Demand and margin pressure to continue…

Asian Paints Ltd. (APNT), is engaged in the business of manufacturing, selling and distribution of paints and related products for home décor. APNT is the market leader in the Indian paint manufacturing industry.

Key Highlights

• Volume growth remains muted at 1.8% in Q4FY25, due to weak demand and increased competition intensity. The company expects single digit value growth in FY26 owing no major sign of demand recovery.

• APNT reported below estimated result, revenue/PAT declined by 4.3%/ 45%, respectively, in Q4FY25. Postponement of repainting demand and sustained slowdown in urban/ Tier -1,2 cities resulted in the weak performance.

• Gross margin improved by 23bps YoY to 43.9% due to benign input prices and backward integration. While EBITDA margin contracted by 219bps YoY to 17.2% due to higher employee costs and an increase in marketing expenses.

• APNT has taken a price cut of ~0.4% in Q4FY25 and retained its margin guidance at 18 to 20% in expectation of deflation in input price and better product mix.

• We expect the demand environment is likely to remain weak in coming quarters while increasing competition intensity in the sector will impact the outlook. We further reduce FY26/FY27 earnings by 7/8%, respectively.

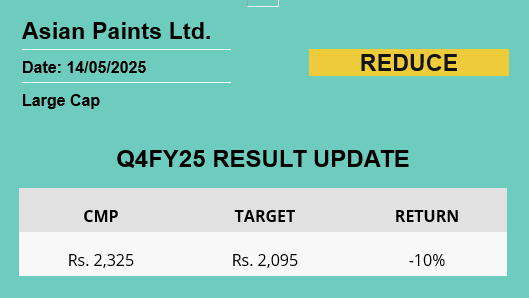

OUTLOOK & VALUATION

The rural demand is expected to do better on account of normal monsoon forecasts and measures from the government to support discretionary spending. However, we expect APNT to continue to face margin pressure as the near-term outlook is tepid with no major reversal in demand trend expected. Due to continued weakness in demand and margin pressure, we revise our rating to Reduce with a revised TP of Rs. 2,095, based on a P/E of 42x on FY27 EPS.