liquidity. An average impact cost of 0.5% or less is considered as liquid enough.

- The security should have high market capitalisation. The average free float market capitalisation should be at least 1.5 times the average free float market capitalization of the smallest constituent in the index.

- Trading frequency should be 100% in the last six months.

These are among the several characteristics that are considered before inclusion or exclusion of stock to and from the index. These data are analysed every 6 months, which in turn means that, we are benchmarking our portfolio of stocks that changes every day, against an Index that could change its constituents potentially twice every year.

Now, try to identify, what is common among DLF, RPOWER, IDEA, SUZLON, UNITECH, & PNB. They were all the darling of traders at one point, and not only are they not favourites any more, they have lost significantly in value, with some of them in single digits. But, the most important common thread among these stocks is that all of them were in the Nifty index just 10 years earlier, but not anymore. In fact, just 56 percent of the stocks that formed the Nifty index in 2008 continue to remain today. And you thought you knew your index!? These are among the many reasons why some investors get disillusioned by the index and do away with comparisons altogether, or call for a better benchmark.

To draw a comparison, it is a bit like looking at a star a million light years away. A normal onlooker, would see the star as it is, at that time, just like any other thing on earth that he can lay his gaze on. But, in reality, since the light took so long to travel here, you are in fact, looking at the star as it were a million light years ago. But how important is this information to the onlooker unless he is specifically looking for the details of a star as it were a million light years afar?

So there is no argument that comparisons or benchmarking are never straightforward. It is often said that democracy is the weakest form of governance, unfortunately we do not have anything better. Now, while the search of an appropriate benchmarking system has been an age old quest, industry has seen several attempts to arrive at better models.

Introduction of TRI (Total Returns Index) has been one. This approach assumes, that dividends are reinvested in the index after, whereas in the normal index, which in fact a PRI (Price Returns Index), is not adjusted for dividend announcements. In other words, the Total Returns Index shows the returns on index, inclusive of dividends.

Yet another recent step that reduces the confusion around comparisons of mutual funds among themselves, or benchmarks etc., is SEBI’s October circular which i) categorised large, mid and small cap stocks, ii) classified funds in to five categories, namely Equity, Debt, hybrid, solution oriented and others, iii)introduced naming convention of schemes on the basis of risk level, and iv) categorised balanced funds into three types: conservative hybrid fund, balanced hybrid fund and aggressive hybrid fund.

While these measures are investor friendly, what do they mean for the markets? Aggregate dividend yield of Nifty is 1.26%, which means that when MF’s returns, which were benchmarked against PRI would show a hit in their performance figures on account of a move to TRI, which incorporates such dividends. Not to speak of the market movements that happen during the churn in search of a suitable alpha, while also considering the shifts owing to re-classifications. In other words, any move towards a better benchmark, comes with a cost, which has a tendency to neutralise the intended gains.

That brings us to the vital question. What is the role of a benchmark? Should it spur us to search for alpha? Or should it give us a perspective? NSE’s NIFTY 50, tracks the price moves of a portfolio of the most liquid Indian securities, capturing over 65 percent of the total market capitalisation, and that tells you where the current ownership is. On the other hand, the scope for development across sectors, when compared to developed countries, millennials driving consumption, along with a strong government at the centre, fuel the search for the potential alpha through investment in second tier companies. The extent and the longevity of the periods of underperformance or outperformance can help shape your view on the latter. It may be time to ditch your long term growth story, or it may be time to ditch your conservatism and go for the high alpha themes. Either way, it isn’t time to ditch the Nifty yet.

Good insights Anand! When its a matter of comparison (with benchmarks) , its duty of every investor to see the parameters considered to make up the result of comparison.Overall, its good to get a perspective rather than looking it as a definite performance measurement.