Indeed, it’s no fun to pay taxes. But fortunately, you have a wide range of tax-saving investment options, each providing its own unique set of advantages. Read here to know some of the top tax-saving instruments to let you keep the money you earn.

If you’re in the market looking for a new smartphone, what’s the first thing that catches your eye? Are you looking for a plain-vanilla phone with long battery life, or would you rather be interested in the newest offering with a warp speed processor, multiple windows, great cameras and the latest features? So, if you take the time and effort to browse through smartphones and choose the one that meets all your requirements, why not do the same regarding tax-saving investments.

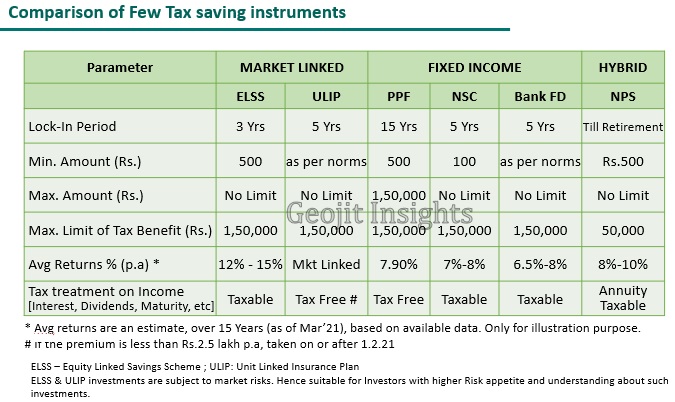

So, let’s look at some of the features of top tax-saving investment plans which you can get tad deduction up to invest up to Rs 1.5 lakh that qualify for tax deduction under Section 80C of the Income Tax Act, 1961., where you can invest up to

· National Pension Scheme [NPS]

The NPS is a voluntary-defined contribution pension scheme similar to the Public Provident Fund and the Employee Provident Fund. NPS gives you an additional Rs 50,000 tax deduction under section 80CCD which is over and above the 80C limit. That means it enjoys almost EEE (Exempt-Exempt-Exempt) status, wherein 60% withdrawal is tax free and 40% is to buy Annuity and that is taxable, subject to slabs and rates. Besides, you pay no tax at the time of withdrawing your pension as the whole amount. But it has a lengthy lock-in period until the investor’s retirement.

· Bank Fixed Deposit [FD]

A tax saving bank fixed deposit is similar to any other fixed deposit. You put in a specific sum of money in this deposit to get a guaranteed fixed return every year. However, a tax-saving bank fixed deposit comes in with a lock-in period of 5 years that does not permit withdrawals until maturity.

· National Savings Certificate [NSC]

The NSC is a Government of India initiative and a fixed income investment scheme. Regarded as a low-risk investment and regarded as secure as the Provident Fund, you can invest in the NSC based on your income profile and investment horizon. Consider the lock-in period of 5 years when investing in NSC. Moreover, you pay tax on the interest amount, calculated at maturity.

· Public Provident Fund [PPF]

The PPF is a long-term saving scheme initiated by the Central Government and regarded as India’s most popular tax-efficient investment plan for salaried individuals. Every year, contributions made towards your PPF account are eligible for a tax deduction. It falls in the EEE or ‘Exempt, Exempt, Exempt’ status. As a result, you get tax-free returns, nil wealth tax and no tax on interest earned from PPF deposits. However, it has a 15-year lock-in period.

· Unit Linked Insurance Plan [ULIP]

A ULIP is an insurance cover as well as an investment scheme combined into a single investment program. This tax-saving investment option gives you the advantage of investing in stocks, mutual funds or bonds but comes with a minimum of 5 years lock-in period. When you put money in a ULIP, the insurance company invests a portion of the premium in equity investments, debt and other securities and the balance amount to provide you with insurance coverage. The premium you pay towards your ULIP is eligible for a tax deduction under Section 80C. Besides, the policy and maturity returns are exempt from Income Tax under Section 10(10D) (if annual premium is less than Rs.2.5 lakh for policies taken on or after 1.2.21), providing you with twin tax benefits.

· Equity-Linked Savings Scheme (ELSS)

ELSS plan is an equity mutual fund scheme that invests at least 80% of its corpus in equity and equity-related instruments. With the shortest lock-in period of all tax-saving investments, ELSS comes with three years. In addition, investing in ELSS funds qualifies you for a tax deduction, regardless of a lump sum or SIP investment.

To sum up the above, below is the comparison of all the tax-saving instruments covered so far.

How ELSS stands out

ELSS funds aim to create long-term wealth by participating in equities and deliver active returns over the benchmark.Therefore, by considering ELSS in your portfolio, you get the opportunity of creating wealth over the long term because of the exposure to equities as an asset class.

Let’s look at additional reasons to choose an ELSS fund over tax-saving instruments.

· Shortest lock-in period

Of all the tax-saving instruments, your investment in ELSS funds is locked in for only three years.

· Unlocks long-term value

Since ELSS funds invest in equity and equity-related instruments, to allow continuous growth of your fund and build wealth, you may want to stay invested for the long term.

· Professional fund management

ELSS funds are actively managed by a professional management team that aims to meet the fund’s objective of growing investor wealth by investing in quality stocks that can reap high returns.

Conclusion

When choosing suitable tax-saving investments, look into various factors, including your present financial situation and retirement goals. If you have a medium to long-term investment tenure, investing in ELSS funds can give you the dual benefits of tax savings and capital appreciation.

Having a financial expert with experience in tax-saving investments can help you select an effective investment strategy to grow your wealth and achieve your goals. Reach out to Geojit today to learn which tax-saving investments are best for you.