by Mahesh Vyas

Data released by the Reserve Bank of India shows that bank credit growth has been modest in recent years, growing at around 8-10 per cent per annum. So, has industry been starved of debt financing or has industry managed to offset the fall in growth of bank credit with alternate sources of debt financing?

It is generally believed that India should move to a situation where companies raise funds through issuance of debt securities rather than raise debt in bilateral arrangement from commercial banks. This could lead to a healthy debt market where such debt instruments are valued regularly providing valuable information that could be used for pricing new issuance of similar securities.

How are companies faring on this front given that growth in borrowing from banks has been tepid?

We seek answer to this question in the financial statements of companies. Prowess database yields a sample of 17,449 non-finance companies whose financial statements are available for 2016-17 and 2015-16. As of March 2017, these companies had an outstanding borrowing of Rs.52.7 trillion. Of this, borrowing from banks was Rs.22.3 trillion. This accounts for well over half the total lending by commercial banks to non-finance companies. The sample was larger at around 20,000 companies a year between 2008-09 and 2015-16. These companies accounted for about 63 per cent of the total bank lending to corporates.

The Prowess data set therefore forms a useful sample to provide an answer to our question.

Aggregates from financial statements show a trend in borrowing that reflects the trend seen in the RBI data on commercial bank lending to corporates. Both series see a secular decline in year-on-year growth rates of corporate borrowing from banks since 2008-09. However, this fall seems to suggest a declining importance of bank borrowing in the overall borrowing profile of corporates.

The share of bank borrowing in the total borrowing of corporates peaked at 50.5 per cent in 2008-09. Since then it has fallen steadily to 42.3 per cent in 2016-17.

Corporates have shifted to debentures and bonds to some extent as a source of financing. The share of such securities in the total borrowing of corporates was around 9 per cent in 2008-09. This increased to 10 per cent in 2013-14, further to 11.2 per cent in 2014-15 and 12.5 per cent in 2016-17.

Reliance on debentures and bonds is now greater than the dependence on foreign currency borrowing whose share has declined from 13 per cent in 2008-09 to 11 per cent. Inter-corporate loans is another significant source of finance for the corporate sector. It has accounted for a steady 8-9 per cent of total borrowing by companies.

It is useful to club the various sources of debt financing by companies into three groups – banks, markets and others. Banks include direct borrowing from banks, borrowing from financial institutions (these are essentially the old development finance institutions like IDBI, IFCI, etc), syndicated loans from banks and financial institutions and also interest accrued and due since this is mostly on account of bank borrowing.

Market borrowings include debentures, bonds, foreign currency loans, inter-corporate loans, fixed deposits and commercial papers. Other sources of finance include borrowing from government, from promoters, directors and shareholders, deferred credit and other borrowing.

Borrowing from banks in India is mostly a long-term institutional arrangement of considerable partnership. Market borrowing on the other hand is transactional between investors and companies, often driven by market forces and intermediaries and is largely a source for short-term funds.

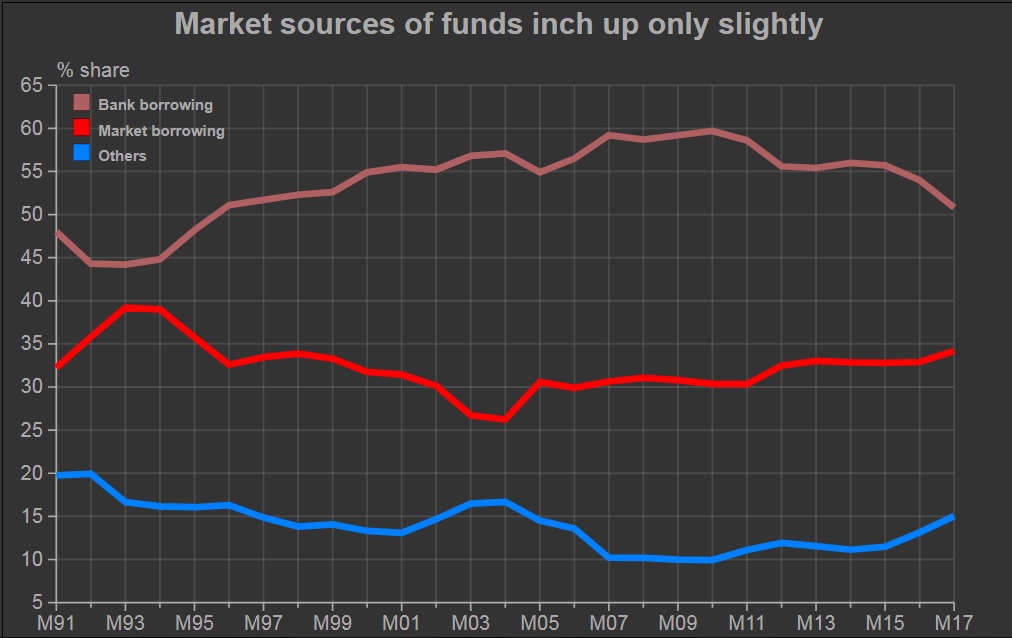

We see the contribution of banks as a group rise from 44 per cent in 1991-92 to a peak of 59.2 per cent in 2008-09 and then decline to 50.8 per cent by 2016-17. This fall of 9 percentage points since 2008-09 in its share was covered nearly half and half by markets and others. The share of markets rose from 30.3 per cent to 34.2 per cent and that of others grew from 9.9 per cent to 12.9 per cent.

The shift in favour of markets was decisive post 2010-11. Its share jumped up from an almost steady 30 per cent to an equally steady 33 per cent share.

The share of “others” was stable, around 10 per cent till 2014-15. However, this increased a bit in 2015-16 and then again in 2016-17. The increase is largely because of an increase in corporate borrowing from central and state governments and to a smaller extent because of an increase in deferred credit.

Only public sector enterprises borrow from the government. In recent years, government lending to Food Corporation of India, Delhi Metro Rail Corpn and discoms received large loans from the government. Private telecom companies were given deferred credit facilities. These led to an unusually sharp increase in the “other” sources of borrowing of the corporate sector.

It is apparent from the above that while the corporate sector has moved towards market sources for debt financing, the move is not large yet. Banks continue to remain the main source of debt funding by a large margin compared to any other source.