By Manu Jacob

The outbreak of Covid-19 from China that quickly spread to other countries have stoked and created fear in markets worldwide. The inability to contain the pandemic at the initial stage caused the virus to spread outside China and now has become a global concern. Many business activities were adversely hit by the pandemic and uncertainty lingers in the global markets. There is a blood bath in the global equity markets as investors fret over the possibility of further slowdown in global economy which is already frail due to the trade war between US and China.

Risk off sentiments swayed worldwide, with investors shifting their investments to safe havens abandoning risky assets. The situation worsened as the World Health Organization (WHO) officially declared Covid-19 as a pandemic. By mid- March, the US Dow Jones Industrial Average index tested the levels of February 2017.The key European indices also followed the same trajectory.

The central

banks adopted aggressive stimulus measures to support global economy from the

impact by the pandemic. US Federal

Reserve cut the lending rate twice in March by 50 basis points and 100 basis

points to 0.00-%.25 percent. The Bank of England also slashed interest

rates to a record low and brought forward other emergency measures to limit

the economic fallout while, the European Central Bank rolled out

another stimulus package but kept the rates unchanged. The emergency policy easing

was later adopted by central banks in New Zealand, Japan, South Korea, and

Australia as a coordinated move aimed at stabilizing economic confidence as the

pandemic threatened a global recession.

The 10-year treasury yields in US hit an all time low as investors drove into safe haven assets after a sequel of rate cuts. For most commodities, however, the present turmoil played as the gravitating factor that kept prices linear on the downward trajectory.

Precious metals

Gold prices were buoyant since second quarter of 2019, as the worsening trade relation between US and China gripped global markets. Increased ETF inflows and safe haven rush contributed to the rally in precious yellow metal in 2019. The appetite was initially revived after the outbreak of corona epidemic, lifting gold prices to seven year highs. According to the data from World Gold Council, global gold backed ETFs and similar products added 84.5 metric tonnes, or net inflows of $4.9billion, across all regions in February 2020, boosting holdings to new all time highs of 3,033 metric tonnes.

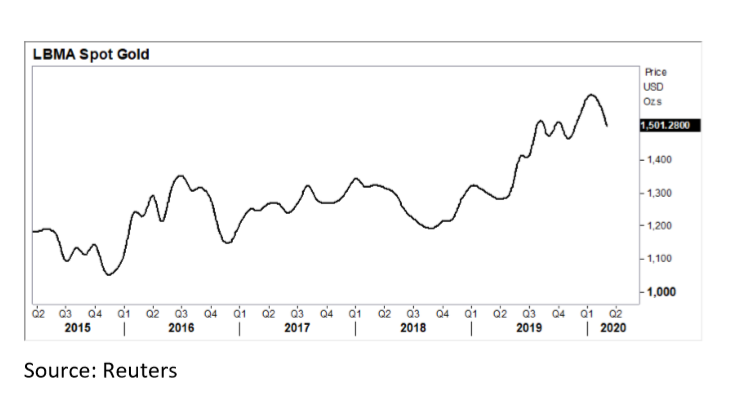

So far in 2020, gold prices in London spot platform, the international benchmark price for gold, rallied more than 12 percent hitting the seven year high of $1702.56 per troy ounce. Prices later declined below $1500 per troy ounce by mid-March driven by the long liquidation and rising appetite for debt instruments in the wake of cut down in interest rates by central banks. In India, the gold prices rallied to all time highs owing to weakness in rupee before testing the December levels.

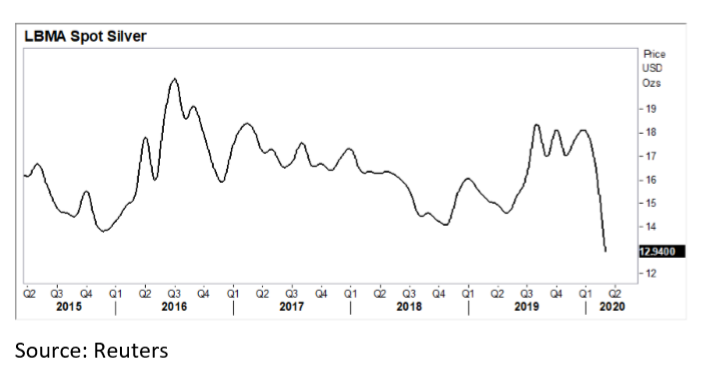

Strong silver backed ETF buying and improved appetite for cheaper safe asset kept silver on the gaining track until the third week of February. London spot silver that tested some monthly highs in February, dipped to more than 10-year lows by mid-March. The selling was augmented by broad liquidation of longs and worsening industrial demand for the white metal. The spot prices gained by around 6 percent in 2020 to $18.937 per troy ounce before the shedding more than 31 percent to below $12 per troy ounce.

Energy

The year 2019 ended with hopes of phase one trade deal between US and China which gave crude oil market a respite from the long trade war between the top two economies. Well supplied market conditions limited major surge in crude oil prices in early 2020. However, the crude oil prices floated around the ideal price range until the pandemic hit the market. The quick spread of Covid-19 doomed the demand prospects of crude oil.

The proposal put forth by Organization of the Petroleum Exporting Countries (OPEC) to cut the oil production by 600,000 barrels per day to mitigate Covid-19 affected demand offered ground for an increase in prices from the initial dips. In the meeting held on 5th and 6th March, 2020, OPEC nations came to an agreement for additional cuts by 1.5 million barrels per day only to find their counterpart Russia disagreeing with the cartel’s proposal. Consequently, more than three year old pact between OPEC and Russia fell apart over the disagreement over deeper cuts to support the oil demand and OPEC responded by removing all limits on its own production. The situation culminated with the OPEC leader Saudi Arabia declaring price war with its one time ally Russia by setting lower prices for its crude oil supplies. As both nations started outdoing each other by pumping oil into already flooded market, crude oil prices plummeted to yearly lows. As the days passed, Saudi, Russia and United Arab Emirates announced production hikes causing an immediate

recovery to become unfeasible.

The WTI Light Sweet crude oil traded in NYMEX platform plunged

as low as $27.34 per barrel, shedding more than 55 percent in first quarter of 2020. The Brent crude, the global benchmark, fell

as low as $33.01 per barrel shedding more than 53 percent during the same

period. Looking forth, a glutted market amid dampened demand conditions would

keep prices in the lower turf.

Base Metals

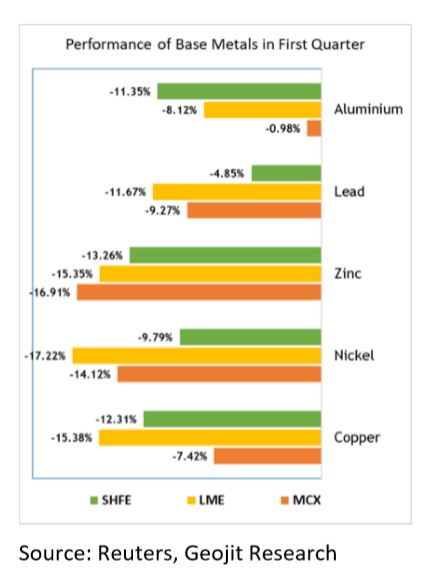

Base metals’ response to Covid-19 outbreak varied in different markets. The fall was bigger in Shanghai and London markets since Covid-19 as it spurred demand fears. Additionally, swamp in inventories in China’s warehouses amid weak demand also put downward pressure on SHFE metals. Industrial activities in China were subdued and many shipments were delayed as importers and manufacturers postponed their business transactions. China’s passenger vehicle sales slumped nearly 80 percent year-over-year in February.

The metals were being bolstered on the hopes of phase one trade deal between US and China. A broad bearish trend grappled the base metals after the pandemic hit the market. The emergency stimulus actions by central banks underscored the extent of global economic slowdown and accelerated the fall in the complex.

Although nickel was the worst performer in the first quarter in London Metal Exchange, the prices managed to float above mid-2019 levels. In LME, copper and aluminium fell to the lowest level since November 2016, while zinc and lead tested the levels of June 2016.

Henceforth in 2020, the present economic slowdown and subsequent fall in demand would restrict revival in most commodities. Bullion will be checked by the rush to debt instruments owing to massive rate cuts by central banks. Immobilisation in industrial sector in China, the top metal consumer, would overshadow the monetary stimulus by central banks and pressure base metals. Meanwhile, the increase in output levels and price war between top producers would add pressure to crude oil.