Indian Mutual Fund industry has been witnessing higher growth in investor participation in the recent years. The rise of equity cult could be gauged from the fact that equity / debt AUM ratio now stands at 0.92, a new high, which was 0.35 in March’14. This impressive growth in equity assets is driven by the likes of common savers, as 88% of equity + balanced funds AUM is owned by individual investors as of March’19. This probably could be the result of a tectonic shift in the way Indian investors are allocating their savings into various alternatives. Thanks to the initiatives of regulators, AMCs and advisors, investors are increasingly gaining awareness about mutual funds. While this is a good trend to look upon, the concern is on the way investors select the schemes for investment, evaluate and hold onto them.

Indian Mutual Fund industry has been witnessing higher growth in investor participation in the recent years. The rise of equity cult could be gauged from the fact that equity / debt AUM ratio now stands at 0.92, a new high, which was 0.35 in March’14. This impressive growth in equity assets is driven by the likes of common savers, as 88% of equity + balanced funds AUM is owned by individual investors as of March’19. This probably could be the result of a tectonic shift in the way Indian investors are allocating their savings into various alternatives. Thanks to the initiatives of regulators, AMCs and advisors, investors are increasingly gaining awareness about mutual funds. While this is a good trend to look upon, the concern is on the way investors select the schemes for investment, evaluate and hold onto them.

As investors, we would always want to invest in the scheme which is in the Top 10 / Top Ranked / Top Rated. In a sense this is a very realistic desire. There are over 400 equity and aggressive hybrid schemes. Which are those 10 schemes that would scale to the Top rank over a period of three, five or ten years is a demanding guess work. Equity investments are ideally recommended for long term and goal planning. Most often investors in general and newcomers in particular are attracted by the short term performance rank of the schemes, especially six months or one. This is what is even highlighted in most of the information sources too, with famous tags like Top 10 schemes. We frequently get queries on them as well.

There are multiple factors at play as to why a scheme or a category outperforms the universe (or under performs) in a particular period or a cycle. Some years there is a broad rally, sometimes it is sector specific, at times a particular theme outperforms. Take the most recent instance. Broad markets were range bound in 2016, when predominantly international funds and some energy portfolios were in Top 10 by one year returns.

Markets showed a blistering performance in CY2017 with blue chip and large cap indices climbing around 28% to 32% during the year, while the mid cap index went up 48% and small cap index was up 60%. Mutual fund schemes delivered on similar lines, as per the category they track. But 2018 has been a mixed year with a narrow rally, with the large cap heavy indices rising 6%, but midcap and small cap dropped by -13% and -23.5% respectively. Portfolio of schemes heavy with technology and IT stocks and most of the ETFs / Index funds mirroring large benchmarks, scorched into the Top 10. Mutual fund schemes tracking mid cap and small cap portfolios tumbled. Data shows that schemes that figured in the Top 10 rank in a calendar year by one year returns, had a big variance in ranks in the subsequent year. The average rank of schemes that were in the Top 10 in CY2016 and CY2017 were 247 and 282 respectively in the subsequent years. CY2016 Top-10 schemes’ average return in the next year CY2017 was 18.53%, against 64.54% of CY2017 Top-10. CY2017 Top10’s average return in CY2018 was -16.17%, against +13.5% of CY2018 Top-10.

Top 10 ranking list of short term performance keeps changing every year. Selecting schemes purely based on the short term performance and churning to stay invested only with the Top ranked schemes carries a higher risk and have proven to be a less rewarding exercise than thought otherwise. It need not augur for higher returns.

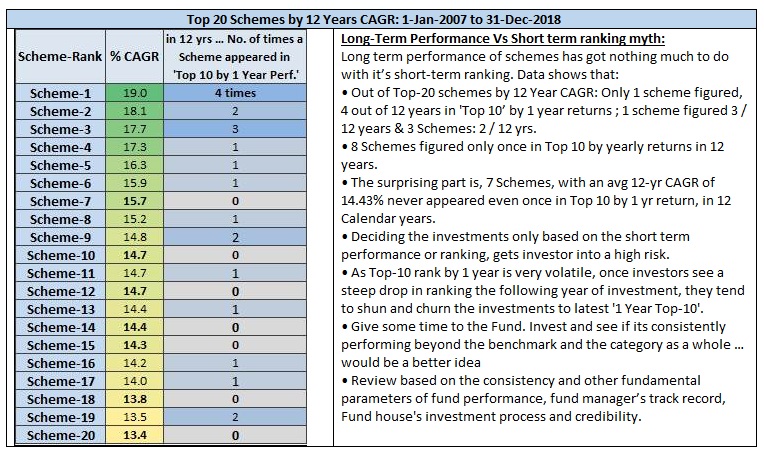

Let us understand this scenario with an example (Universe: all equity schemes).

An investor choose to invest in mutual funds based on the Top 10 schemes of calendar year 2006 in January 2007. Here the urge is to always remain invested in the Top-10 best performing schemes and typically they get carried away by the recent past – the trending ones. The investor keeps churning the lot every year with a new set of Top-10 funds of each completed year. Hence the investment made in January 2007 gets replaced with the Top-10 of CY2007 in January 2008 and so on. This is called “Chasing the Returns”. The hard fact is that this exercise has yielded below average return. On an average (of the 10 schemes) Rs.100 invested in January 2007 would have grown to Rs.159 in December 2018, over 12 years, a CAGR of 3.9%, less than a savings account interest rate. For two schemes out of 10 that was invested in, the returns were negative. On the other hand Nifty-50 Index (TRI) would have grown to Rs.316 or 10%, if invested in January 2007 and held till December 2018, without any churn.

Probably the results could be different for a different period. Returns fell especially in those years when there was an overall correction in the market across the sectors, like in 2008, 2011, 2018. Time and again we have been suggesting investors not to select a schemes based on the short term performance alone or evaluate the investments in short term. Investing for long term works, with periodic review of performance over time.

Few factors to consider:

Importance of research and advisory: Mutual Fund industry today has a wider choice for investments. Advisors play a very crucial role in understanding the investors’ needs, risk profile and suggest suitable schemes to help reach their goals. Investors should open up about their objective and the monthly cash flows as much as possible so that advisors can assess them and come up with suitable portfolio. Advisors are also able to help with their research based inputs, which eases the decision making process for investors and helps them to focus on other aspects of the investing journey. Investors can continue with their advisors if they are satisfied with the experience.

Long term track record and consistency: Carefully observe the track record of the schemes and its consistency of performance over the longer term and across different market cycles and phases. If the scheme is relatively new, consider it for investment if it has something unique and different to offer. For new schemes, the fund manager’s or the fund house’s track record could be a better gauge.

Clarity of goals, time horizon and risk appetite: Invest not because a scheme is available. Invest for your goals. Estimate the required sum by adequately considering the inputs required to calculate and by what time it is needed. Choose equity-oriented schemes only for goals that are five to seven plus years away. Allocate between equity sub-categories based on your risk appetite. For eg: A Mid / Small cap / Sectoral / Thematic fund may outperform the broader portfolios or large cap schemes in certain years, but they are also prone to volatility in the short term.

Quartile performance and comparisons: The first and foremost expectation from the investor of an actively managed scheme is to outperform the benchmark. Next should be the category average. Comparing the performance of a small cap scheme with large cap scheme or a sectoral fund would be incorrect. Try and see if your scheme is above the benchmark, the category average and if it is in the top quartile, in simple words say the first 25% of the universe. If it so, then as an investor, your investment is doing well. If the scheme is constantly failing to match up with the above thresholds even over a three to five plus year horizon, then we believe you have reasons to review and change the scheme.

Performance Ratios: Ratios like Standard Deviation and Sharpe can help investors to know how much a scheme can deviate from its mean and the risk-adjusted performance of a scheme. How much risk is assumed by the fund manager to potentially generate returns.

SIPs are a good choice: Investing systematically helps in equities. Regular investing is a technique in itself as it adjusts the quantum of units to the price by participating across market ups and downs. It also helps to get rid of timing the market. Important point an SIP investor should remember is to continue the SIPs when market comes down.