By Vinod Nair

By Vinod Nair

We had indicated in last month’s article “Investors will have to perform within this volatility…” that we can experience a bounce in the market led by reduction in domestic and global interest yields, ease in redemption and bargain in trade war. We advise retail investors to use this rebound as an opportunity to churn their portfolio by including more defensive and upcoming sectors like consumer durables, agro, export oriented companies, FMCG, IT and healthcare. Haven assets like debt and liquid funds, gold and cash can also garner a portion of your portfolio depending on your risk appetite. We have a moderate expectation on equity market as indicated in January-2018, due to increase in global risk and high valuation. Post that we had a correction of about 10%, which has reduced the risk to some extent but this uptrend can be tested at high level, as volatility strikes again.

A dismal end to the last fiscal

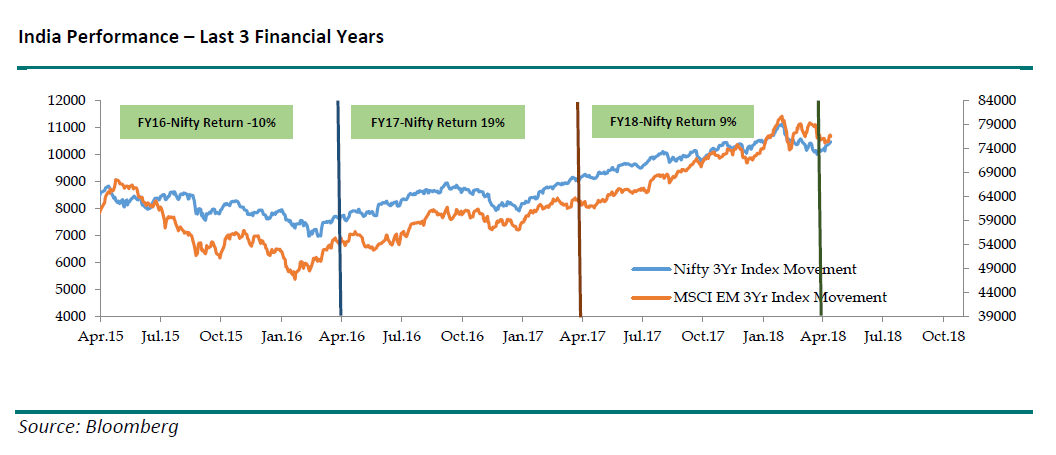

The last two months of FY18 were a challenging period for the equity market. Sceptic view on 2018 Union Budget’s agenda, introduction of LTCG (Long Term Capital Gains) tax, hike in global and domestic bond yield and slower earnings growth impacted the performance of India during this period. Consequently, India has been under performing other emerging markets during this period. Large, mid and small cap indices fell by 8%, 8% and 9% respectively, in the last two months of the fiscal.

A promising beginning for fiscal 2019

The start to the fiscal of 2019 was promising as redemption and profit booking eased and bond yield in India declined substantially. Trading till 15th of April has been good with signs of sustaining the trend. Nifty is up by 5%, mid cap by 7% and small cap by 8% from the last low. One technical factor which has helped is a bounce from the oversold region. As far as the full year performance of 2019 is concerned, volatility is expected to stay, given the high valuation, fall in credit growth, pre-election volatility and concerns of trade war.

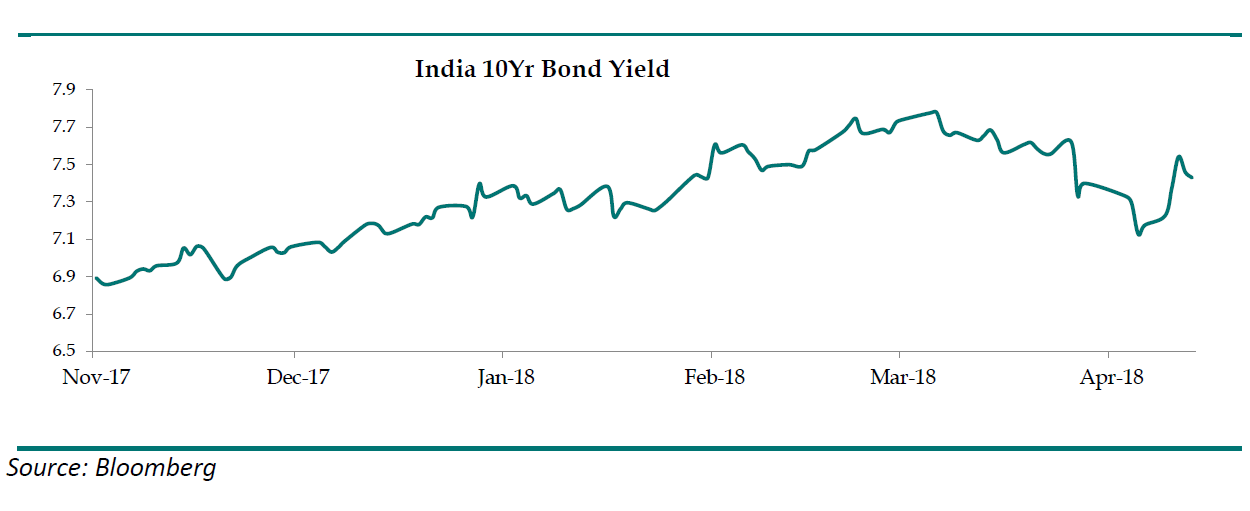

A fundamental factor which has helped this bounce is normality in bond yield and inflation against rise in interest rate which the market was anticipating in 2018. G-Sec 10 year yield has declined sharply by 40bps to 7.4%. This is due to the reduction in central government’s borrowing plan, improvement in financial liquidity due to RBI’s open action and allowance by RBI to spread debt holding losses of banks. Additionally, in the April 5th policy meet, RBI has increased the GDP outlook of India while reducing inflation forecast. Domestic sentiment turned cheerful, since a downward revision in inflation was a surprise to the market, indicating that the central bank will hold the rate against the expectation of rising rate scenario. However, rising crude prices, vibrant bond yield, trade war, high NPAs and spending by government may retain interest rate on the higher side. Clarity on monsoon will be a key factor in the near-term.

Bargain in trade war

Global market was in a cautious mood during the end of March awaiting the outcome of FOMC meeting, which was in-line with expectations. As a result, global market was expected to experience a relief rally. But a new contagion triggered when fears of trade war impacted the market. US started the war with a tariff of 25% on steel and 10% on aluminium import, to which China retaliated with a tariff of 25% on 128 US products including pork and wine. Later US imposed tariffs on Chinese products worth $60bn, which will affect hundreds of China-made products such as semiconductors, cars, aircraft parts and machine tools. The US argued that these tariffs were in response to unfair Chinese practices around intellectual property theft. Accordingly, China announced tariffs of up to 25% on 106 US imports, amounting to $50bn. Beijing said the move was to safeguard China’s interests and to balance the losses caused by the new US tariffs. The items include soybeans, automobiles and chemical products originated in the United States. The current global concern is whether we will have an extension of this trade war.

The initial set of retaliation measures affect only a small percentage of the total trade between both the countries. However, these tariffs will lead to imbalances in trade, rules and regulations leading to inefficiency and loss in world trade. The US aims to reduce trade deficit to the extent of $100bn with China through these tariffs. Therefore, there is a possibility that this trade war can continue unless US and China discuss and negotiate. In the near-term, these tariffs will increase global risk, costs to consumers and manufacturers of both countries and the world. However, the knee jerk reactions in the global markets subsided as investors hoped that these actions are unlikely to aggravate into a big trade war. This expectation strengthened when the Chinese President promised on Tuesday to cut auto tariffs and improve the intellectual property protection and to defuse the dispute with Washington over trade and technology.

Timing of entry and exit, and churning the portfolio in favour of defensive, low beta stocks with strong balance sheet will be the key catalysts to outperform during the year. Including defensive stocks like IT and pharma, and companies focused on domestic economy with strong presence in rural segment would be a good decision. Some sectors which can be considered are domestic oriented sectors like FMCG and agro, infrastructure companies and export companies with stable businesses and balance sheet. Largely the valuation of mid and small caps continue to be on the premium and therefore they are unlikely to perform as well as they did in FY18. Stock specific approach would be the key to make returns in this market.