By Krishnaprasad N. B.

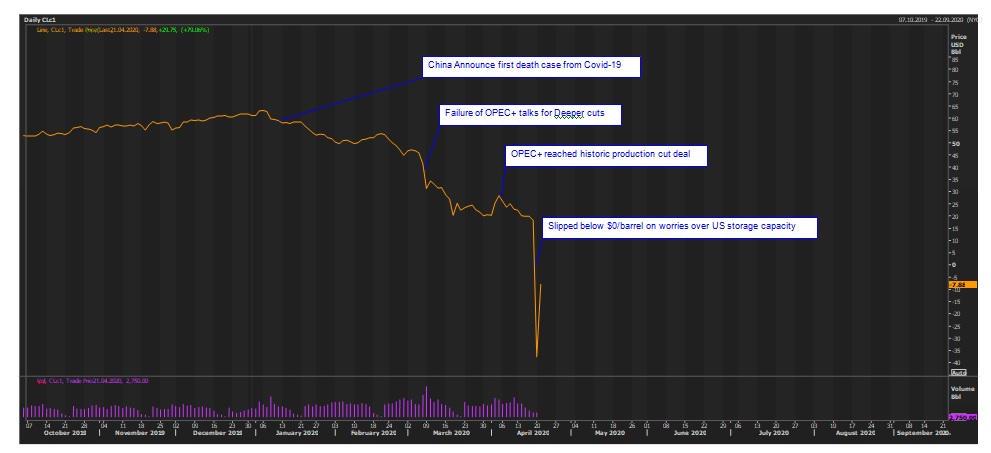

The year 2020 so far is turning out to be a highly turbulent one for the commodity markets with crude oil being one of the biggest causalities. Crude oil has been bound south since the beginning of this year and in April it witnessed a historic collapse in US crude oil prices as it went below $0 a barrel, while Brent crude oil on the Inter Continental Exchange (ICE) has dived to more than two decade low. Crash in global demand caused by the Covid-19 pandemic and a supply glut triggered by a price war between Saudi Arabia and Russia caused the tailspin in crude oil prices.

Crude oil began to lose steam from the second week of January on easing geopolitical tensions in Middle East after the assassination of Iranian military general and on fear of slowing oil demand growth. The increasing uncertainty due to the pandemic in China, the world’s largest crude importer and top consumer after the US, subsequently raised demand concerns. However, the signing of an initial trade deal between the US and China set the stage for a brief recovery in crude oil prices. But, it was short-lived and soon market witnessed a contraction in oil demand due to imposition of travel restrictions during the Lunar holidays and muted manufacturing activity on spiking virus cases in China. Extended radar of Covid-19 outside China to other countries led regional refiners to cut runs and even to “force majeure” for crude imports owing to steep fall in margins. Italy became the next hotspot of Covid-19 after China and this unprecedented development sent shockwaves across European countries and led to severe restrictions on social life including lockdowns all across Europe, which further hampered the price sentiments. Announcement of travel ban to US from European countries following WHO labeling the Covid-19 as pandemic also accelerated the price fall. The price war triggered after the collapse of production cut talks, between OPEC+ group led by de facto leaders Saudi Arabia and Russia in its March meeting, devastated the oil market even as there is demand destruction caused by the pandemic.

Fall out in the OPEC pact and the win back

Even when the Covid-19 pandemic was destroying global oil demand, the OPEC and its allies were struggling to reach an output cut pact before they made a historic deal in April. In December 2019, the OPEC group had decided to increase its production cuts from 1.2 mbpd (million barrels per day) to 1.7 mbpd, effective from January 2020 until March 2020. This move aimed to counteract the weak demand growth and a supply glut, but the pandemic failed the OPEC+ group efforts to balance the oil market.

To prevent the price fall, Saudi Arabia demanded OPEC+ group to deepen its production cut further by 1.5 mbpd, all through 2020. But, the reluctant partner Russia turned down this proposal as it did not want the US shale industry to benefit from high prices and the resultant altercation sent the three-year pact between OPEC and Russia into risk. Subsequent action from Saudi Arabia, of cutting official selling price and ramping up of production, provoked Russia to go with a similar action to garner as much market share and punish rival producers. Oil prices continued to tumble amid this wrestling between Saudi Arabia and Russia, which has spooked worries of a wave of bankruptcies and investment cuts in the US oil industry. As a result, the US president pressured the OPEC+ group by threatening sanctions and tariffs on their oil if they did not act on price collapse.

After marathon talks, OPEC+ agreed to cut production by 10 mbpd or 10% of global supplies and asked participation from other oil-producing nations to deal with the biggest oil crisis in decades. The 10 mbpd cut in May and June will be followed by a gradual reduction in cuts until April 2022. But, the reality is this action addresses only one-third of the worldwide demand fall. However, OPEC+ sources said they expected total global oil cuts to more than 20 million bpd. Total global cuts will include contributions from non-members, steeper voluntary cuts by some OPEC+ members, and strategic reserve purchases by the world’s largest consumers.

Developments in top oil-consuming nations: China and US

China is slowly lifting its draconian lockdown measures which they had adopted during their Covid-19 phase, which led to huge demand destruction for crude oil, caused mainly due to auto and industrial sectors. Economic activity in China started to recover by late March, albeit slowly. Unless there is a second wave of infections prompting another lockdown, chances are for progressive development in the oil demand. Even in low demand, China’s imports of oil in the first quarter of this year rose 5 percent from a year earlier to 127.19 million tonnes according to official customs data. Signs of improving economic sentiments along with boosting measures adopted by policymakers are likely to play out in the coming days over oil consumption.

In the meantime, US remained the biggest casualty of virus attack in the world. Rising fatalities and the rapid spread of the pandemic have led to the enforcement of social distancing guidelines until April 30, dampening oil demand. Spiraling oil inventories and fall in crude production with rigs going offline continued to jolt the US oil market. Whereas on the other hand, soaring unemployment and dismal economic situation in the country are signs of an imminent recession unless there is significant ease in the economic tension caused by the pandemic. In the latest development, Washington set out guidelines for reopening of the economy in different phases which may help the country to move out of shadows and get back to the recovery path.

Looking forward, the glut in the market amid weak demand conditions is expected to be the major catalyst influencing crude oil prices in the rest of the year. In a recent report, OPEC indicated that the global oil demand is expected to drop by 6.8 mbpd in 2020 and also said that demand would be 20 mbpd in April 2020 amidst travel bans and lockdowns aimed at preventing the spread of the Covid-19. Global crude oil demands in Q2 are set to be at around 86 mbpd, down by 12 mbpd on YoY basis. Meanwhile, the International Energy Agency (IEA) expects an oil demand dive of 29 mbpd in April, to levels which were not seen during the last 25 years and has projected a demand fall of 9.3 mbpd in 2020 against 2019. Although the OPEC+ alliance returned to production cuts, subdued refinery runs and lowering crude oil imports would glut the market even during the supply cuts. In the meantime, the leading economies are rolling out a slew of fiscal and monetary measures in an attempt to limit the economic impact emerging from the pandemic. Like during the 2008 global financial crisis, China was one of the first to come out with measures that included lowering benchmark lending rates, bank loan rates, additional subsidies, and tax breaks. There was a swift action from the US Federal Reserve as well, by revising down the interest rate to near zero in an emergency move which was followed by a $2 trillion booster package from the US government to the ailing economy. European Central Banks’ 750 billion Euro bond purchase program and Japan’s $1 trillion virus aid package are some of the other commendable actions to soften the economic blow. However, these attempts seem to have failed to pacify the crude oil market as of now. Fears of global recession and the lingering pandemic cases and subsequent demand concerns will restrict a strong recovery in prices.