Moderate revenue growth & strong order book uptick

Cyient Ltd., is one of the leading players in the IT-enabled services space, providing services to the Engineering Research and Development segment.

Key Highlights

In Q3FY25, Cyient reported moderate revenue growth of 5.8% YoY to Rs. 1,926cr. Design-led manufacturing (DLM) segment revenue surged by 38.4% YoY. whereas DET (digital engineering technology) softened by 0.8% YoY, New growth areas offset the sustainability sector decline.

EBITDA margin declined by 340bps YoY to 14.5%, primarily on account of wage hikes. However, net profit de-growth of 17% YoY was due to significant negative movement in other income, especially from unrealized forex losses.

In DET, Transportation and Connectivity declined by 1.7% and 0.7% YoY, respectively, while the Sustainability sector decreased by 10.4% due to the completion of several large projects and slower scaling of new ones.

The new growth areas saw a 14.1% increase in YoY, with recent deal wins amounting to $11-12 Mn expected to support continued technology momentum.

Q3FY25 DET order intake $312.3 Mn with 100% QoQ growth and 5% YoY growth. The company secured 13 large deals worth $234.5 Mn, expected to position the Cyient for sustainable growth in the medium term.

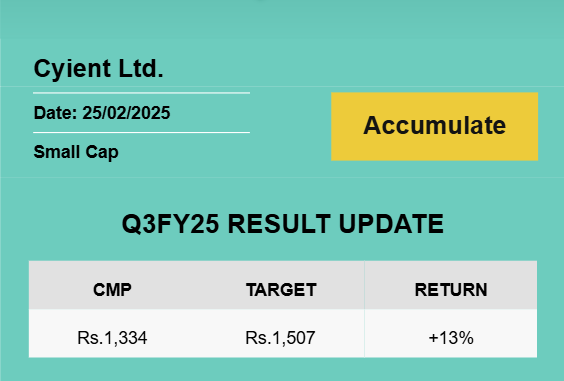

Outlook & Valuation

Cyient experienced moderate revenue growth, driven by the DLM segment. Despite a slight decline in DET, the order book showed a strong uptick with the highest ever intake. The management focuses on enhancing differentiating technology offerings, transitioning to value-based selling, and setting an objective framework for tracking the sales efficiency. The acquisition of Altek has diversified the company’s industry base, especially in the industrial and medical sectors where the current mix is minimal. Favourable US political developments promoting local manufacturing are expected to create significant opportunities for Altek. Therefore, we expect earnings to grow by a CAGR of 17% during FY25E-27E and maintain Accumulate rating with a revised target price of Rs. 1,507 based on SOTP valuation.